According to data from the Customs Department, the final months of 2025 saw a rapid increase in the import turnover of milk and dairy products. By the end of 2025, the import turnover for this category reached $1.36 billion, marking a 24% increase compared to the same period in 2024.

In terms of market sources, Vietnam’s dairy supply remains concentrated in a few traditional countries. New Zealand continues to be the largest supplier, accounting for nearly one-third of total import turnover and recording significant growth compared to the previous year. The United States and Australia maintain their positions as key suppliers, though their growth rates vary. Notably, imports from Ireland and several European countries have surged, indicating a more pronounced trend toward supply diversification.

Within Southeast Asia, milk imports from Thailand and Singapore have continued to rise, reflecting businesses’ flexible shifts in response to escalating logistics costs and heightened quality demands.

By product category, powdered milk remains the largest segment in terms of import turnover. Throughout the year, powdered milk imports grew steadily, primarily serving food processing and domestic milk production. Skimmed and whole milk powders retained their critical roles, alongside increased demand for value-added products such as butter, cream, UHT milk, and organic milk.

Origin, transparency, and traceability have become the top criteria for consumers when choosing dairy products.

Conversely, certain product lines like sweetened condensed milk and yogurt saw a decline in imports, reflecting shifts in consumption patterns and improvements in domestic production capabilities for specific segments.

Alongside the rise in imports, 2025 marked a significant shift in Vietnamese dairy consumption behavior. Market analysis by VinaStrategy reveals that consumers are becoming increasingly discerning. Origin, transparency, and traceability now top the list of purchasing criteria, even surpassing brand loyalty, as concerns about food safety, health, and nutritional quality grow, particularly among young urban families.

Consumption patterns are also deepening. Fresh milk is gaining popularity due to its perceived naturalness and minimal processing, while traditional products like sweetened or flavored milk show signs of stagnation. Simultaneously, segments such as organic milk, functional milk, and age-specific or specialized dairy products are experiencing notable growth, indicating consumers’ willingness to pay a premium for products tailored to their specific needs rather than relying on habit-driven purchases.

Consumer behavior also varies by generation: Younger individuals are more open to new products and experiences, while families with young children prioritize nutrition, safety, and long-term brand reputation. Additionally, dairy shopping channels are rapidly expanding into e-commerce and convenience stores, complementing traditional retail and introducing new competitive pressures for industry players.

Vietnam’s Fast-Food Market: Fried Chicken Combos Reign Supreme, American Burgers Lose Their Edge

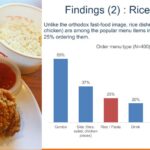

Q&Me’s report on Vietnam’s fast-food market reveals that fast food is no longer just a quick, Western-style meal option. Instead, it’s being localized to better suit Vietnamese tastes and preferences.