In a newly released strategic report, Rong Viet Securities (VDSC) highlights that the stock market is in a state of “cheap by the masses but expensive by the index” when viewed through the lens of P/E distribution.

Specifically, while most stocks are in the low-to-mid P/E range, the capitalization weight has shifted significantly toward high P/E groups, pulling the Index P/E upward. Since the latter half of 2025, the group with P/E >30x has seen a sharp increase in market capitalization (its share of total market capitalization rose from approximately 9% to ~27% since the market bottomed after the tariff event), despite no corresponding increase in the number of stocks. This reflects a “rerating” phenomenon concentrated in large-cap stocks.

One key driver is the “Vingroup family” of stocks, which accounted for 24% of HoSE’s capitalization by the end of 2025.

Regarding market support factors in 2026, VDSC analysts anticipate improved foreign capital inflows driven by: (1) the Fed’s potential to further cut rates to around 3.25%, enhancing the appeal of emerging market assets toward year-end; (2) foreign ownership ratios having dropped to multi-year lows; and (3) Vietnam’s increasing likelihood of inclusion in the FTSE Emerging Market index, which could trigger early capital inflows.

Domestically, while monetary policy is unlikely to ease further, fiscal expansion through accelerated public investment disbursement and treasury management remains a controllable tool to support liquidity and mitigate interest rate shock risks.

Based on the synergy between expected foreign capital inflows and domestic fiscal support, VDSC identifies three key investment themes for 2026.

Theme 1: “Fuel for High-Growth Engines”

To achieve the 10% average GDP growth target for 2026–2030, total social investment capital is estimated at VND 35 quadrillion, corresponding to a 15% CAGR. The private sector, a key growth pillar, is expected to account for 55–60% of total investment.

2024 data shows bank credit meeting approximately 80% of the private sector’s capital needs. Given Vietnam’s credit-dependent economy, bank lending will remain the primary capital source, at least through 2026–2027. VDSC estimates average credit growth of 18% during this period to meet economic demands, corresponding to outstanding loans of nearly VND 25.8 quadrillion and a credit/GDP ratio potentially reaching 170%.

A high credit/GDP ratio could undermine growth sustainability, with economic crises becoming an unavoidable risk. Thus, alongside bank credit, the capital market (stocks, bonds) must develop to share the burden of medium-to-long-term capital mobilization with the banking system.

According to VDSC, the high growth targets for 2026–2030 require substantial capital investment, promising a prolonged favorable cycle for finance and financial services.

Banks will anchor the new growth cycle by expanding asset scale, growing interest income, and financing major economic projects. The capital market, through securities firms and financial institutions, will play a crucial role in equity and bond capital mobilization, improving capital allocation efficiency. This promises enhanced market liquidity, increased investment banking, brokerage, margin lending, and asset management activities.

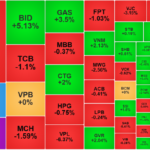

VDSC highlights well-positioned banks with strong corporate lending capabilities: VCB, CTG, BID, MBB, TCB. The securities sector, represented by TCX, is also positively viewed.

Theme 2: “Riding the Wave of Creation”

VDSC emphasizes investment as a key 2026 growth driver. Total social investment has returned to recovery, led by stable FDI disbursement and accelerating public investment—both likely to remain pivotal in 2026. Notably, the private sector (approximately 53% of total investment) and state-owned enterprises (approximately 9%) are expected to show stronger breakthroughs as institutional reforms are implemented.

Major reform initiatives have been translated into policies and legal frameworks. Resolution 198/2025/QH15, detailing Resolution 68-NQ/TW, is central to improving the private sector’s investment environment. Simultaneously, state capital governance reforms under Law 68/2025 and SOE wage reforms under Decree 248/2025 are expected to enhance capital efficiency and operational discipline. 2026 is likely to mark the beginning of tangible results from these reforms.

Directly, construction material suppliers, contractors, and infrastructure project developers will benefit from project scale and execution pace.

Indirectly, increased investment activity and labor migration to new projects will positively impact residential real estate values, industrial zones, and local consumption demand.

Companies with revenue directly tied to the investment cycle and strong core business prospects include construction materials (HPG, BMP,…); construction (PVS, PC1, TV2); industrial and energy services (PVD, PVT); infrastructure and energy developers (GEG, POW, REE,…); and residential and industrial real estate (KBC, SIP, PHR,…).

Theme 3: “The Heating Up Consumer Race”

The consumer story is becoming clearer and more compelling in 2026, driven by government policies supporting purchasing power (VAT reductions, minimum wage increases, education and healthcare policies). In the short term, VDSC sees public investment spillovers boosting domestic consumption and production, particularly in the private sector. Long term, Vietnam’s large domestic market of over 100 million people and expanding middle class (projected at 75% of the population by 2030) offer sustained potential.

Additionally, government policies promoting economic efficiency (converting household businesses to enterprises, simplifying administrative procedures) and creating a transparent business environment are shifting activity from the informal to the formal sector, boosting consumer confidence.

VDSC notes that policies and consumption trends favor companies with well-structured, transparent business models that reduce compliance costs and earn consumer trust.

Opportunities also exist for companies benefiting from rebounding consumption as government stimulus and public investment spillovers strengthen domestic demand. Analysts highlight MWG, MSN, FRT with modern retail channels, and DGW, PNJ as high-growth potential enterprises.

Vietnam’s GDP Projected to Hit $514 Billion by 2025, Poised to Surpass Singapore and Thailand, Experts Forecast

The latest report from the Statistics Bureau on the socio-economic landscape reveals that Vietnam’s GDP at current prices is projected to reach 12,847.6 trillion VND in 2025, equivalent to $514 billion. This marks a significant $38 billion increase from 2024, when the GDP stood at $476 billion.

VN-Index Officially Surpasses the 1,800-Point Milestone

The first trading week of the new year saw the VN-Index officially surpassing the 1,800-point milestone on January 6th, followed by a series of new highs. Despite an unexpected correction on January 8th and a capital outflow from the real estate sector in the subsequent session, the index continued its upward trajectory, closing the week at a new peak of 1,867 points.

January 8th Stock Market Update: VCB Hits Ceiling, VN-Index Adjusts

The stock market on January 8th witnessed profit-taking pressure in the Vingroup sector, while “king” stocks provided support. As a result, the VN-Index corrected following yesterday’s heated rally.