A Resurgence in Infrastructure: THACO’s Ambitious Comeback

In a move that captured market attention, THACO officially submitted a proposal to the Vietnamese government in mid-2025, expressing interest in the North-South High-Speed Railway Project, with an estimated investment of over $61 billion.

According to the proposal, the company commits to securing 20% of the capital, equivalent to more than $12 billion, from equity and legal fundraising sources. The remaining funds will be borrowed domestically and internationally, under a 30-year government-backed interest rate support mechanism.

Notably, THACO plans to establish subsidiaries to attract additional capital from domestic and international enterprises, aiming to complete the project within approximately 7 years from the approval of the investment policy.

Expanding beyond the North-South railway, THACO is setting its sights on urban infrastructure, with Ho Chi Minh City as a focal point.

The company has proposed the urban rail line connecting Tan Son Nhat Airport – Thu Thiem – Long Thanh Airport, creating a strategic transportation axis linking the two largest airports in the Southern region and integrating with the existing metro network. This proposal has received positive feedback from Ho Chi Minh City authorities, who have instructed relevant departments to collaborate on finalizing the project dossier. The Ben Thanh – Thu Thiem section is expected to break ground on April 30, 2026, with the entire line targeted for completion by 2030.

Additionally, in Ho Chi Minh City, THACO has proposed investing in Metro Line 2, Ben Thanh – Tham Luong section, spanning over 11.2 km and passing through 14 wards, with a total investment of approximately VND 57 trillion.

In the road sector, THACO, in collaboration with Son Hai Corporation, is investing in the Dau Giay – Tan Phu Expressway under the PPP model (Phase 1). The project, which began construction in mid-August 2025, spans over 60 km with a total investment of nearly VND 8.5 trillion, connecting Dau Giay Junction to Phu Lam Commune (Dong Nai).

THACO’s reach extends beyond the South, as it joins a consortium of major investors including Dai Quang Minh, Van Phu, T&T, and Hoa Phat, to develop the Hong River Scenic Boulevard in Hanoi, with a total investment of approximately VND 855 trillion.

The project broke ground on December 19, 2025, marking a significant milestone in the realization of one of the largest and most unprecedented urban infrastructure projects in history.

THACO Group Chairman Tran Ba Duong (left) and Dai Quang Minh Chairman Tran Dang Khoa (center) at the groundbreaking ceremony of the Hong River Scenic Boulevard (Photo: HN/Investor Magazine).

Also in Hanoi, a THACO ecosystem company has been “handed over” the Hoang Mai – Giap Bat parking lot and shopping center by Japanese retail giant Aeon, located in Dinh Cong Ward. According to the plan, this area will develop a modern parking lot combined with a shopping center, offices, and warehouses, without residential functions.

Notably, THACO is not just an investor; the company has signed a strategic cooperation agreement with Hyundai Rotem (South Korea) to acquire locomotive and train car manufacturing technology for urban railways and high-speed trains in Vietnam. They are also studying advanced metro models like Shinbundang for design, operation, and maintenance purposes.

The Quiet Steps Preceding the Comeback

In reality, before its strong “comeback” in national infrastructure projects, THACO had already expanded into construction, real estate, and infrastructure.

Since 2003, the company has invested in the Chu Lai Open Economic Zone, not only building factories but also developing synchronized infrastructure for transportation, seaports, logistics, warehouses, and functional areas to serve production and export. By early 2020, Chu Lai had evolved far beyond a “production cluster,” becoming an industrial-urban-service complex, with transportation and logistics infrastructure as its backbone.

THACO’s most prominent presence in real estate and urban infrastructure is linked to Dai Quang Minh Corporation, the developer of major projects in the Thu Thiem New Urban Area (Ho Chi Minh City). During 2014–2018, Dai Quang Minh invested in and completed numerous key infrastructure works such as the central lakefront road, Thu Thiem 2 Bridge, and main axes connecting the urban core.

Beyond infrastructure development, Dai Quang Minh has also implemented high-end real estate projects spanning dozens of hectares, with total investments reaching tens of trillions of dong. In recent years, Dai Quang Minh has continued to expand strongly into infrastructure and industry, notably the Binh Duong Mechanical Industrial Park with an area of 786 ha and a total investment of over VND 75 trillion.

The Financial Power Behind the Grand Ambitions

THACO’s continuous emergence as an investor or proposer in large-scale infrastructure projects naturally raises questions about its financial capacity.

In the market capital channel, THACO recently announced the successful issuance of VND 2 trillion in bonds, with an interest rate of 8.5% per annum, maturing on December 30, 2030. The bond issuance is guaranteed and asset-backed.

From 2019 to the present, THACO has raised a total of over VND 18 trillion through bond issuances. Currently, in addition to the newly issued bonds, the company has three other bond lots in circulation, with a total outstanding balance of nearly VND 12 trillion.

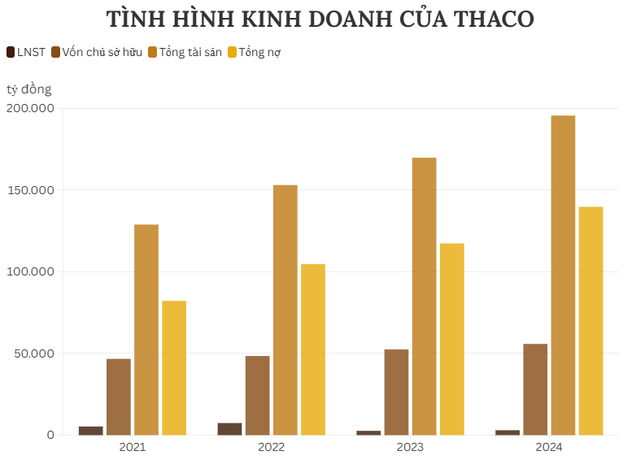

In terms of business results, according to the 2024 financial report, THACO recorded an after-tax profit of over VND 3 trillion, a 14% increase compared to the previous year; undistributed after-tax profit reached over VND 16.7 trillion. As of December 31, 2024, owner’s equity stood at over VND 55.8 trillion, while total assets reached more than VND 195.5 trillion (equivalent to over $7.5 billion).

Alongside the expansion of operations, THACO’s financial leverage has also increased significantly. The company’s total liabilities as of the end of 2024 were nearly VND 140 trillion, with bank loans accounting for over VND 91 trillion and outstanding bonds at over VND 13.3 trillion.

According to the credit rating report published in December 2025, the rating agency noted that the automobile segment still accounts for approximately 70% of THACO’s consolidated revenue over the past 5 years; other segments include mechanical engineering and supporting industries (12%), agriculture (4%), construction and real estate (5%), trade and services (3%), and logistics (3%).

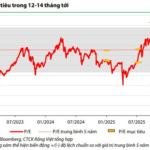

Over the next 12–18 months, THACO’s profits are expected to be driven by the residential real estate segment. Thadico (Dai Quang Minh Real Estate Investment JSC), a subsidiary in THACO’s real estate sector, plans to launch apartments in the C2, C3, lot 6.8 projects, and the high-end Sarina and Saroma villas in the Sala urban area, Ho Chi Minh City. The management expects Thadico’s contribution to consolidated revenue to increase from 10% to 15% during 2025–2027, with an EBITDA margin of 50% to 65%, which will help raise the consolidated EBITDA margin to nearly 20%.

Regarding debt structure, as of the end of June 2025, THACO’s consolidated loans (excluding convertible bonds) had reached VND 105 trillion. Approximately 60% of this is short-term debt, concentrated mainly at Thaco Auto LLC, which accounts for over 75% of total consolidated loans. In contrast, long-term debt is primarily held by the parent company (41%) and Thadico (34%).

Notably, in late 2025, THACO announced a plan to issue shares to pay dividends at a ratio of 3:1. If completed, the company’s charter capital will increase by over VND 10 trillion, from nearly VND 30.4 trillion to over VND 40.5 trillion.

Redefining Vietnam’s Global Image: CMC Chairman’s Visionary Proposal

At the online conference with Vietnamese ambassadors and heads of representative agencies abroad, summarizing economic diplomacy in 2025 and outlining tasks for 2026, the Chairman of CMC Technology Group proposed that Vietnam proactively craft and communicate a new global image: “New Vietnam.” This vision emphasizes technological capabilities, aspirations for advancement, and a commitment to fair collaboration in emerging fields such as AI.

Phú Thọ Unveils Scenic Riverside Avenue Along the Red River, Fostering New Development Horizons

The Standing Committee of the Phú Thọ Provincial Party Committee has unanimously agreed to explore the development of a scenic Hong River Boulevard axis. This initiative aims to restructure the region’s spatial development, enhance inter-regional connectivity, and unlock new growth opportunities for the locality.

“Transforming States, Shifting Paradigms: Revolutionizing Government Leadership”

On the morning of January 11th, during the 2025 year-end review and 2026 task deployment conference of the Government Party Committee, Prime Minister Pham Minh Chinh emphasized the need for a transformative shift in leadership and management. This shift aims to turn the tide and lay the groundwork for a new phase of development.

“Stocks ‘Cheap by the Crowd, Expensive by the Index’: Brokerages Highlight Key Investment Opportunities for 2026”

Leveraging the synergy between anticipated foreign capital inflows and supportive domestic fiscal policies, VDSC identifies three pivotal investment themes for 2026.