Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.3 billion shares, equivalent to a value of more than 39.4 trillion VND; the HNX-Index reached over 110 million shares, equivalent to a value of more than 2.4 trillion VND.

The VN-Index opened the afternoon session continuing its strong tug-of-war, with the advantage slightly favoring the buyers until the end of the session. In terms of impact, VCB, BID, VPB, and HPG were the most positively influential stocks on the VN-Index, contributing over 20.2 points. Conversely, VIC, VHM, VRE, and MCH faced selling pressure, taking away more than 29.1 points from the VN-Index.

| Top 10 stocks most impacting the VN-Index in the morning session of 12/01/2025 |

Similarly, the HNX-Index showed quite positive movements, with the index positively influenced by stocks such as SHS (+9.57%), MBS (+9.16%), NVB (+2.94%), CEO (+7.07%), and others.

| Top 10 stocks most impacting the HNX-Index in the morning session of 12/01/2025 |

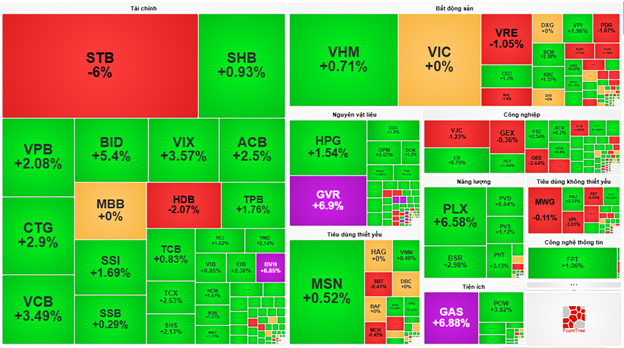

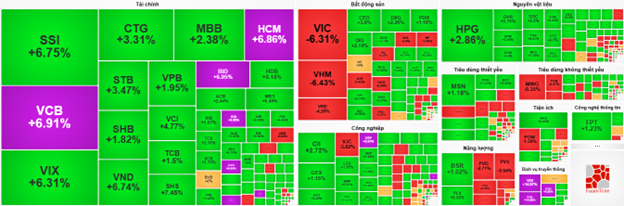

At the close, the market rose by 1.07%, with green dominating most sectors. Notably, the communication services sector led the market with a 12.34% increase, primarily driven by stocks such as VGI (+14.97%), CTR (+6.99%), FOX (+4.79%), and YEG (+2.09%). Following the recovery were the finance and materials sectors, with increases of 4.51% and 2.49%, respectively. Among these, standout stocks included SSI (+6.92%), VCB (+6.91%), VPB (+6.9%), VND (+6.99%), VCI (+6.86%), HPG (+4.96%), NKG (+5.07%), and KSB (+6.85%).

Conversely, the real estate sector recorded the largest decline in the market, dropping by 5.2%, mainly due to VHM (-7%), VIC (-6.99%), VRE (-6.86%), and BCM (-1.41%).

In terms of foreign trading, foreign investors continued to net buy over 1.07 trillion VND on the HOSE, focusing on stocks such as VCB (420.95 billion), VPB (270.4 billion), HPG (177.02 billion), and MWG (161.38 billion). On the HNX, foreign investors net sold over 13 billion VND, concentrated in MBS (31.74 billion), NTP (6.89 billion), IDC (6.12 billion), and PVI (3.12 billion).

| Top 10 stocks with the strongest foreign net buying and selling in the session of 12/01/2026 |

Morning Session: Narrowing Gains

The upward momentum showed signs of cooling toward the end of the morning session due to pressure from major Vingroup stocks. From a high of nearly 20 points, the VN-Index narrowed its gain to just over 2 points (+0.18%), closing the mid-session at 1,871.33 points; the HNX-Index also rose by 0.81%, reaching 249.1 points. However, market breadth remained very positive, with 435 gainers and 253 decliners.

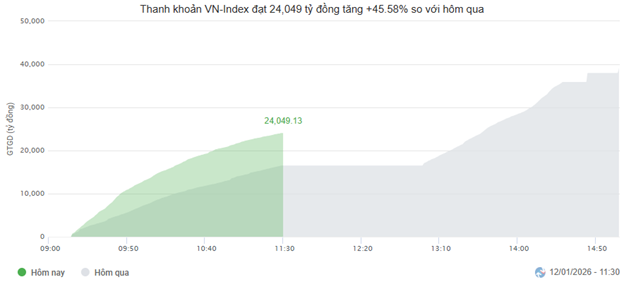

Increased trading in large-cap stocks boosted market liquidity this morning. The trading value of the HOSE reached over 24 trillion VND, up 45.58% compared to the same period in the previous session. Similarly, the HNX recorded a volume of over 66 million units, equivalent to more than 1.4 trillion VND, up 51.83% from the previous week’s session.

Source: VietstockFinance

|

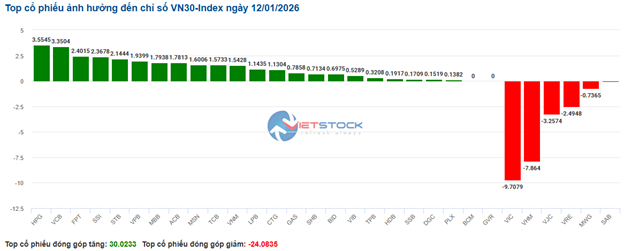

In terms of impact, financial stocks accounted for 9 out of the top 10 most positively contributing stocks to the VN-Index, with VCB leading the way, contributing 9.16 points. Following closely were BID, VPB, and CTG, which collectively added nearly 10 points to the index. Conversely, the duo of VIC and VHM were the most negatively impactful, taking away nearly 24 points from the index.

Among sectors, the communication services sector temporarily led the market with an impressive 12.66% increase, thanks to standout performers such as VGI, CTR, and VTK hitting their ceilings, along with FOX (+7.04%), YEG (+0.84%), MFS (+4.36%), and FOC (+3.08%).

Additionally, two large-cap sectors, finance and industry, traded quite actively this morning, with vibrant purple hues seen in stocks like VCB, BID, SSI, VND, VIX, HCM, BSI, CTS, DSE, AGR, VTP, STG, and DPG. Alongside these were numerous stocks rising positively by over 3%, including VPB, F88, TCX, CTG, VCI, ACV, HVN, MVN, VCG, and CC1.

On the flip side, the real estate and energy sectors temporarily lagged, with declines of 4.58% and 1.58%, respectively, influenced by adjustments in leading stocks such as VIC (-5.97%), VHM (-6.07%), VRE (-4.71%), KSF (-1.5%), PLX (-1.98%), PVS (-3%), PVD (-4.07%), OIL (-2.48%), PVT (-3.45%), and MVB (-4.52%).

Source: VietstockFinance

|

Foreign investors continued to net buy with a value of nearly 192 billion VND across all three exchanges. Buying focused heavily on VCB, with a value of 338.67 billion VND, followed by VPB and HPG, with values of 137.23 billion and 105.2 billion, respectively. Conversely, CTG led the net selling with a value of 130.08 billion VND.

10:40 AM: Capital Flows into Financial Stocks, VN-Index Maintains Green

Investor sentiment remains somewhat hesitant, causing the VN-Index to fluctuate and hover above the reference level, around 1,871 points. Similarly, the HNX-Index maintained a gain of over 2.2 points, trading around 249. Among these, banking, securities, industrial, and materials stocks led the market’s upward trend.

Most stocks in the VN30 basket were in the green, notably HPG contributing 3.55 points, VCB adding 3.35 points, FPT contributing 2.4 points, and SSI adding 2.36 points to the VN30-Index’s gain. Conversely, only a few stocks like VIC, VHM, VJC, and VRE faced selling pressure, taking away more than 23.3 points from the index.

Source: VietstockFinance

|

Large capital continued to flow into the securities and banking sectors. Among these, four stocks significantly impacted the VN-Index: SSI, VIX, VND, and HCM, all hitting their ceilings. Additionally, the banking sector spread green across stocks such as VCB and BID hitting their ceilings, CTG rising by 4.54%, and MBB increasing by 2.38%…

Following this, industrial stocks also spread green, with giants like ACV rising by 6.18%, VTP by 6.91%, VCG by 3.73%, CII by 2.45%, and GEX by 1.4%.

The materials sector also joined the upward trend. Specifically, green was seen in steel stocks such as HPG (+2.48%), NKG (+2.36%), HSG (+2.88%), and fertilizer stocks like DPM (+3.16%), DCM (+4.18%), and BFC (+1.75%).

Conversely, the real estate sector showed some divergence, with red concentrated in large-cap stocks, posing challenges for the sector. Specifically, stocks like VIC fell by 6.31%, VHM by 6.29%, and VRE by 4.43%. The remainder, including stocks like CEO (+3.8%), DXG (+1.94%), and PDR (+1.16%), maintained green.

Overall market breadth favored buyers, with over 380 gainers, higher than the approximately 210 decliners. The VN-Index rose by more than 3.7 points, reaching 1,871 points; the HNX-Index increased by 0.95%, around 249 points, and the UPCoM-Index rose by 0.5%.

Source: VietstockFinance

|

Opening: Financial Sector Continues to Lead

Following the previous session’s gains, the VN-Index opened this morning in positive green. The financial sector contributed the most to this upward trend.

After General Secretary Tô Lâm signed Resolution No. 79-NQ/TW of the Politburo on state economic development, this positively impacted stocks with state-owned shareholders. Notably, the Big4 banking group saw BID rise by over 6.95%, followed by CTG and VCB, with increases of 5.64% and 6.91%, respectively. Additionally, green appeared in securities stocks such as VIX (+1.87%), HCM (+4.87%), and SSI (+2.64%), also contributing significantly to the index’s rise.

Conversely, the real estate sector opened less positively. Leading stocks such as VIC, VHM, VRE, CEO, and DIG all declined, with only a few stocks in the sector showing insignificant gains.

Overall, the morning session opened positively, with green dominating most sectors, including materials, energy, utilities, and communication services…

– 15:25 12/01/2026

Vietstock Daily 13/01/2026: Sustaining the Upward Momentum

The VN-Index continued its upward trajectory, supported by trading volumes surpassing the 20-day average, reflecting investor optimism. Positive momentum is reinforced by the MACD sustaining its upward trend and widening its divergence from the Signal line. However, with the Stochastic Oscillator venturing deeper into overbought territory, investors should remain cautious of potential volatility should reversal signals emerge in upcoming sessions.

Three Key Factors That Could Propel the Stock Market Beyond 2,000 Points

Maybank anticipates that the VN-Index remains on a positive trajectory, with a potential scenario targeting the 2,000-point milestone by 2026.

Top Executives Step Down from Leadership Roles

SMC Investment and Trading Joint Stock Company, Song Da 11 Joint Stock Company, Hai Minh Joint Stock Company, and Saigon – Hanoi Securities Joint Stock Company have announced leadership changes, including new appointments for the positions of CEO, Board of Directors members, and Board of Supervisors members.

Vietstock Weekly 12-16/01/2026: Reaching New Heights

The VN-Index extended its rally into a fourth consecutive week, decisively breaking through the previous October 2025 peak to establish a new all-time high. Surging trading volumes, surpassing the 20-week average, underscore a significant improvement in liquidity and a prevailing optimism among investors.