Mr. Vo Huynh Tuan Kiet, Residential Director at CBRE Vietnam

|

Post-merger Ho Chi Minh City sees average apartment prices at VND 68 million/m²

At the Vietnam Real Estate Market Outlook 2026 event on the morning of January 13, Mr. Kiet revealed that in 2025, Ho Chi Minh City’s housing market witnessed a significant shift in supply structure. Previously, the central area’s apartment supply had been consistently low for years. However, post-merger, the total market supply surged past 24,000 units, with the central area accounting for only about 7,000 units. This shift has balanced the market between the core and expanded areas while diversifying product segments.

Post-merger, units priced below VND 60 million/m² dominate the market, reflecting improved housing accessibility compared to pre-merger times. Absorption rates in Ho Chi Minh City remain strong, averaging 83% market-wide, with some central area quarters reaching up to 90%, indicating stable real demand.

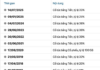

In Hanoi, 2025 saw the highest apartment supply in five years, while landed property supply slightly decreased compared to 2024. Nonetheless, absorption rates for both segments remain robust, showcasing the capital’s resilient market demand.

Hanoi’s new apartment supply hits a five-year high. Photo: Thuong Ngoc

|

Apartment prices remain a market focal point. In Ho Chi Minh City’s central area, average prices reached approximately VND 94 million/m², a 21-24% increase year-on-year.

Post-merger, the city-wide average price stands at around VND 68 million/m². Notably, the most common transaction prices now range from VND 55-65 million/m², reflecting the majority of buyers’ affordability thresholds.

Primary apartment prices in Ho Chi Minh City average around VND 94 million/m². Photo: Thuong Ngoc

|

In Ho Chi Minh City’s landed property segment, 2025 saw a significant supply increase, particularly in Q4 with over 4,500 units, primarily from large-scale urban projects. While primary prices dropped due to increased supply in outlying areas, secondary prices continued to rise, indicating stable investment and asset accumulation demand.

Hanoi’s price dynamics differ. Primary apartment prices remained stable, while secondary landed property prices adjusted due to new projects in peripheral areas, lowering average primary prices compared to the urban core.

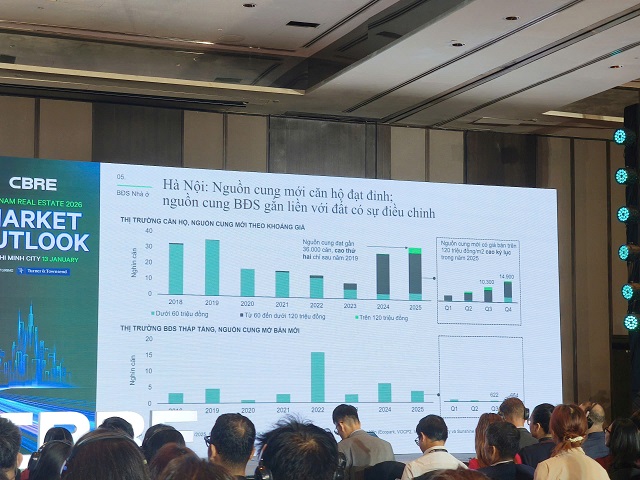

Mr. Kiet forecasts that from 2026 to 2028, property prices will generally rise but at a slower pace than previous cycles, given the already high price levels and rising interest rates.

Rising interest rates will significantly impact the 2026 real estate market. Photo: Thuong Ngoc

|

Infrastructure drives urban expansion trends

A key driver of the housing market in the coming period is transportation infrastructure. Ring roads, highways, metro lines, and satellite city connectors are accelerating in both Ho Chi Minh City and Hanoi. This pushes project development to outlying areas, forming new cities and mega-urban complexes spanning thousands of hectares.

According to Mr. Kiet, from 2026 onwards, Ho Chi Minh City’s apartment supply is expected to balance between the central and expanded areas. For landed properties, the 2026-2028 supply will concentrate more in the central area and well-planned mega-urban zones. Major projects will align with Ring Road 3, Ring Road 4, and strategic transportation routes to leverage connectivity advantages.

In Hanoi, about 40% of new supply is in expanded areas, mirroring Ho Chi Minh City’s centrifugal trend. Projects continue to shift along new transportation axes, guiding mid- to long-term urban spatial development.

Buyers and investors prioritize utility over speculation

Rising deposit and lending interest rates make both end-users and investors more cautious in their purchasing decisions. Instead of focusing solely on price appreciation, buyers increasingly value quality of life, operational efficiency, property management, transportation connectivity, and urban amenities.

Mr. Kiet believes that Transit-Oriented Development (TOD) will become the new standard, reducing traffic pressure and enhancing living quality. Developers will also need to offer more flexible sales policies to support buyers’ cash flow amid rising capital costs.

A notable new factor is the implementation of property identification, which will enhance transaction transparency, legal history, and ownership records. Mr. Kiet expects this to improve management, curb speculation, and establish a clearer, more sustainable price baseline for the market.

– 15:59 13/01/2026

Urgent Submission to Ho Chi Minh City People’s Council: Investment Plan for Thu Thiem 4 Bridge and Multiple Key Projects

The Vice Chairman of the Ho Chi Minh City People’s Committee has directed the Department of Finance to urgently review, consolidate, and draft a proposal for submission to the City People’s Council. This proposal seeks approval for the investment policy of the Thu Thiem 4 Bridge project, with the aim of presenting it at the nearest council session.

Unlocking Affordable Housing: HoREA Chairman Proposes Development for Earners Above 20 Million VND/Month

The Chairman of the Ho Chi Minh City Real Estate Association (HoREA), Le Hoang Chau, emphasizes the urgent need to expand the supply of affordable housing tailored for individuals earning over 20 million VND per month. This demographic falls into a gap where they are ineligible for social housing yet cannot afford high-priced commercial properties, highlighting a critical market imbalance that requires immediate attention.