No Va Investment Group Joint Stock Company (Novaland, Stock Code: NVL, HoSE) has announced a Board of Directors Resolution regarding its commitment to the loan obligations of its subsidiary, Ngan Hiep Real Estate JSC, at the Military Commercial Joint Stock Bank (MB).

Specifically, Ngan Hiep Real Estate has been granted a maximum credit limit of VND 2,320 billion by MB, with a maximum outstanding debt at any time of VND 1,720 billion.

The loan is intended for investment, construction, and development of the Ngan Hiep 1 – Ho Tram Tourism Project and the Ngan Hiep 2 – Ho Tram Tourism Project in Ho Tram Commune, Ho Chi Minh City, as well as other investment activities related to the company’s strategic development.

Novaland will support Ngan Hiep Real Estate in managing, consulting, and developing the two aforementioned projects. In the event that additional financial obligations related to land arise for the projects, Novaland commits to providing financial support to Ngan Hiep Real Estate for supplementary payments.

Rendering of the Ngan Hiep 1 – Ho Tram Tourism Project

As of September 30, 2025, Ngan Hiep Real Estate is a subsidiary of Novaland with a 99.98% ownership stake and a 99.99% voting rights ratio.

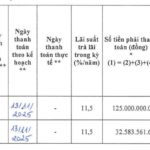

In other news, Novaland recently reported the conversion of a portion of its $335 million international convertible bond into shares. On December 31, 2025, Novaland converted 133 bonds into 20.8 million shares, with a total conversion value (based on the adjusted face value) of over VND 747 billion. The conversion ratio is one bond for 156,018 shares, equivalent to a conversion price of VND 36,000 per share.

Also on December 31, 2025, Novaland completed the issuance of nearly 163.7 million shares to swap for debt totaling over VND 2,577 billion. The issuance price was VND 15,746.667 per share, equivalent to VND 15,746.667 of debt being converted into one new share.

These shares were directly distributed to two creditors: Novagroup JSC (nearly 156.6 million shares) and Diamond Properties JSC (nearly 7.1 million shares).

Both companies are shareholders of NVL and are affiliated with Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors.

In total, through both schemes, Novaland has issued over 184.4 million shares to swap for debts valued at more than VND 3,324 billion. Consequently, the company’s charter capital increased from over VND 20,476 billion to over VND 22,320 billion.

Gia Phú Real Estate Misses Another Deadline on Bond-Related Commitments

As of December 31, 2025, the Bondholder Representative has yet to receive a resolution plan for the GPRCH2123001 bond series issued by Gia Phú Real Estate.

Novaland’s Subsidiaries Settle Over VND 2 Trillion in Corporate Bonds

After multiple delays and extensions, two subsidiaries of Novaland, Unity Real Estate and Aqua City, are set to fully settle trillions of dong in bonds by the end of 2025.