The year 2026 marks the beginning of a new economic development cycle and a transformative era for the nation. Vietnam’s stock market is entering a “new normal,” operating under international standards following its upgrade, becoming more transparent, yet still facing global economic risks.

In this context, opportunities and challenges coexist, demanding investors to embrace a strong sense of autonomy. This is the core element for the new generation of investors to adapt and remain calm amidst market fluctuations.

According to representatives from Pinetree – Vietnam’s pioneering comprehensive digital securities company (a subsidiary of Hanwha, South Korea), this spirit of autonomy is embodied in four genetic codes: freedom, automation, confidence, and decisiveness.

Freedom Code: Diverse Products – Trade Anywhere

After a year of significant volatility, portfolio restructuring and risk management have become top priorities for investors. Instead of limiting themselves to traditional channels like real estate, gold, or savings, they are actively diversifying their portfolios and exploring new investment avenues to mitigate risks.

Aligning with this spirit, many securities companies and financial institutions have introduced a wide range of investment products tailored to customer needs. A prime example is Pinetree Securities, which has focused on building a diverse ecosystem of products and services, including stocks, bonds, derivatives, thematic investment portfolios, and fund certificates.

The company also offers various support policies, such as lifetime free trading, up to VND 1 million in stocks for new customers, P-Margin margin loan packages with flexible interest rates starting from 0%, and three months of free trading for derivatives.

Automation Code: Harnessing the Power of Technology

Securities trading is a field that reacts swiftly to information. With the ever-growing volume of news, investors often face information overload, risking missed trading opportunities. Here, the automation code becomes crucial, enabling investors to leverage technology and smart tools for timely information updates and decision-making.

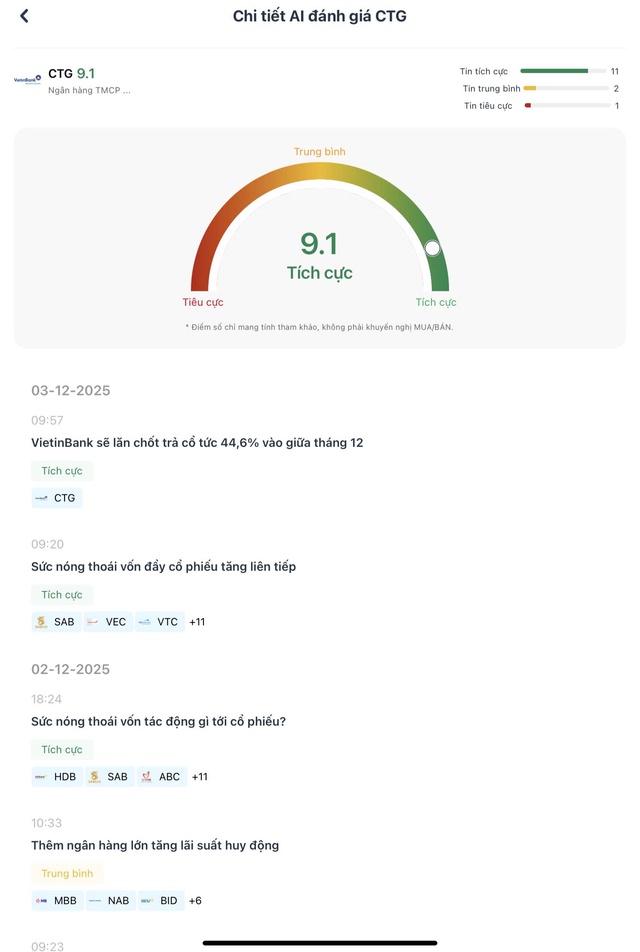

To meet this need, Pinetree has developed intelligent support features like AI News, SmartNoti, and intuitive charts.

AI News aggregates market news from multiple reputable sources, categorizing information related to stock codes into positive, neutral, and negative sentiments.

SmartNoti allows investors to set tracking criteria for stock prices, such as increases/decreases or reaching new highs/lows, ensuring timely alerts for quick decision-making.

Confidence Code: Seamless Trading Experience

Confidence is an internal strength built through experience and practical training. This confidence is further reinforced by a seamless and reliable trading platform.

By fully owning its securities core system, Pinetree has developed robust trading platforms like AlphaTrading and WebTrading. These platforms handle large trading volumes, execute orders swiftly and flexibly, and operate stably even during peak hours and under various market conditions.

According to Pinetree representatives, once the KRX system in Vietnam is operational, owning a Korean-standard securities core will enable the company to swiftly upgrade products, add new features, and seamlessly integrate with the market’s technological capabilities.

Decisiveness Code: Calm Decision-Making Amidst Volatility

In a market sensitive to macroeconomic factors like the Fed’s interest rate policies or domestic fiscal adjustments, relying on verified news and reports from trusted sources is essential.

The decisiveness code empowers investors to remain calm amidst unverified market information. Instead of reacting emotionally, they base decisions on verified data and in-depth analysis.

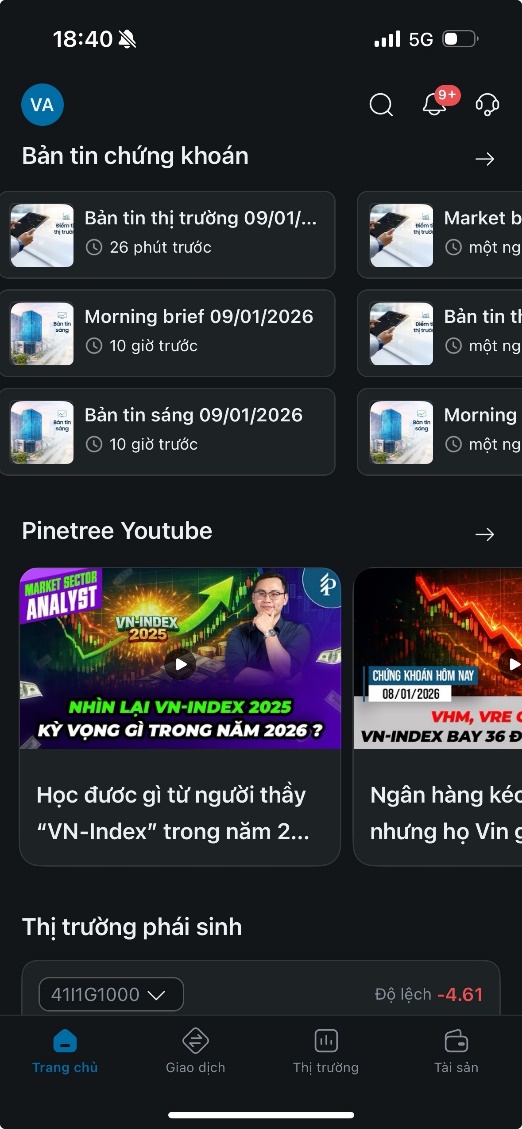

Supporting this code, Pinetree has pioneered a diverse system of securities news and analytical reports. Beyond traditional formats, the company offers digital content like videos, livestreams, podcasts, and motion graphics, making information more accessible.

Pinetree ensures rich and continuous content, covering market overviews, sector analyses, stock and derivative insights, and global market trends, with 24 weekly bulletins and reports.

These efforts have earned Pinetree recognition, placing it among the Top 10 companies with the “Best Retail Services in Vietnam’s Stock Market” by VietnamBiz in November 2025.

Continuously updating technology, upgrading systems, and diversifying services and products, Pinetree remains committed to empowering autonomous investors. By fostering the four genetic codes—freedom, automation, confidence, and decisiveness—Pinetree aims to help investors achieve sustainable financial freedom and prosperity.

To explore and fully embrace this spirit, becoming part of the Autonomous Investor Generation, visit here.

Soaring Scores, Hesitant Cash Flow: Insights from Tran Duc Anh (KBSV)

The stock market in 2026 is poised to revolve around the narrative of extending the bullish cycle, with public investment taking center stage. Foreign capital inflows are expected to rebound, and the IPO wave may continue to surge. However, rising interest rates could temper liquidity, leading to a less vibrant trading environment.

Textile Stocks Diverge as VN-Index Hits Record High

The VN-Index reached an all-time high in 2025, yet the textile and garment sector defied the trend, underperforming the broader market. This divergence was driven by the lingering impact of tariff shocks and prolonged cautious sentiment among investors.

VN-Index Surges Past 1,900 Mark Just One Week After Breaking 1,800 Barrier

The VN-Index has etched another chapter in its historic journey, surpassing the 1,900-point milestone. With consistent breakthroughs to new highs—and forecasts from experts suggesting even greater potential—this achievement solidifies the market’s robust mid- to long-term upward trajectory.