Geleximco Group – JSC has recently registered to sell its entire stake in An Binh Securities (ABS, stock code: ABW, UPCoM) from January 15, 2026, to February 13, 2026.

Specifically, Geleximco aims to offload nearly 46.37 million ABW shares (equivalent to 45.85% of the charter capital) through a negotiated sale to restructure its capital. If successful, Geleximco will no longer hold any shares in ABW, relinquishing its position as the largest shareholder.

As of January 14, ABW shares were trading at around VND 12,200 per share, valuing the transaction at approximately VND 565 billion. Geleximco has not yet disclosed the identity of the transferee.

Notably, Ms. Vu Thi Huong serves as the Chairwoman of ABS’s Board of Directors and is also a Board Member of Geleximco. Mr. Tran Kim Khanh, Deputy General Director of Geleximco, concurrently holds a position on ABS’s Board of Directors.

In other developments, ABS shareholders approved two capital increase plans in late 2025.

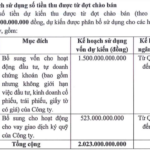

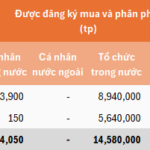

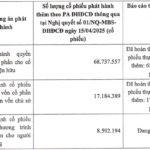

First, ABS plans to issue 202.3 million shares to existing shareholders at a ratio of 1:2, allowing shareholders to purchase two new shares for every one held. These shares will be unrestricted for transfer.

Priced at VND 10,000 per share, the offering is expected to raise VND 2,023 billion. ABS intends to allocate VND 1,500 billion for proprietary trading and the remaining VND 523 billion for margin lending. Disbursement is scheduled from Q2/2026 to year-end.

Second, An Binh Securities plans to issue 5 million shares under an Employee Stock Ownership Plan (ESOP). These shares will be subject to a one-year transfer restriction.

The ESOP is slated for Q2/2026, following the completion of the existing shareholder offering. The anticipated VND 50 billion proceeds will be directed toward margin lending, with disbursement from Q2/2026 to year-end.

Upon completion of both issuance plans, An Binh Securities’ charter capital will increase from VND 1,011.5 billion to VND 3,084.5 billion.

Established in 2006, An Binh Securities has Geleximco Group – JSC as its largest shareholder, holding 45.85% of the company’s capital as of September 30, 2025.

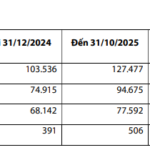

In Q3/2025, An Binh Securities reported a 59% year-on-year increase in operating revenue to nearly VND 141 billion. Operating expenses rose by 72%. Consequently, ABS’s after-tax profit surged 72% to over VND 46 billion.

For the first nine months of the year, operating revenue reached nearly VND 341 billion, with after-tax profit at VND 105 billion, reflecting 26% and 27% growth, respectively, compared to the same period in 2024.

An Binh Securities Shareholders Finalize Two Capital Increase Plans

An Binh Securities shareholders have approved two issuance plans totaling 207.3 million shares, aiming to raise the company’s charter capital beyond 3,000 billion VND.

BVBank: 11-Month Profit Hits VND 515 Billion, Board of Directors and Supervisory Board Elected for 2025-2030 Term

On the afternoon of December 26th, Ban Viet Commercial Joint Stock Bank (BVBank, UPCoM: BVB) held an extraordinary shareholders’ meeting. The agenda included proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members to the Board of Directors and the Board of Supervisors for the 2025-2030 term.

BVBank Seeks to Boost Capital by 9.912 Trillion VND

Ban Viet Joint Stock Commercial Bank (BVBank, UPCoM: BVB) has announced the materials for its 2025 Extraordinary Shareholders’ Meeting, scheduled for December 26. The agenda includes proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members of the Board of Directors and Supervisory Board for the 2025-2030 term.

VNDIRECT Raises Nearly VND 2,000 Billion Through Two “Triple Zero” Bond Issues

Marking the end of the subscription and payment period from November 21 to December 12 for two publicly offered bond lots, VNDIRECT Securities Corporation (HOSE: VND) recorded a total of over 19.98 million bonds purchased, achieving a 99.92% subscription rate.