Vietnam’s Real Estate Market Rebounds in 2025: A Pivotal Year for Residential Property

2025 marks a pivotal year for Vietnam’s residential real estate market, signaling a clear recovery after a prolonged period of stagnation. Data from Datxanh Services reveals a rising price trend across most regions and property types, coupled with a significant improvement in liquidity. This reflects a resurgence in both genuine demand and investment capital.

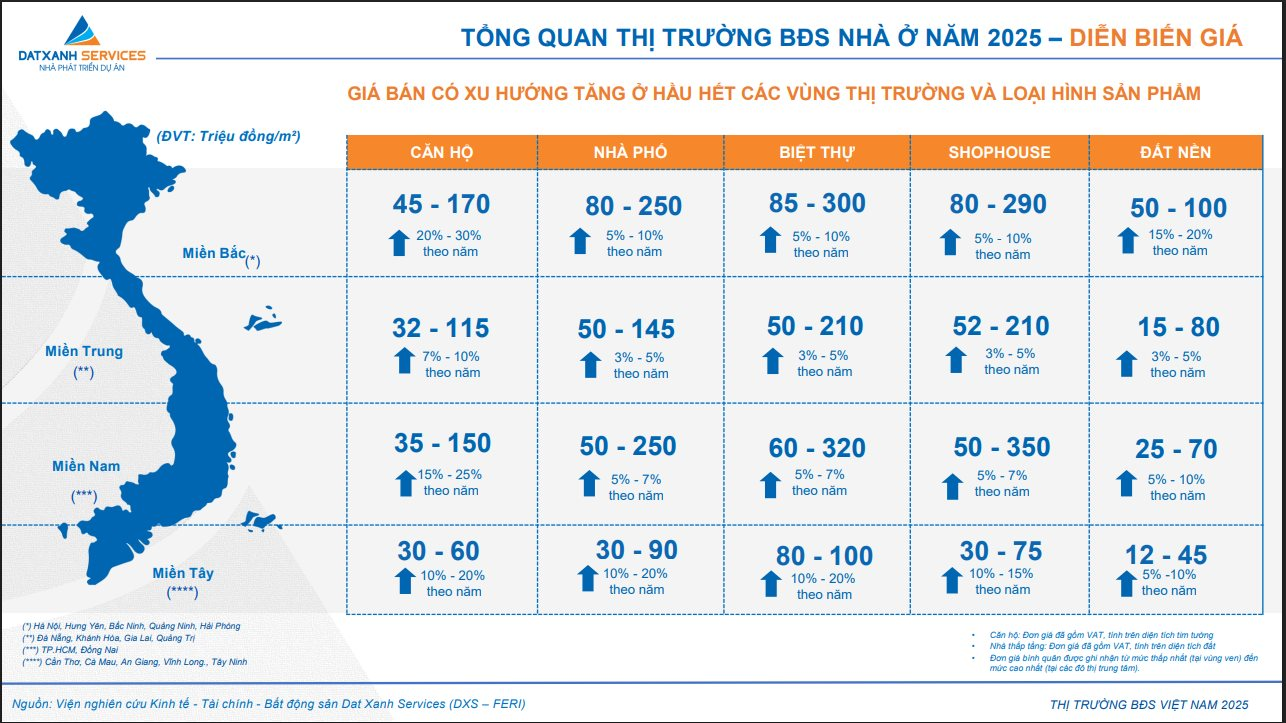

Nationally, residential property prices in 2025 exhibited an upward trajectory, though with distinct variations across regions and segments. The Northern region continues to lead in both price levels and growth rates. Apartment prices here range from VND 45 million to VND 170 million per square meter, reflecting an average annual increase of 20-30%. Prices for landed properties like townhouses, villas, and shophouses remain stable at VND 80 million to VND 300 million per square meter, growing by 5-10% annually. Land plots, driven by long-term investment demand, are priced between VND 50 million and VND 100 million per square meter, with a 15-20% annual increase.

The Central region’s recovery is more cautious. Apartment prices typically range from VND 32 million to VND 115 million per square meter, growing by 7-10% annually. Low-rise properties like townhouses, villas, shophouses, and land plots see modest growth of 3-5% per year.

The Southern region remains a key market driver. Apartment prices here fluctuate between VND 35 million and VND 150 million per square meter, increasing by 15-25% annually. Notably, villas and shophouses command high prices, reaching up to VND 320-350 million per square meter in some areas, with a steady 5-7% annual growth, particularly in Ho Chi Minh City and well-connected satellite cities.

While the Mekong Delta has the lowest prices nationwide, it shows positive improvement signs. Apartment prices range from VND 30 million to VND 60 million per square meter, with low-rise properties growing by 10-20% annually. This indicates significant growth potential in the medium to long term as infrastructure and urbanization efforts continue.

Market Liquidity Surges in 2025: A National Overview

Alongside price movements, market liquidity in 2025 showed a remarkable recovery. The national absorption rate reached 45-50%, equivalent to nearly 67,000 units, doubling from 2024 and quintupling from 2023. The Northern region led with a 50-55% absorption rate, thanks to improved supply and stable demand. The Southern region closely followed with a 45-50% rate, reflecting a strong recovery in key markets. The Central and Mekong Delta regions, while improving, maintained moderate absorption rates of 25-35%.

Looking ahead to 2026, Datxanh Services forecasts selective growth in the residential real estate market. In an ideal scenario, supply could increase by 40-50%, floating interest rates remain at 9-11%, prices rise by 10-15%, and absorption rates reach 50-60%. In a more expected scenario, supply may grow by 30-40%, prices by 5-10%, interest rates stay at 10-12%, and absorption rates hit 40-50%. If the market faces greater challenges, supply could rise by 20-30%, interest rates reach 12-14%, prices increase by only 2-5%, and liquidity may drop to 25-35%.

Mr. Nguyen Thai Binh, CEO of Dong Tay Land, predicts a promising growth phase for the real estate market in 2026.

Commenting on the 2026 market outlook, Mr. Nguyen Thai Binh, CEO of Dong Tay Land, stated that the real estate market is likely to enter a phase of solid to strong growth, with some segments performing exceptionally well. However, this growth will be more sustainable and less likely to replicate the overheated expansion seen in 2016-2019.

“The upcoming real estate market will not grow uniformly but will show clear regional differentiation. In Ho Chi Minh City and its surrounding areas, the city center and established areas like old Binh Duong, with projects boasting complete legal frameworks and meeting genuine housing needs, will become prime investment destinations,” emphasized the CEO of Dong Tay Land.

2025 Real Estate Demand Trends: What Does 2026 Hold for Housing Supply?

Experts predict that the demand for residential properties will spearhead the real estate buying trend in 2025. By 2026, the market is expected to witness a significant influx of new supply in Vietnam, fueled by the dual engines of private and state-driven economic growth, creating fresh momentum for expansion.

Unusual Shifts in the Condominium Market After Years of Price Surges

The prolonged price surge in the apartment segment shows signs of stagnation as numerous investors begin to list properties at a loss. Market reports indicate a decline in liquidity, with genuine demand now steering price dynamics, signaling the onset of a corrective phase following the rapid growth cycle.

The Shifting Investment Mindset of Vietnam’s Affluent Class

As Vietnam enters an aging phase, the demand for long-term healthcare is no longer a distant concern. In this context, healthcare real estate—particularly projects integrated with therapeutic hot mineral springs—is emerging as a new “core asset” among Vietnam’s affluent. It not only accumulates value but also serves as essential infrastructure to safeguard the quality of life for families.

The An Heritage Signs Strategic Partnership with Four Diamonds Alliance and Crystal Bay

On the morning of January 8, 2026, as part of the Four Diamonds Alliance launch ceremony, The An Heritage officially sealed a strategic partnership with Vietnam’s leading real estate alliance and operator, Crystal Bay.