Following the recent interest rate hike, Military Bank (MB) has introduced a new deposit interest rate structure for individual customers in VND. The highest rate reaches 6.4% per annum. However, rates vary significantly based on region and deposit amount across different terms.

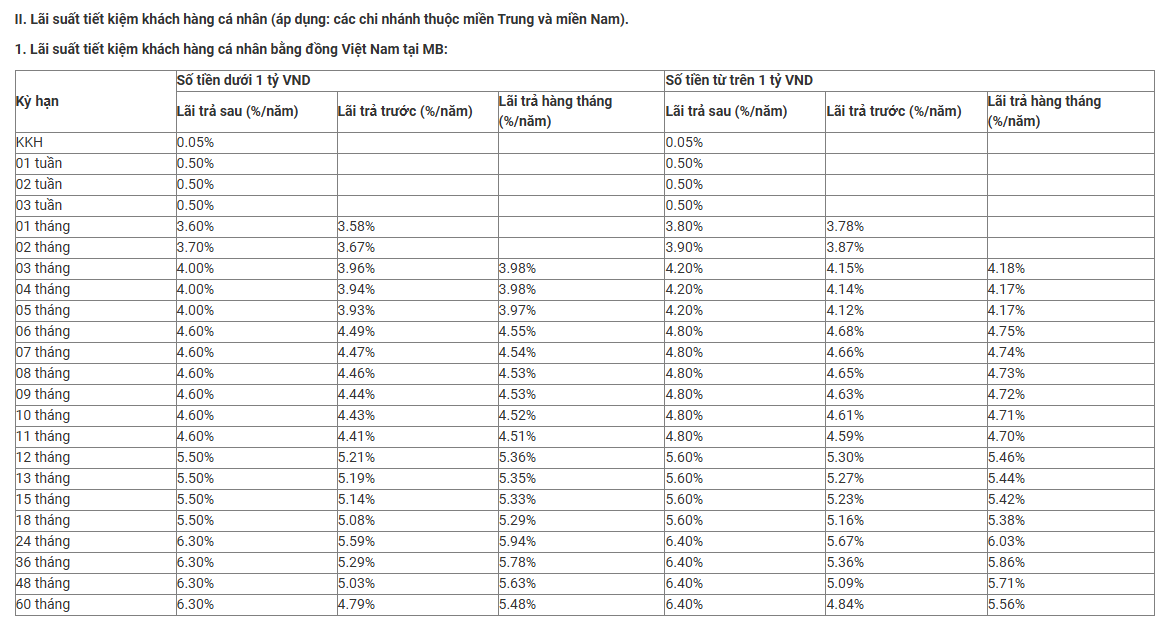

Savings Interest Rates at MB – Applicable to Central and Southern Region Branches

For Central and Southern region branches, MB applies a tiered interest rate system based on deposit amounts, categorized into two groups: below 1 billion VND and 1 billion VND and above.

For deposits below 1 billion VND, the non-term rate remains at 0.05% per annum. Terms of 1–3 weeks uniformly receive 0.5% per annum. The 1-month term offers 3.6% per annum, while the 2-month term increases to 3.7% per annum. For 3–5 months, the rate rises to 4.0% per annum.

For longer terms, deposits of 6–11 months are listed at 4.6% per annum. The 12–18 month term offers 5.5% per annum. Notably, terms from 24 to 60 months reach 6.3% per annum, the highest rate for deposits below 1 billion VND in this region.

Individual Savings Interest Rates at MB – Central and Southern Region Branches

For deposits 1 billion VND and above, rates are higher. The non-term rate remains at 0.05% per annum, with 1–3 week terms at 0.5% per annum. The 1-month term reaches 3.8% per annum, and the 2-month term increases to 3.9% per annum. For 3–5 months, the rate is 4.2% per annum.

For 6–11 month terms, MB lists rates at 4.8% per annum for deposits of 1 billion VND and above. The 12–18 month term offers 5.6% per annum. Notably, for 24–60 month terms, rates rise to 6.4% per annum, currently the highest at MB.

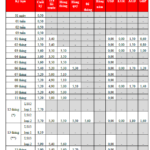

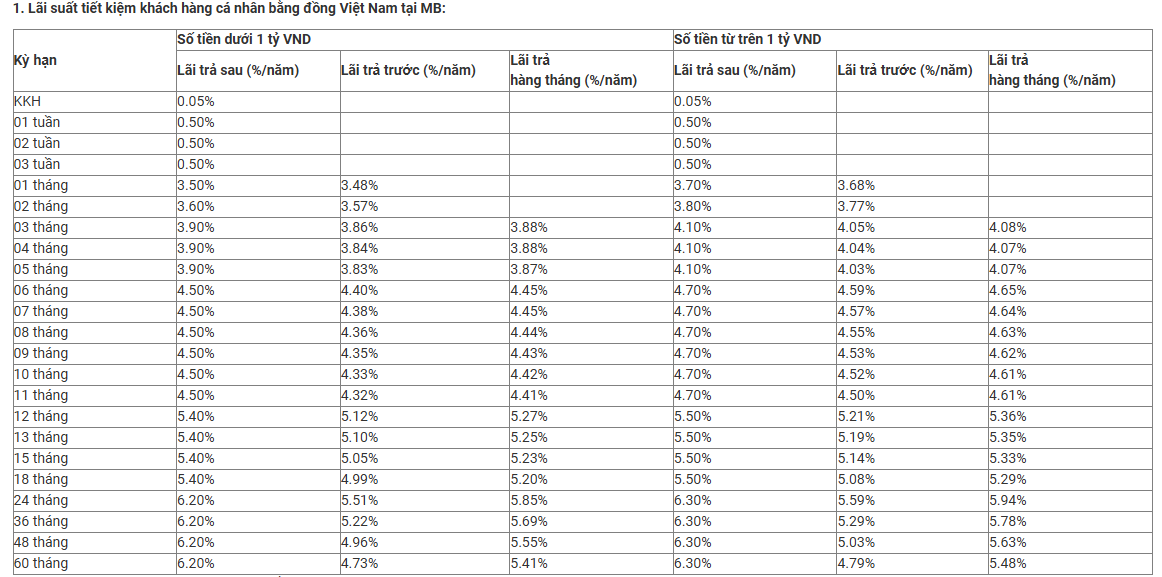

Savings Interest Rates at MB – Standard Rate Table

In addition to the regional tables, MB also publishes a standard interest rate table applicable across its network, with lower rates for longer terms.

Specifically, for deposits below 1 billion VND, the non-term rate is 0.05% per annum, with 1–3 week terms at 0.5% per annum. The 1-month term offers 3.5% per annum, the 2-month term is 3.6% per annum, and 3–5 month terms reach 3.9% per annum. For 6–11 months, rates increase to 4.5% per annum. The 12–18 month term is listed at 5.4% per annum, peaking at 6.2% per annum for 24–60 month terms.

Standard Individual Savings Interest Rate Table at MB

For deposits 1 billion VND and above under the standard table, the 1-month term reaches 3.7% per annum, the 2-month term is 3.8% per annum, and 3–5 month terms are at 4.1% per annum. For 6–11 months, rates increase to 4.7% per annum. The 12–18 month term offers 5.5% per annum, while 24–60 month terms peak at 6.3% per annum, the highest in the standard table.

Banks Hike Savings Interest Rates to Over 7% for Regular Deposits

Unlock exceptional returns with our exclusive deposit interest rate of 7.1% per annum. Tailored for deposits of 1 billion VND or more, this offer is available for terms ranging from 18 to 36 months. Maximize your savings with a bank that prioritizes your financial growth.

BIDV Bank Interest Rates January 2026: First Hike in Over 3 Years – Which Term Offers the Highest Rate?

At the beginning of January 2026, BIDV announced the highest interest rates for individual deposits, specifically for the 24-month term.