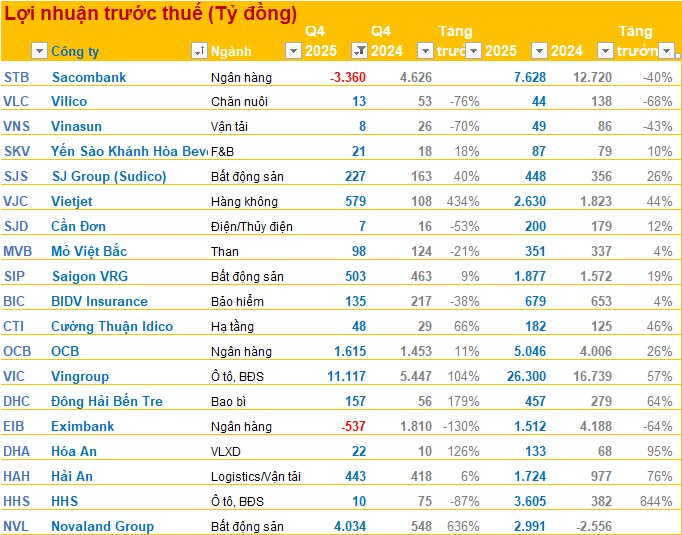

Recently Released Q4/2025 Financial Reports as of January 30th:

HDBank reported pre-tax profits of VND 6,519 billion, a 60% increase year-on-year, with full-year profits reaching VND 21,322 billion, up 27% compared to the previous year.

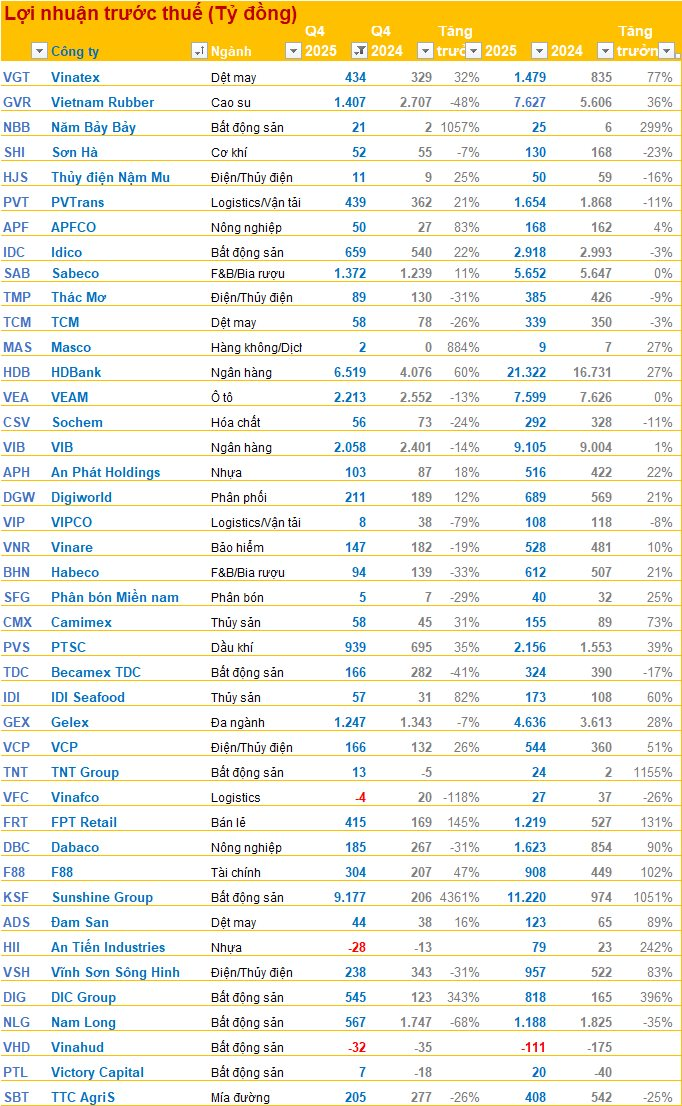

FPT Retail (FRT) recorded a Q4 pre-tax profit of VND 415 billion, a 145% growth year-on-year. For the full year 2025, FPT Retail achieved VND 1,219 billion in pre-tax profits, a 131% increase compared to 2024.

Masco (MAS) saw an 884% surge in Q4 profits, albeit with a modest absolute figure of VND 2 billion. For the entire year 2025, Masco’s profits reached VND 9 billion, a 27% growth.

Sabeco (SAB) maintained its industry-leading position with Q4 profits of VND 1,372 billion, an 11% increase. For the full year 2025, Sabeco’s profits totaled VND 5,652 billion.

PVTrans (PVT) reported Q4 profits of VND 439 billion, a 21% growth. The maritime transport company’s full-year profits reached VND 1,654 billion.

Digiworld (DGW) had a strong Q4 with profits of VND 211 billion, bringing full-year profits to VND 689 billion, a 21% increase.

In the real estate sector, Idico (IDC) reported Q4 profits of VND 659 billion (up 22%), while Nam Long (NLG) saw a sharp 68% decline to VND 567 billion. Becamex TDC (TDC) also reported a 41% drop in Q4 profits.

Similarly, Vietnam Rubber Group (GVR) reported full-year profits of VND 7,627 billion (up 36%), but Q4 profits fell by 48% to VND 1,407 billion.

Vinafco (VFC) reported a Q4 loss of VND 4 billion, a significant decline from the previous year’s profits.

An Tien Industries (HII) remained in the red in Q4 with a loss of VND 28 billion, despite full-year profits of VND 79 billion.

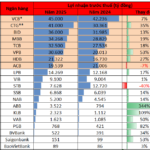

20 Banks Reveal 2025 Profits: HDBank Secures Spot Among Top 3 Private Banks in Earnings

As of January 30th, 2025, 20 leading banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, BVBank, VIB, and HDBank.

HDBank Successfully Issues $100 Million International Green Bonds

On January 7, 2026, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) successfully completed the issuance of the second tranche of its international green bonds, totaling $50 million, to the Dutch Entrepreneurial Development Bank (FMO) and British International Investment (BII). This milestone marks the official completion of HDBank’s $100 million green bond program in the international market, initiated in 2025.

Week of January 12-16: Record-Breaking Dividends Highlighted in Maritime Transport Sector

During the week of January 12–16, 2026, 11 companies will finalize dividend payments in cash. The highest payout ratio stands at 92.5%, equivalent to 9,250 VND per share held.