MB Partners with Visa and KOTRA to Launch the New MB Visa Hi BIZ...

On November 19, 2025, in Hanoi, Military Commercial Joint Stock Bank (MB) unveiled the new MB Visa Hi BIZ Corporate Card, offering exclusive benefits for business management. This launch, in strategic partnership with Visa and the Korea Trade-Investment Promotion Agency (KOTRA), aims to facilitate international trade and support digital transformation in line with Decree 70. Designed to optimize costs and enhance operational efficiency, the card empowers Vietnamese businesses in the era of smart management.

Illegal Gold Smuggler Caught Transporting 440g of Gold Worth Over $60,000 in Da Nang

A man from Da Nang City was caught smuggling over 440 grams of gold from Laos into Vietnam at the border crossing.

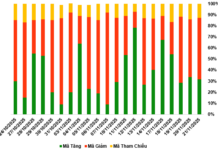

Bank Profits Surge 10x, Stock Prices Double Since Year’s Start

ABB Bank's stock (ABB) has surged an impressive 100% since the beginning of the year, making it one of the top-performing bank stocks in the market. This remarkable rally coincides with the bank's strong nine-month financial results and a strengthened management team. These positive developments are expected to propel ABBANK into a new phase of accelerated growth.

F88 Wins Double Awards for Best Workplace Environment 2025

At the Best Places to Work in Vietnam® 2025 conference held on November 19th in Ho Chi Minh City, F88 was honored by Anphabe as both the Best Place to Work in Vietnam and the company with the Happiest Workforce. This recognition celebrates F88’s relentless decade-long commitment to fostering a people-centric work environment.

“Swipe, Save, and Chill: Mastering Holiday Spending with BVBank Credit Cards”

As the year draws to a close, wallets are at their busiest, and consumers seek tools that maximize the value of every transaction. BVBank’s card ecosystem stands out as a unique choice, offering multi-tiered rewards, lifestyle-tailored designs, and optimized spending across all channels—from groceries and fashion to dining, travel, and online shopping.

MSB Secures Spot Among Vietnam’s Top 100 Best Places to Work

Maritime Bank (MSB) solidifies its position as one of Vietnam's most attractive financial institutions to work for, securing a spot in the Top 100 Best Places to Work in Vietnam 2025.

Massive Flooding Forces Banks and ATMs to Suspend Operations Across Multiple Branches

Due to severe flooding caused by heavy rainfall in the South Central region, numerous banks have temporarily closed their branches, transaction offices, and ATMs in the affected areas.

The Fate of the Billionaire Hứa Thị Phấn’s Mega Project

Unveiling the fate of a mega-project in Bình Chánh district (formerly), Ho Chi Minh City, once leveraged by tycoon Hứa Thị Phấn to secure bank loans, remains a compelling question that demands attention. What has become of this ambitious venture?

Three Major Banks Hike Savings Interest Rates

OCB, TPBank, and VIB have emerged as the latest commercial banks to raise deposit interest rates across various terms, marking a significant shift in the financial landscape.

Revolutionizing Personal Finance: VIB’s Installment Payment Solution on Credit Cards

Vietnam boasts 125 million payment cards, yet only 13 million are credit cards, leaving a significant gap in the unmet demand for installment payment options among Vietnamese consumers.