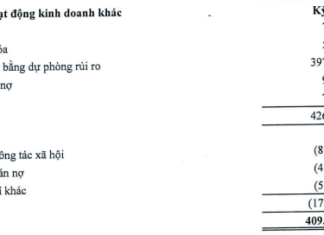

KienlongBank: Projected 2025 Profits Double, Nearly 50% of Loans at Risk of Default

KienlongBank (HOSE: KLB) has reported a remarkable pre-tax profit of nearly VND 2.323 trillion in 2025, doubling its previous year's performance. This outstanding result surpasses the bank's annual profit target by 68%. Notably, despite a 25% reduction, non-performing loans still amounted to over VND 625 billion by year-end, accounting for 47% of total bad debt.

Celebrating Techcombank’s 6 Breakthrough Achievements and Ecosystem Innovations at Fchoice 2025

Techcombank and its Ecosystem emerged as the most celebrated entities at the "Business and Entrepreneur Highlights" FChoice 2025, securing the highest number of accolades. Notably, Techcombank was the only bank to sweep both reader-voted categories, claiming the titles of "Bank of the Year" and "Most Favored Bank Stock."

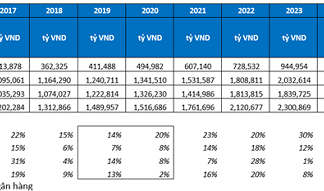

The Big 5 Banks: Which One is Leading the Race in Scale and Growth?

In the 2020-2025 period, as Vietnam's banking sector entered a more cautious business cycle amid macroeconomic fluctuations, the market witnessed a clear divergence among the top five largest banks (Big 5).

Where Will Banks Boost Revenue as Credit Targets Shrink?

This year's credit growth target has been set lower than in 2025, limiting the lending expansion capacity of many banks. In this context, banks are compelled to accelerate their revenue diversification strategies, gradually reducing reliance on traditional interest income from credit.

Green Financial Orientation in the International Financial Center Framework: A Catalyst for the Carbon...

Unlocking the potential of green finance is the cornerstone of Ho Chi Minh City’s International Financial Center, offering a transformative solution to mobilize capital and drive market growth with unparalleled efficiency.

Bank Auction: 30 Cars on Sale Starting at Just $2,500 Each

Agribank is auctioning off assets securing loans from BG Taxi Joint Stock Company, a traditional taxi firm previously operating in Hanoi. The lot includes 30 Kia Morning vehicles, starting at a mere 1.8 billion VND.

Vietcombank Issues Critical Announcement to Customers

Vietcombank has issued a critical announcement regarding upcoming changes, set to take effect officially starting January 22, 2026.

BIDV: Your Financial and Technological Pillar

Leading software solution providers have developed a suite of innovative tools designed to streamline financial tracking, ensure precise invoicing, and eliminate the burden of manual bookkeeping and tax declarations for their clients.

What is the Highest Savings Interest Rate at Military Bank (MB) in January 2026...

Following a significant surge in December 2025, MB Bank now offers the highest savings interest rate of 6.4% per annum. This rate applies to individual customers depositing 1 billion VND or more at branches in the Central and Southern regions, with terms ranging from 24 to 60 months and interest paid at maturity. Meanwhile, for branches in other regions, the highest rate currently stands at 6.3% per annum.

Proposed Establishment of a Green Finance Community to Position Ho Chi Minh City as...

At the "Promoting Green Finance and Carbon Credit Exchange in the International Financial Hub" seminar, Nam A Bank took the lead by proposing the establishment of a Green Finance Community.