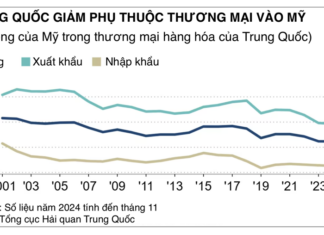

China’s Trade Dependence on the US Plunges to a New Low

"This development comes as Beijing braces for the possibility of tariffs being imposed by U.S. President-elect Donald Trump when he assumes office on January 20th. With Trump's return to the White House, there is anticipation and concern over potential new trade policies that could significantly impact China's economy."

Gold to Maintain its Bullish Streak in 2025, Defying Global Commodity Turbulence

2024 is set to be a challenging year for key global commodities, particularly Brent crude oil and copper. However, in a contrasting development, gold is forecasted to continue its upward trajectory, remaining resilient amidst economic and geopolitical uncertainties, and is expected to soar in price over the coming year.

The Power of Words: Crafting a Compelling Title “Finalizing the 8th Power Plan Revision: A...

The delays in implementing power source and grid projects are prolonging the timeline for operation, impacting the goals of providing sufficient electricity and socio-economic development. To address these challenges, it is necessary to adjust Power Planning 8 to ensure alignment with the actual situation and legal requirements.

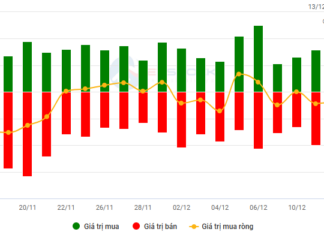

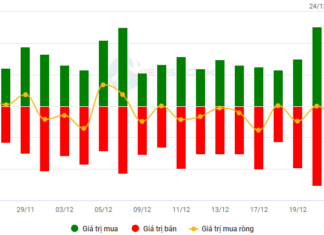

Stock Market Outlook for Week of December 9-13, 2024: Short-Term Correction Pressure

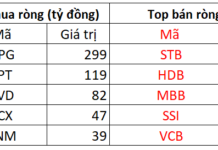

The VN-Index had a lackluster performance last week, declining in 4 out of the last 5 trading sessions. Moreover, the trading volume remained below the 20-day average, indicating a shift towards cautious sentiment among investors. Adding to this, the return of net selling by foreign investors suggests that the short-term outlook for the market remains risky.

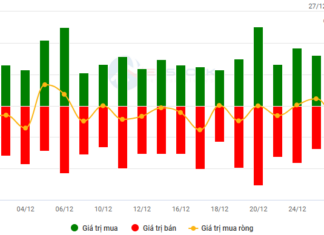

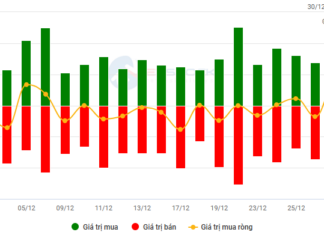

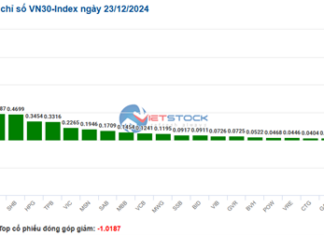

The Stock Market Week of December 23-27, 2024: Foreign Investors Turn Net Buyers

The VN-Index rose last week, with alternating up and down sessions. Erratic trading volume around the 20-day average reflected investor sentiment lacking stability. However, foreign investors' net buying after a continuous net-selling period bodes well for a more optimistic outlook.

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.

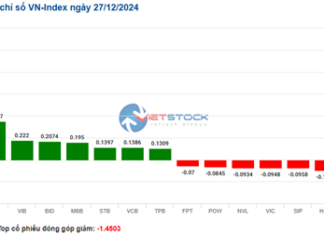

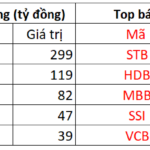

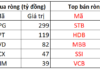

Market Beat on Dec 27th: Foreigners Net Buy Financial Group, VN-Index Maintains 1,275 Point...

The market closed with the VN-Index up 2.27 points (0.18%) to 1,275.14, while the HNX-Index fell 0.77 points (0.33%) to 229.13. The market breadth tilted towards decliners with 432 losers and 331 gainers. The large-cap stocks in the VN30 basket painted a positive picture, with 13 gainers, 10 losers, and 7 stocks ending flat.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors' unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.