Chinese SUV Plunges Down Cliff, Smashing Railing After Attempting to Climb 999 Steps to...

While attempting the steep staircase challenge on China's Tianmen Mountain, the Chery Fulwin X3L SUV lost control, sliding backwards down the slope and colliding with the protective railing, causing significant damage.

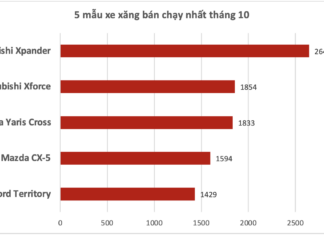

Vietnam’s Best-Selling Gasoline Cars in October: Top 2 Spots Dominated by One Brand!

Both of Mitsubishi's top-selling models experienced a remarkable surge in October 2025. The Xpander saw its sales nearly double in just one month, while the Xforce reclaimed the top spot in its segment after a three-month hiatus.

Vietnam’s Retail Pharmaceutical Market Takes an Unexpected Turn

Vietnam's retail pharmacy sector, once dominated by large chains with hundreds of stores, is witnessing a remarkable reversal. Traditional pharmacies, particularly in the North, are regaining momentum, sparking a notable market structure shift.

The $3.60 Cake That Had 2,000 People Lining Up in Hanoi

The bakery's owner considers the massive influx of orders for a single cake to be perfectly ordinary.

VinFast Dominates: 4 Out of 5 Top-Selling Cars Are Electric, Leaving Only 1 Gasoline...

Introducing the only gasoline-powered vehicle to secure a spot in the top 5 car sales rankings for October.

Elite Task Force Led by Brigadier General Dismantles Counterfeit Agricultural Chemical Ring, Seizes Unlicensed...

Authorities in Thailand raided a warehouse, uncovering a massive stash of counterfeit agricultural chemicals being sold online.

“Swapping Two VinFast VF 8s in Two Consecutive Years, Owner Shares: ‘Having Driven All...

After nearly 30 years of driving various gasoline-powered vehicles, Nguyen Anh Tuan decided to switch to the VinFast VF 8. He discovered that electric cars are not only smooth and cost-effective but also far easier to use than he had ever imagined.

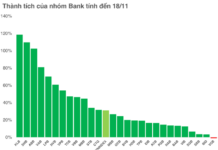

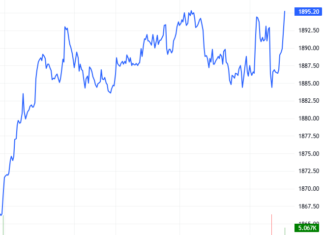

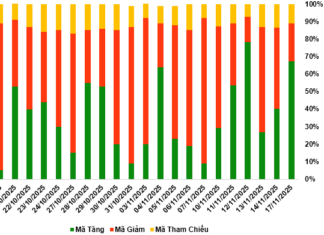

Vietstock Daily November 18, 2025: Strengthening the Recovery Momentum

The VN-Index extended its recovery, breaking above the Middle Bollinger Band. The Stochastic Oscillator continued its upward trajectory, reinforcing the buy signal after exiting oversold territory. Similarly, the MACD indicator echoed this positive outlook, bolstering short-term optimism.

Derivatives Market Outlook for November 18, 2025: Short-Term Prospects Continue to Improve

On November 17, 2025, both the VN30 and VN100 futures contracts surged during the trading session. The VN30-Index continued its upward trajectory, forming a small-bodied candlestick pattern. However, trading volume remained below the 20-session average, indicating investor hesitation and uncertainty in the market.

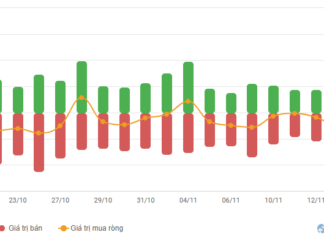

November 18, 2025: Warrant Market Rallies Alongside Underlying Market

As the trading session closed on November 17, 2025, the market witnessed 203 stocks advancing, 67 declining, and 31 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 2.05 billion worth of shares.