Pyn Elite Fund Exits Sacombank Major Shareholder Status Just Before Stock Surges to Upper...

Just one week into trading, STB has surged nearly 22% in market value, catapulting its market capitalization to an impressive 105.6 trillion VND.

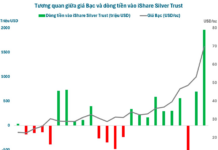

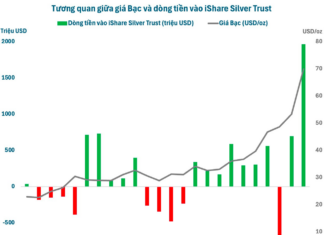

Unprecedented Record: BlackRock Invests Over $1 Billion in Silver in a Single Night

The world's leading silver funds have been aggressively buying, fueling the meteoric rise in silver prices over the past period.

Hydropower Plant Song Ba Ha Finalizes 2025 Dividend Advance and Calls for Extraordinary Shareholders’...

On December 31, 2025, Song Ba Ha Hydropower (SBH) will finalize its shareholder list for the 2025 interim cash dividend payment, offering a 5% dividend rate. Subsequently, on January 5, 2026, SBH will set the record date for shareholders to attend the Extraordinary General Meeting.

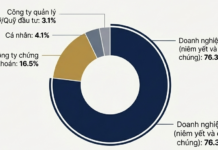

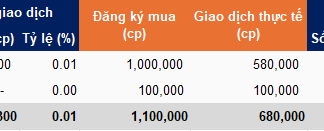

Vietcap-Affiliated Funds Execute 62% of VCI Share Purchase Plan, Targeting 2 Million BVB Shares...

VCAM and VCAMDF have completed their early purchase of VCI shares, acquiring a total of 680,000 shares, with VCAM not fully meeting its initial target. In a notable development, VCAM has registered to buy 2 million shares of BVB, the stock code for Ban Viet Bank.

Hoa Sen Group Plans to Establish Iron and Steel Manufacturing Company in Hai Phong

Hoa Sen Group is set to establish Hoa Sen Hai Phong One-Member Limited Liability Company, with a chartered capital of 300 billion VND. The company will primarily focus on the production of iron, steel, and cast iron.

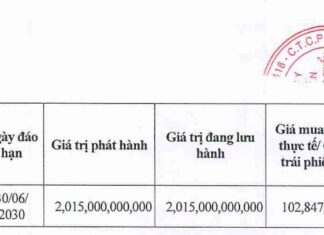

Tiến Phước Group’s Affiliated Enterprises Successfully Settle Over 2 Trillion VND Bond Issuance

Despite operating at a loss, TMT Real Estate—a company with significant ties to Tien Phuoc Group—has successfully settled its TMTCH233001 bond issuance, valued at 2.015 trillion VND.

Viconship Seeks to Acquire Additional 14 Million HAH Shares of Hai An Stevedoring

Viconship has recently filed to acquire 14 million shares of HAH, with the strategic aim of increasing its ownership stake to 21.238% in Xep Do Hai An.

Stock Market Surges Toward All-Time Highs: Buy or Take Profits?

The exhilarating start to the week’s trading session propelled the VN-Index to the brink of its historic peak at 1,760 points, leaving investors pondering their next strategic move, as experts weigh in with timely advice.

State Shareholder Offers Nearly 190 Million Shares of a Bank for Sale, Yet No...

Due to the absence of investor participation, the auction of MSB shares owned by VNPT failed to meet the necessary qualifications for proceeding as stipulated by regulations.

Stock Market 2026: Minimal Shockwaves Expected, Steady Growth Forecasted

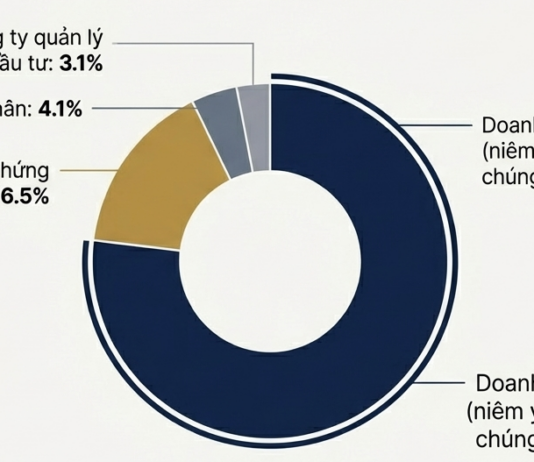

Vietnam enters 2026 with a bold GDP growth target of 10%, a challenging yet achievable goal. In the stock market, experts predict a more stable and evenly distributed flow of capital compared to the fluctuations seen in 2025.