What’s Happening with Đức Giang Chemicals?

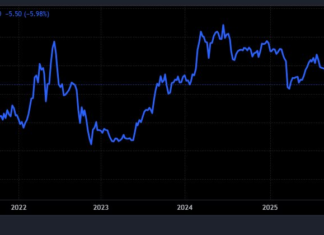

DGC, once hailed as the shining star of the chemical sector, has left investors baffled with its sudden plunge during today’s session, raising significant questions about its future trajectory.

33-Year-Old Mastermind Behind $87 Million “Ghost” Project: Da Nang Police Issue Urgent Notice to...

By late 2021, after successfully luring numerous investors, the perpetrators orchestrated the collapse of the DRK project. They systematically dismantled the website, deleted the fan page, and eradicated all associated groups, ultimately absconding with the investors' funds. These funds were then converted into Vietnamese currency and used for personal expenditures.

Vietnam’s Music Export: YeaH1 – Sony Music Alliance Launches Global Runway

Sony Music Entertainment has officially entered Vietnam's cultural industry through a strategic investment in the YeaH1 ecosystem.

Foreign Block “U-Turn” Sells Off as VN-Index Surges, Countering Massive Inflow into Single Stock

On the sell side, VIC witnessed the most significant offloading by foreign investors, with a value of approximately VND 167 billion.

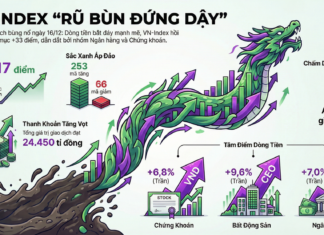

VN-Index Rebounds Strongly, Surging Over 33 Points

Following a successful "test" of the bottom in the morning session, a surge of capital flooded the market during the afternoon session on December 16th, igniting an explosive upward momentum.

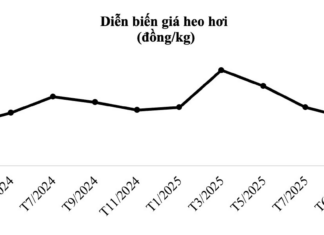

Pig Prices Surge 36% to $2.80/kg Amid Supply Shortages, Boosting Profits for High-Tech Farming...

Historically, prices have surged following significant declines caused by pandemics. This year, the pattern repeats amidst reduced supply and heightened year-end demand, particularly during the peak consumption period leading up to the Lunar New Year.

F88 Successfully Completes ESOP Share Issuance to 324 Employees

Following the conclusion of the issuance on December 11, 2025, F88 successfully distributed 206,615 shares to 324 employees within the company at a price of 10,000 VND per share.

Techcom Securities Eyes $7 Million Investment in Digital Asset Firm Post-IPO

TCBS has injected 11% of its equity capital, totaling 165 billion VND, into TokenBay to accelerate its digital asset strategy in the coming period.

Surprising Surge in ‘Mountain Tycoon’ Stocks

The VN-Index has stabilized following a sharp decline, leaving the overall market sentiment subdued. Meanwhile, a surprising development emerged with shares of Quoc Cuong Gia Lai, which surged to their upper limit for four consecutive sessions.

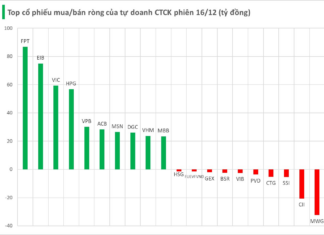

Major Stock Unexpectedly Swept Up by Brokerage Firm’s Proprietary Trading Desk in December 16...

Proprietary trading desks at Vietnamese securities companies collectively net bought VND 478 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.