The Great Escape: Hòa Bình Construction and HAGL Agrico Stocks Face Delisting, Triggering Investor...

The stocks of Hòa Bình Construction (HBC) and HAGL Agrico (HNG) plummeted following the announcement of their forced delisting. Meanwhile, the market witnessed a surge of cash flow as investors rushed to rescue QCG of Quốc Cường Gia Lai.

The Power Shift: QCG Stock Surges as Cuong ‘Dollar’ Takes Over the Hot Seat...

A surge of cash flow into QCG stock resulted in a significant spike in liquidity, with nearly 7.5 million units traded—the highest volume in 18 months since January 20, 2022.

The Great Stock Exodus: HBC and HNG Delisting Disaster, Investors Flee 20 Million Units...

The Stock Duo Unexpectedly "Plummets": HoSE's Delisting Decision Shocks Investors.

The Road to Success: BCG Energy’s Profits Soar 33-Fold Ahead of UPCoM Listing

On July 31st, BCG Energy will debut on the UPCoM stock exchange, offering 730 million shares under the ticker symbol BGE. The reference price is set at VND 15,600 per share.

Peaceful Construction: From Pioneer Contractor to Stock Exchange Listing, and Now Delisted to Trade...

Xây Dựng Hòa Bình was the first comprehensive contractor to list its shares on HoSE. However, 2024 marks a somber milestone as the company faces mandatory delisting.

The Stock Market Rebounds, but QCG Remains Liquidity-Challenged

The selling pressure eased, with large-cap stocks making a strong comeback, led by technology stocks. The VN-Index closed the week's final trading session (July 26) with a nearly nine-point gain.

The Ultimate Guide to Stock Market Success: Unveiling the Secrets of the Pros “Revolutionizing...

"Van Phu - Invest Joint Stock Company is poised to issue 29.65 million shares to settle a VND 690 billion debt (excluding interest) in convertible bonds, with a conversion price set at approximately half of the current market price."

Let me know if there are any other adjustments or refinements you would like to see!

The Foreigners’ Sell-Off: Over $12M Net Sold as Contrarians Scoop Up a Brokerage Stock

In the afternoon trading session on the HOSE, PDR experienced the most significant selling pressure from foreign investors, with a value of nearly VND 41 billion. DCM and MWG also witnessed notable sell-offs of VND 39 billion and VND 27 billion, respectively.

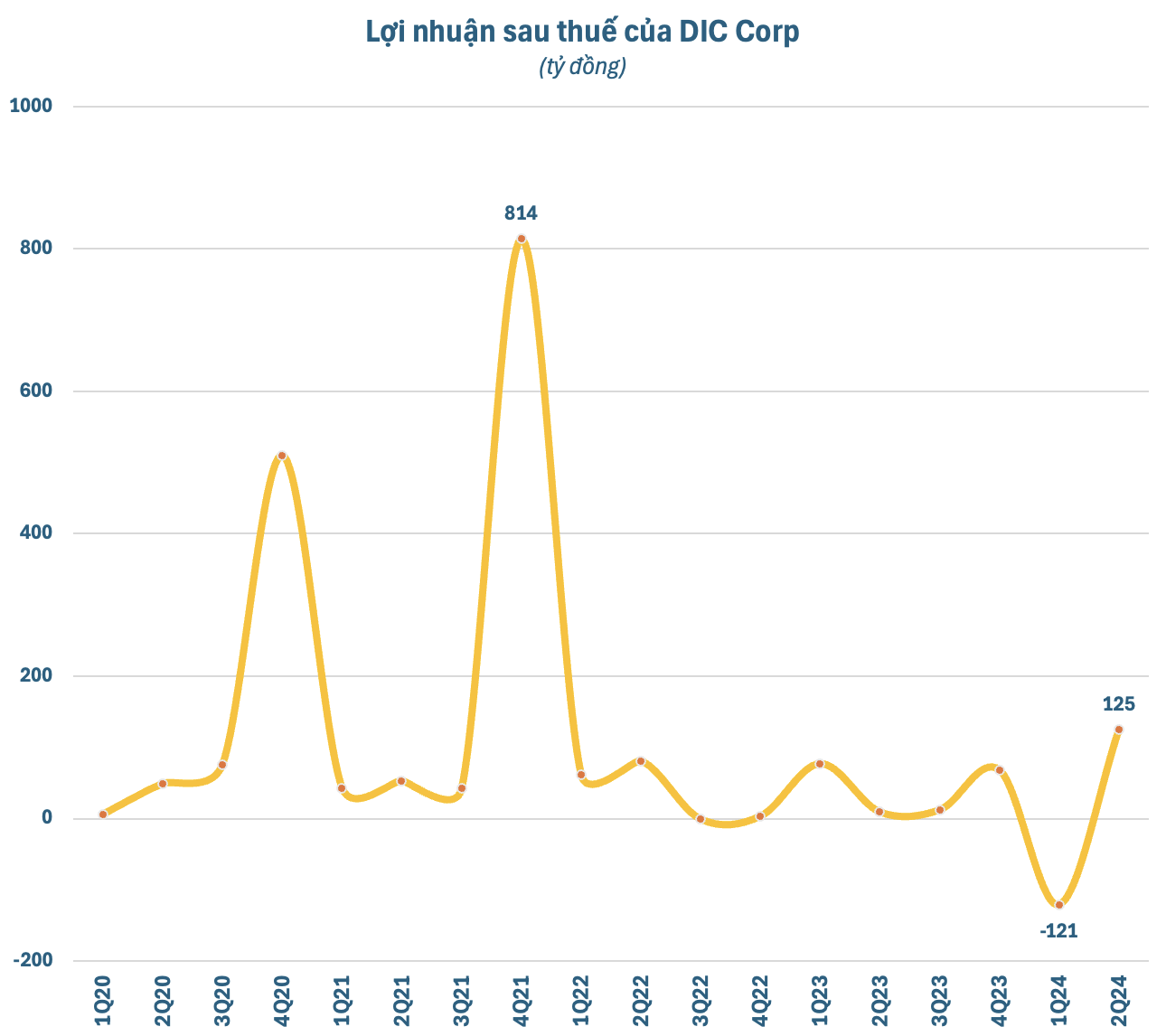

Maximizing Profits, Navigating Challenges: DIC Corp (DIG) Boasts Highest Earnings in 10 Quarters, Despite...

For the first six months of the cumulative year, DIC Corp recorded a pre-tax profit of nearly VND 48 billion, a 60% decrease compared to the same period last year, mainly due to a significant loss in the first quarter of this year.

“Unraveling the ‘Pre-Funding’ Conundrum: Crafting a Seamless Process for Foreign Investors to Navigate the...

Chairman of the State Securities Commission of Vietnam, Vu Thi Chan Phuong, has stated that, in order to meet the criteria for pre-funding requirements as per the standards set by leading rating organizations, the solution is to waive full pre-funding requirements in the short term. In the long term, however, the implementation of a central counterparty clearing model (CCP) will be the key strategy.