Vietstock Daily 19/12/2025: Accumulation Amid Low Liquidity?

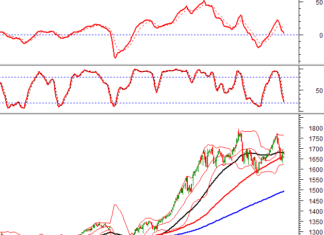

The VN-Index rebounded into positive territory late in the session, forming a Hammer candlestick pattern. Currently, the index is consolidating above the 100-day SMA, while trading volume remains subdued below the 20-session average, signaling cautious investor sentiment. The MACD indicator continues to weaken, hovering near the zero line, heightening short-term risk should it cross below this threshold in upcoming sessions.

SCIC Launches Another Auction for 98.31% Stake in Mekonimex, Aiming to Raise VND 295...

On December 16th, the Ho Chi Minh City Stock Exchange (HOSE) announced a public auction of shares held by the State Capital Investment Corporation (SCIC) in Can Tho Agricultural and Food Export Joint Stock Company (Mekonimex).

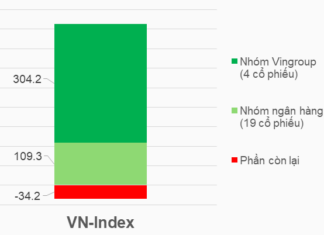

Unveiling the Overlooked: Hidden Gems in the Stock Market

Market enthusiasm is not uniform; it’s concentrated on a select few large-cap stocks. Meanwhile, numerous mid-cap sectors remain largely overlooked, including export industries, industrial zones, and aviation services.

Tracking the Whale Money Flow on December 18: Foreign Investors Net Sell DXS Aggressively

On December 18th, both securities company proprietary traders and foreign investors engaged in net selling. This marked the third consecutive session of net selling by foreign investors and the second session for proprietary traders.

Steel Stock Surges 90% from Lows as Executives Unanimously Register to Divest

Recently, three key executives at B.C.H Joint Stock Company (UPCoM: BCA) have collectively registered to sell nearly 3.2 million BCA shares, following a remarkable 90% surge in the stock price from its recent low.

Technical Analysis for the Afternoon Session of December 18: Still Trapped in a Tug-of-War

The VN-Index remains locked in a tug-of-war around the critical 50-day SMA technical threshold, accompanied by subdued trading volumes. Meanwhile, the HNX-Index continues its pattern of alternating between gains and losses in recent sessions.

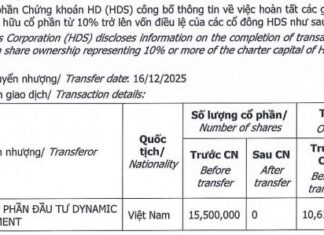

Major Shareholder of HD Securities Divests 10% Stake

HD Securities Corporation (HDS) has announced a significant transaction, transferring over 10% of the charter capital of Dynamic & Development Investment Corporation.

Derivatives Market Update: Volatile Trading on December 19, 2025

On December 18, 2025, both the VN30 and VN100 futures contracts saw a collective rise in points during the trading session. The VN30-Index exhibited a tug-of-war pattern, characterized by small-bodied candlestick formations and erratic trading volumes in recent sessions, indicating investor sentiment remains unsettled.

MCH Confirms HOSE Listing on December 25th with Reference Price of VND 212,800 per...

Masan Consumer Holdings (Masan Consumer, UPCoM: MCH) has announced its official listing on the Ho Chi Minh City Stock Exchange (HOSE) starting December 25, with a reference price of VND 212,800 per share.

How is Duc Giang Chemical Group Performing in the Market?

DGC shares of Duc Giang Chemicals Group experienced their second consecutive floor-price drop, triggering a wave of investor sell-offs. The sell queue reached approximately 12 million shares, with no buyers in sight, reflecting investor anxiety despite the company's fundamentally strong financial performance.