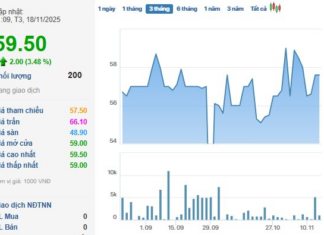

Vietnam Stocks Defy Global Trend on November 18, Vingroup Shares Surge

Vietnam's stock market continued its upward trajectory on November 18th, defying the broader downturn across Asian markets.

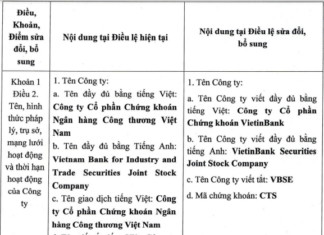

VietinBank Securities Rebrands: New Name, New Identity

The extraordinary shareholders' meeting of VietinBank Securities will approve the resignation of Ms. Bùi Thị Thanh Thúy from her position as a Board of Directors member and elect a new member to fill the vacancy. Additionally, the company aims to rebrand, including a name change and a refreshed corporate identity.

Proprietary Trading Firms Reverse Course, Offloading Hundreds of Billions in Vietnamese Stocks on November...

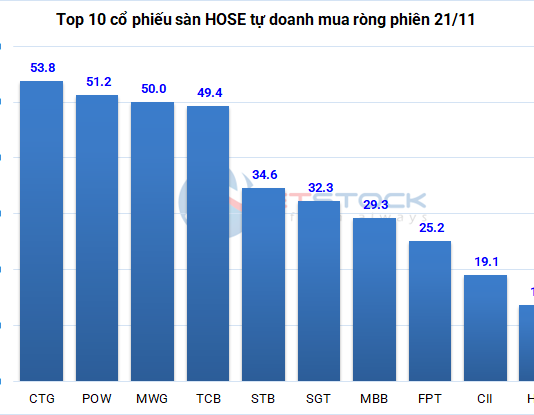

Proprietary trading firms reversed their stance, shifting to net sellers with a total of VND 365 billion on the Ho Chi Minh Stock Exchange (HOSE).

Stock Market Rallies for Three Consecutive Sessions, Yet Investor Caution Persists

The VN-Index rebounded towards the end of today’s session (November 18), extending its winning streak to three consecutive days. While investor sentiment remained cautious and the market showed signs of divergence, a notable development emerged within the seafood stock group.

“Dragon Capital CEO: Without Rising Consumption, What Drives Inflation?”

The expert asserts that, given the current macroeconomic factors, the risk of inflation remains low.

“Billion-Dollar Battle: Vietnam’s Stock Market Soars Past 1,650 Points as ‘Chứng trường bạc tỷ’...

On November 17, 2025, as Vietnam’s stock market surged by over 18 points and the VN-Index surpassed 1,650, the Chứng Trường Bạc Tỷ investment competition officially entered its competitive phase.

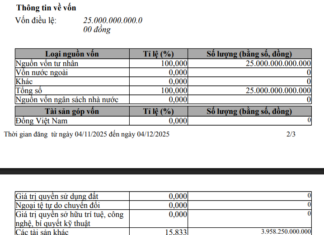

Green SM Capital Surge: Reaching 25 Trillion VND Milestone

In its latest business registration update, Xanh SM has significantly boosted its chartered capital from 18 trillion VND to 25 trillion VND.

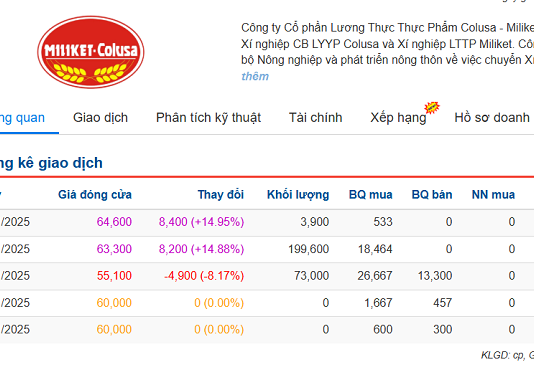

Upcoming Dividend Payout of VND 2,000 per Share Sparks Strong Rally in Stock Price

With over 82.2 million outstanding shares, the total payout for this dividend distribution is estimated to exceed 164.4 billion VND.

VNECO Reminded for Delayed Disclosure of Information

HoSE has issued a formal reminder to VNECO regarding the delayed disclosure of its 2025 Annual General Meeting (AGM) documentation, emphasizing the requirement for simultaneous publication in both Vietnamese and English as per regulatory standards.

What Does a Company Say When Its Stock Hits the Upper Limit for Five...

Danang Oil & Gas Machinery Joint Stock Company has issued an official statement following a remarkable five consecutive sessions of its stock, DAS, hitting the ceiling price.