EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses...

Doubling Profit Target in 2024, How is Masan Performing?

Despite the challenging macroeconomic environment, Masan's business operations continued to perform well in 2023, with a net revenue of VND 78,252 billion, representing a 2.7% increase compared to VND 76,189 billion in 2022...

Individual Investors Sell Off Heavily in January, Proprietary Traders Seize Opportunity to Accumulate VND...

Individual investors were net sellers with a total value of 1,397.6 billion VND, of which they sold a net value of 1,343.38 billion VND in January 2024, in contrast to proprietary trading which was the buyer...

Gold prices face headwinds due to interest rate expectations, domestic price maintained at 78...

Gold is a non-interest bearing asset, so the Federal Reserve keeping interest rates higher for longer is not favorable for the price of gold. This is the main reason why investors on Wall Street are predicting that the price of gold will have a difficult time increasing this week...

HAG continues to spend over 350 billion VND to repay bond debts.

Hoàng Anh Gia Lai Joint Stock Company (code HAG-HOSE) hereby announces the status of principal and interest payment of HAGLBOND16.26 Bonds. The next payment is scheduled for the first quarter of 2024.

The price of sugar in the domestic market is expected to continue decreasing in...

The global sugar price is expected to continue its downward trend in 2024 due to the projected El Nino event, which is expected to extend until mid-2024. Domestic sugar prices will also decrease in accordance with the fluctuations of the global sugar price.

Market Continues to “Give Gifts for Lunar New Year”, Bank Stocks in Positive Rebound

VCB is the only bank that helped restrain the morning gain of VN-Index. However, the banking sector as a whole showed positive recovery, with 8 out of the top 10 gainers belonging to this group. Trading volume also surged, accounting for over 28% of the total trading value on the HoSE floor.

Stocks in banking sector suffer as money floods in, VN-Index returns to January peak

The amount of money poured into successful transactions in banking stocks on the HoSE exchange nearly doubled in the afternoon session, reaching approximately VND 3,695 billion, equivalent to 36.4% of the total trading volume for the day. Throughout the day, banking stocks traded VND 5,632 billion, equivalent to 33.2%, the highest level in 16 sessions, returning to levels seen at the beginning of this year.

Cautious Businesses Issue Bonds, Only Reaching 6.45 Trillion in January, a Sharp Decrease Compared...

Looking ahead to the stages of 2021 and 2022, the total value of successful sales in this January 2024 remains very modest at 6.45 trillion VND...

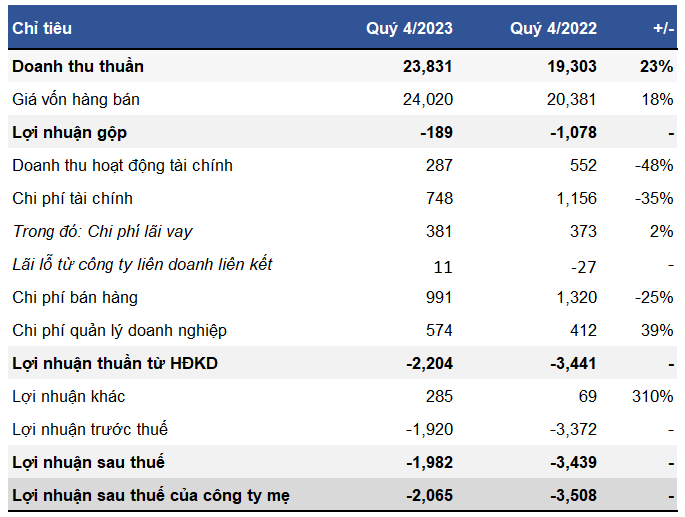

Vietnam Airlines continues to sing the “loss song” in Q4, with cumulative losses nearing...

For the past 4 years, shareholders of Vietnam Airlines (HOSE: HVN) have not experienced what it feels like to make a profit. In the fourth quarter of 2023, the national airline even suffered a gross loss.