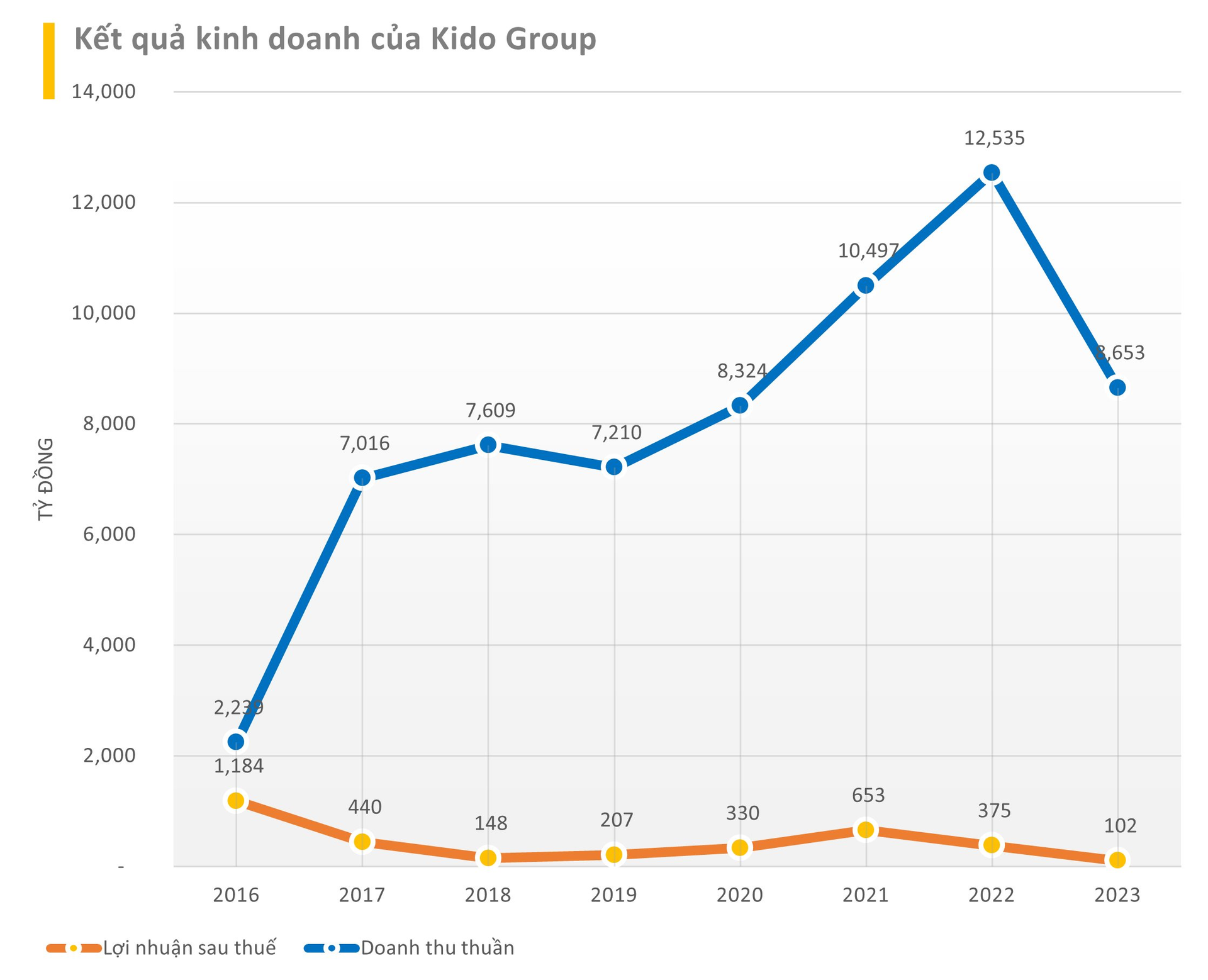

KIDO Corporation (stock code KDC) has just announced its consolidated financial statements for the fourth quarter of 2023, reporting net revenue of nearly 2,000 billion VND – a 33% decrease compared to the same period last year. The decrease in cost of goods sold helped the company increase its gross profit by 35% to 380 billion VND, while the profit margin also increased compared to the same period in 2022.

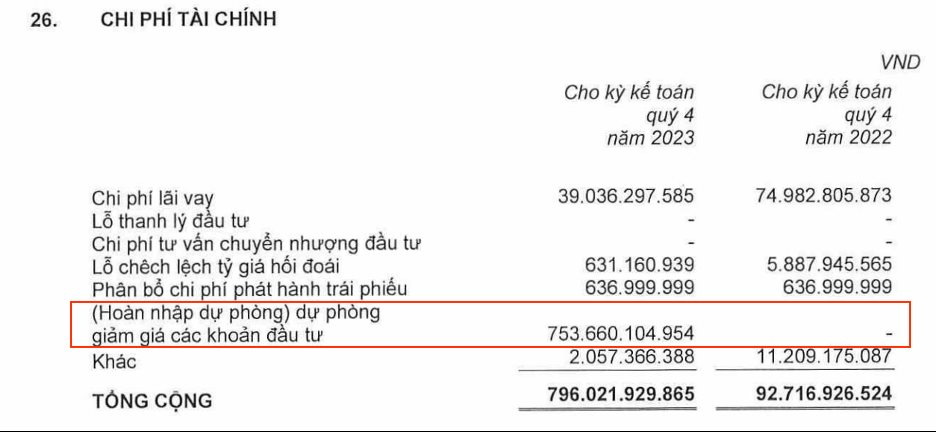

During the period, the company also significantly reduced various expenses, including a 48% decrease in interest expenses, a 31% decrease in selling expenses, and a 46% decrease in general and administrative expenses…

However, during the quarter, KIDO recorded impairment losses of approximately 753 billion VND on the fair value of its investments, resulting in a sharp increase in financial expenses to nearly 800 billion VND. As a result, KIDO incurred a net loss of 565 billion VND in the last quarter of the year, compared to a profit of 25 billion VND in the same period.

For the full year 2023, KIDO reported net revenue of over 8,650 billion VND and a net profit of nearly 110 billion VND, representing a decrease of 31% and 70% respectively compared to the same period.

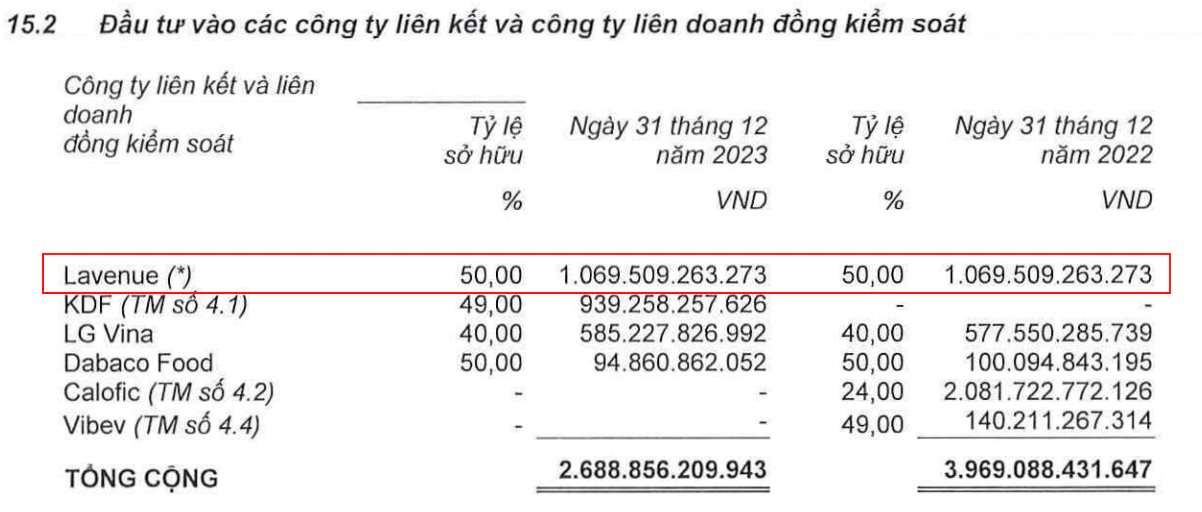

Regarding the provision of impairment losses of 753 billion VND on the fair value of investments, this is a strong move by KIDO in the “golden land” project on Le Duan Street after a decade of unsuccessful pursuit.

KIDO currently holds a 50% stake in Lavenue Investment Corporation (Lavenue) – a company established to implement a project on the 8-12 Le Duan land plot, District 1, Ho Chi Minh City.

However, leasing, transferring land on 8-12 Le Duan has been marred by numerous violations that have hindered the project’s implementation.

KIDO stated that the corporation acquired shares of Lavenue in 2010, until now in 2024, after a long period of undergoing various procedures, legal documents, project investment… and problems arising that have affected the separate and consolidated financial statements of KDC for many periods and years. Recognizing this issue, in the annual financial report for 2023, the Board of Directors discussed and agreed to make a provision for the investment in Lavenue.