VNG JSC (code: VNZ) has just released its Q4/2023 consolidated financial report with a net revenue of VND 2,177 billion, a 7% increase compared to the same period in 2022. The cost of goods sold increased faster (22%), narrowing the gross margin to 36.2%, resulting in a gross profit of over VND 787 billion, a nearly 12% decrease compared to Q4/2022.

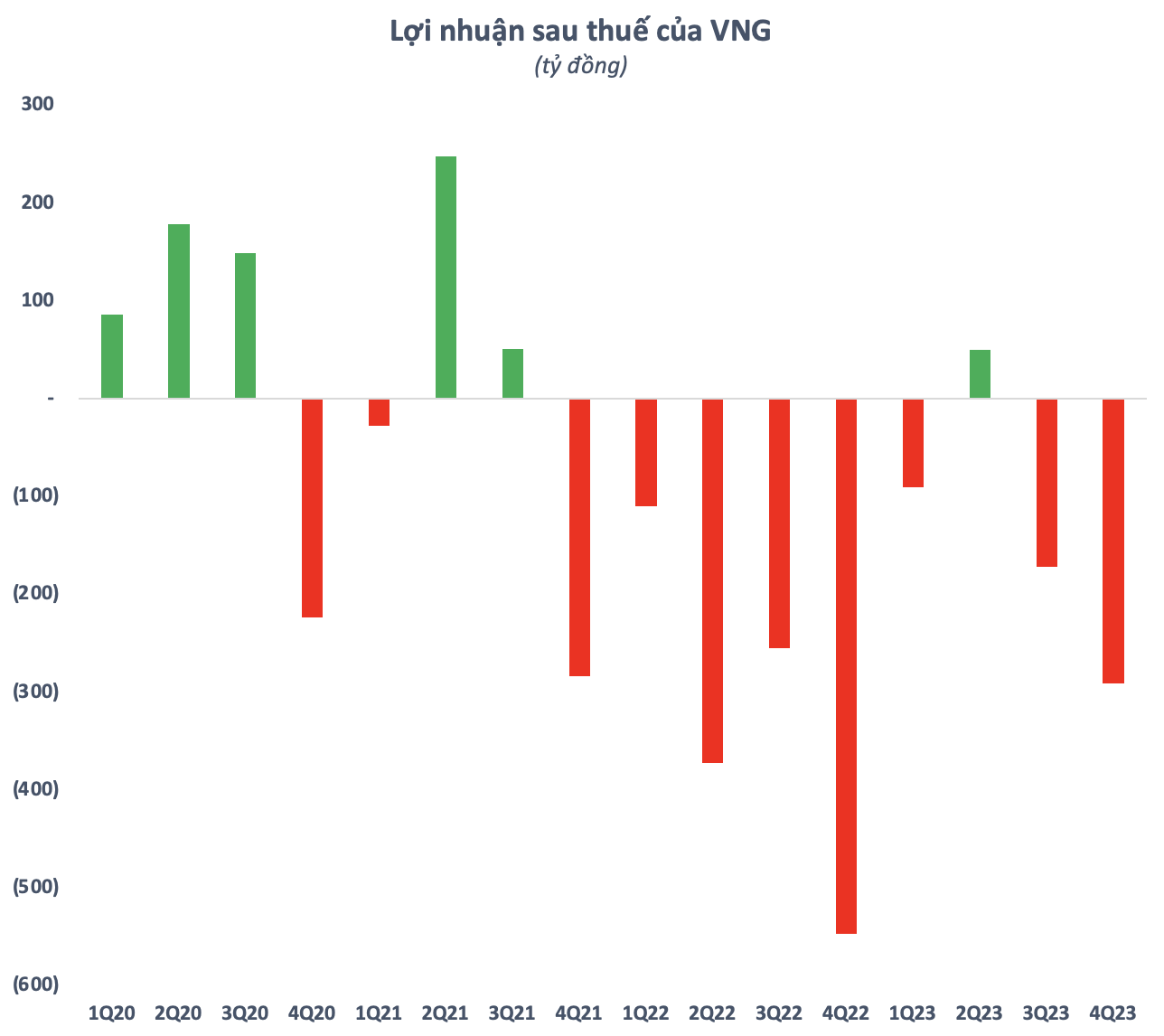

After deducting expenses, VNG incurred a net loss of VND 291 billion in Q4/2023, while the loss in the same period last year was VND 766 billion. The post-tax loss attributable to the parent company’s shareholders was nearly VND 230 billion. This is the third quarter in 2023 that VNG has incurred losses, except for Q2, which had a profit of just over VND 50 billion.

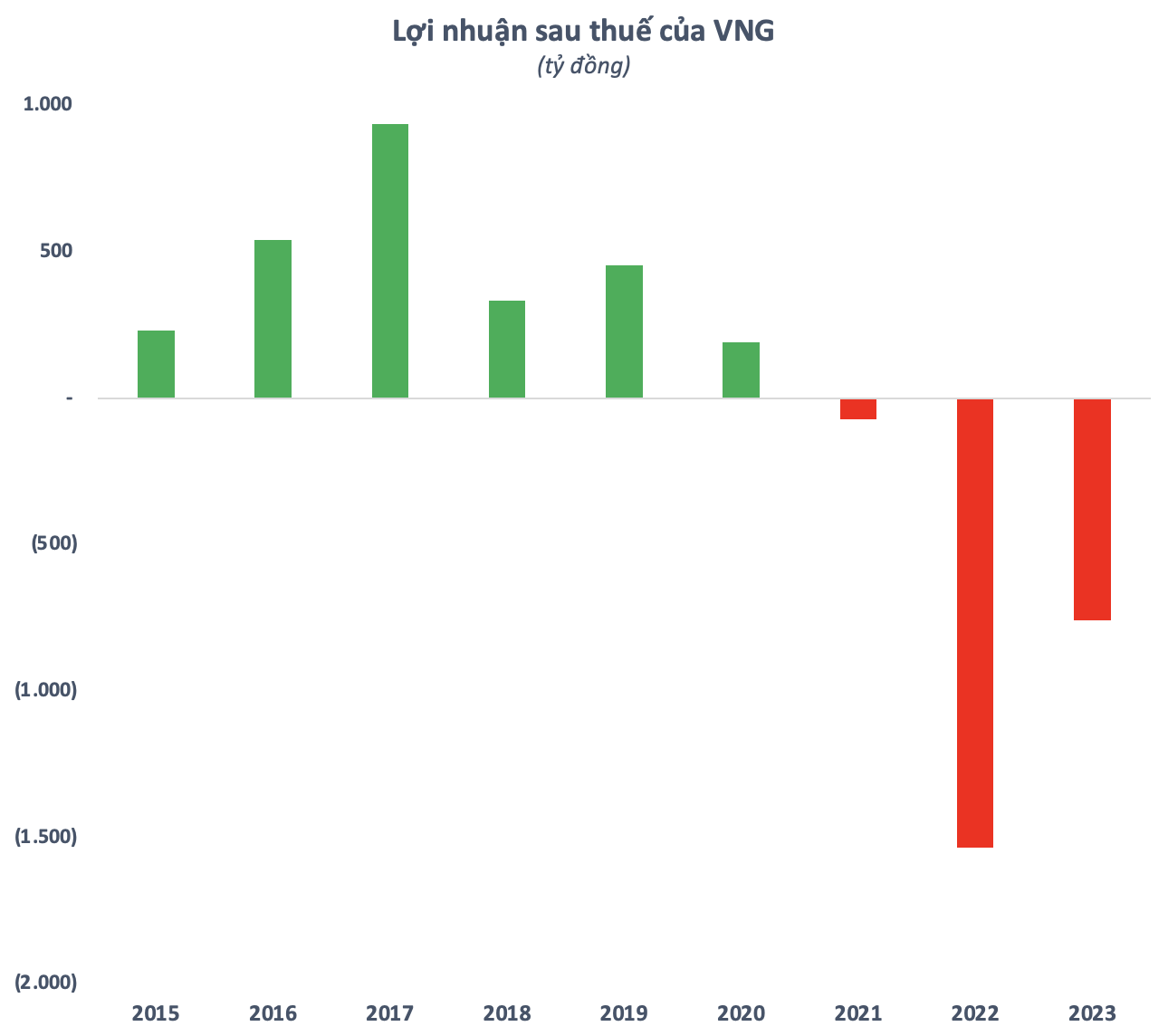

For the full year, VNG recorded a net revenue of over VND 8,608 billion, a 10% increase compared to the previous year. Online gaming services accounted for 75% of the revenue with VND 6,489 billion, a more than 19% increase compared to 2022. VNG incurred a net loss of over VND 756 billion for the whole of 2023, of which the loss attributable to the parent company’s shareholders was VND 540 billion.

This is the third consecutive year that VNG, the technology unicorn of Vietnam, has reported losses. Although the loss has been significantly reduced compared to 2022, it is not enough for VNG to achieve its goal of reducing the net loss to VND 378 billion.

As of December 31, 2023, VNG’s total assets reached VND 9,716 billion, a 9% increase compared to the beginning of the year. Cash and cash equivalents increased by 29% to nearly VND 4,000 billion. Short-term receivables from customers decreased slightly to VND 544 billion. Construction in progress was recorded at VND 214 billion, only 1/5 of the beginning of the year, as the VNG Data Center construction project has been completed.

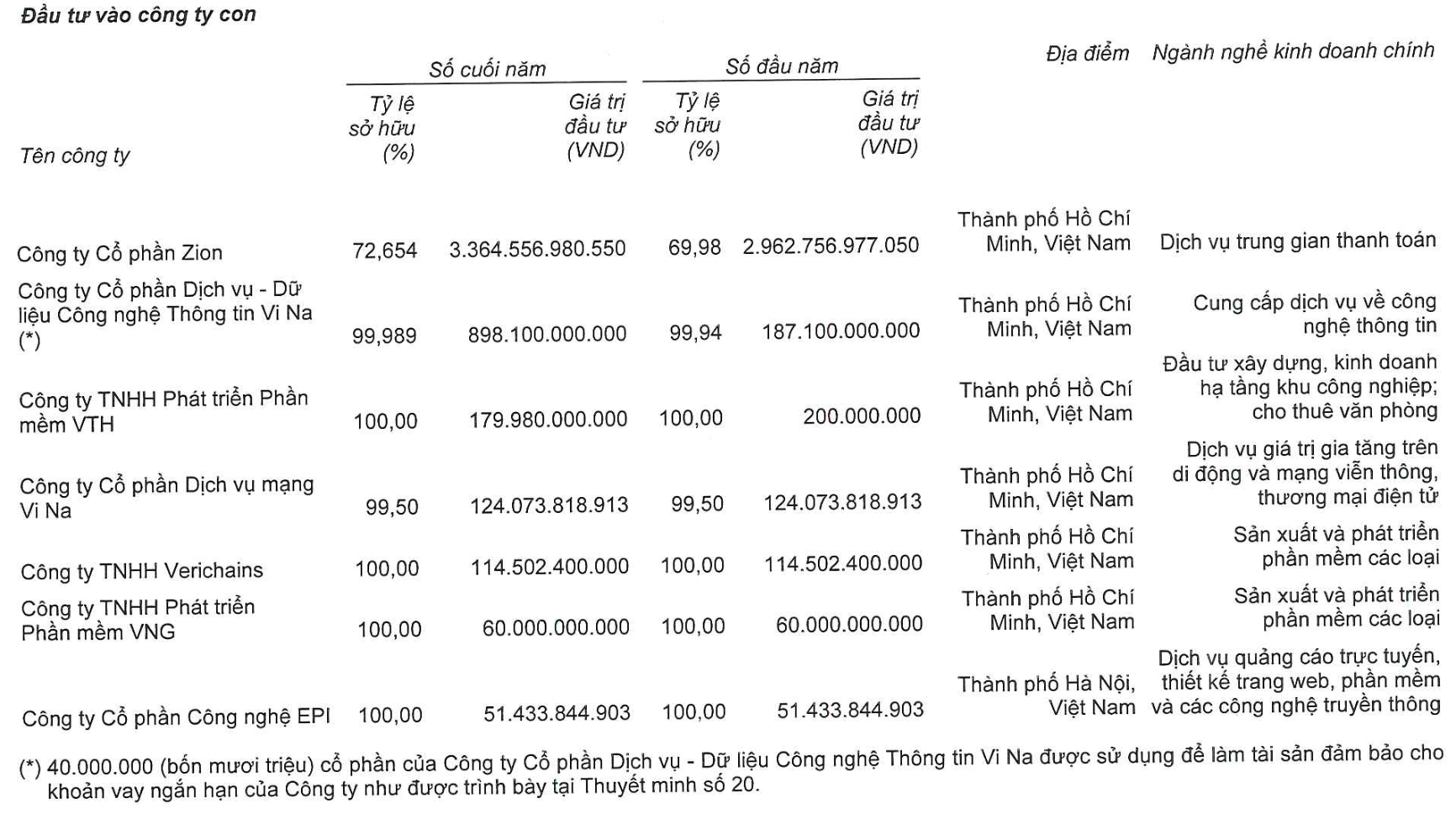

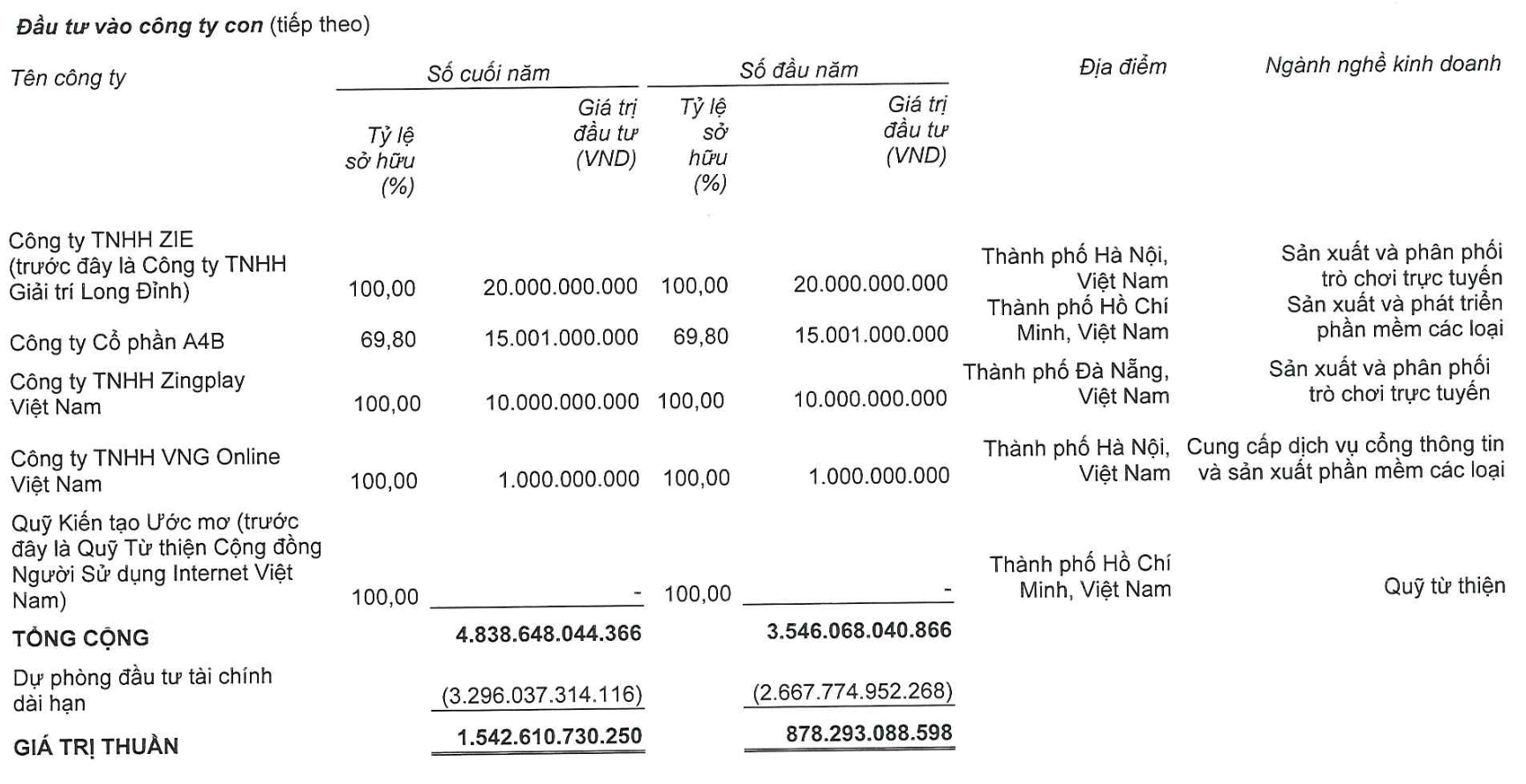

In Q4 alone, VNG’s long-term investments increased by 36% compared to the beginning of the year, reaching VND 4,839 billion. Among them, the ownership ratio at Zion (the owner of ZaloPay) increased from 69.98% at the beginning of the year to 72.654%, corresponding to an investment value of nearly VND 3,365 billion, an increase of VND 190 billion compared to the end of Q3 and an increase of over VND 400 billion compared to the beginning of the year.

Notably, provisions for long-term financial investments at the end of the period also increased to nearly VND 3,300 billion from VND 2,668 billion at the beginning of the year. VNG did not provide detailed explanations, but it is highly likely that the majority of these provisions are related to investments in Zion.

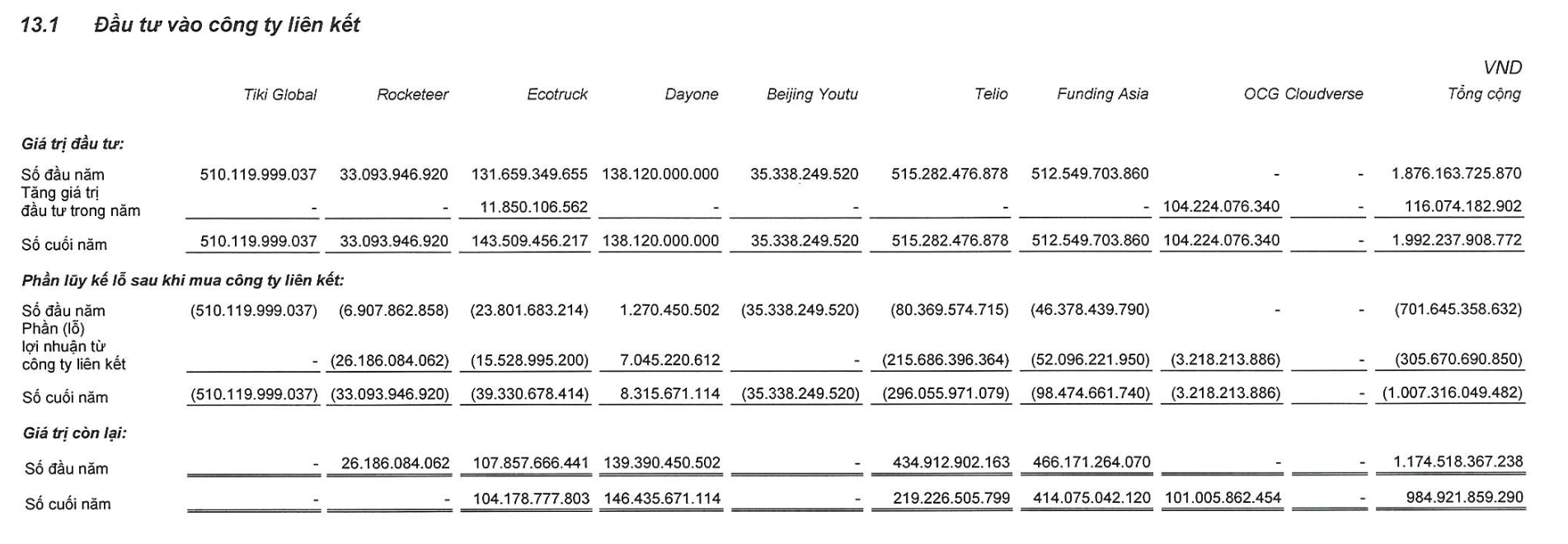

In addition, VNG’s majority of affiliated investments are also incurring losses, except for Dayone, which has a profit of about VND 8 billion. The heaviest loss is at Tiki Global, with accumulated losses of over VND 510 billion, equal to the recorded investment value at the beginning of the year.

In another development, VNG has recently officially withdrawn its IPO application in the US. The company has decided not to proceed with the public offering of its common stock at the current time and plans to re-file in the future. The statement does not provide any timeframe for resuming the IPO process or reasons for the aforementioned withdrawal.

Prior to that, in August 2023, VNG Limited submitted a registration statement on Form F-1 with the US Securities and Exchange Commission (SEC). The controlling shareholders of VNG are expected to offer their common stock for public sale (IPO) on the Nasdaq Global Select Market under the trading code “VNG”.

According to Reuters, Vietnam’s technology unicorn aims to raise approximately $150 million through this IPO. The listing could take place in late September or October. The underwriters for the IPO include Citigroup Global Markets Inc., Morgan Stanley & Co. LLC, UBS Securities LLC, and BofA Securities, Inc.

However, immediately thereafter, the company announced the postponement of its IPO plans in the US, citing unfavorable market conditions. According to information from Tech in Asia, VNG CEO Le Hong Minh shared internally about the reasons for the company’s postponement of listing in the US. Specifically, Le Hong Minh believes that investors are still not ready for IPOs of technology companies in Asia.

On the market, VNZ shares have dropped nearly 60% from their peak in mid-February last year, but they are still the most expensive stock on the Vietnamese stock exchange with a price of VND 572,200 per share. The corresponding market capitalization is still VND 16,400 billion, although it peaked at over $1.5 billion at one point.