Becamex IDC, listed under the stock code BCM, has announced its business results for the fourth quarter of 2023, with a revenue of VND 5,059 billion, a 5.7-fold increase compared to the same period last year thanks to a significant increase in revenue from real estate business activities. After deducting the cost of goods sold, the company’s gross profit reached VND 2,590 billion, 8.5 times higher than the previous year.

The company’s financial income reached nearly VND 20 billion in the fourth quarter of 2023, a 66% increase compared to the same quarter in 2022. The major real estate firm did not see significant changes in its expenses compared to last year.

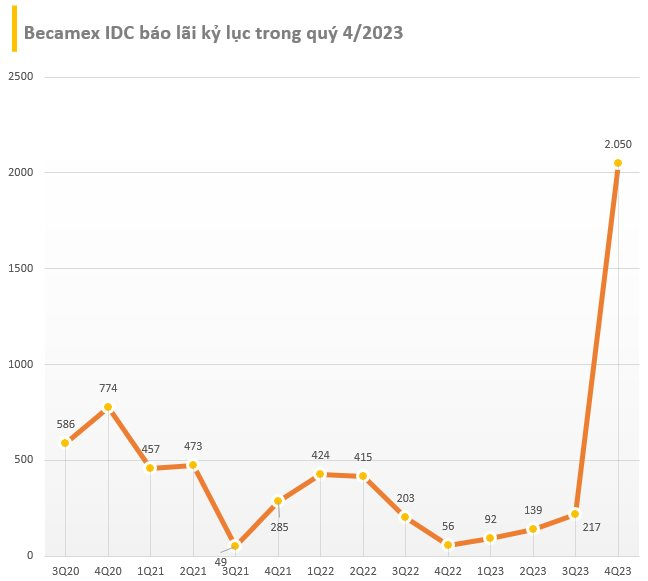

As a result, Becamex IDC reported a net profit of VND 2,050 billion in the fourth quarter of 2023, 36 times higher than the same period the previous year. The earnings per share (EPS) increased from VND 54 to VND 2,050. This is also a record profit in a quarter since the company’s listing.

Becamex IDC recorded a total revenue of VND 8,204 billion and a net profit of VND 2,441 billion in 2023, an increase of 23% and 43.6% respectively compared to the previous year.

In the financial statement, Becamex IDC did not specify the sources of the significant revenues in the past quarter from its real estate business. However, in December 2023, the People’s Committee of Binh Duong Province approved the transfer of the Tan Thanh Binh Duong mixed-use residential urban project from Becamex IDC to Sycamore Company, a subsidiary of Capitaland. The project’s objective is to build housing for people in need.

The transfer project covers a total area of 18.9 hectares, including a total of 462 low-rise villa houses and about 3,300 apartments. The total construction area is approximately 592,876 square meters. The transfer price is estimated to be more than VND 5,000 billion.

The commercial name of this project is Sycamore Capitaland, consisting of 7 sub-areas including 1 block of shophouses and townhouses, 1 villa area, 4 24-floor apartment areas, and 1 10-floor apartment area. The total investment amount for the project is approximately VND 18,300 billion.

The transfer plan has been announced by Becamex IDC since 2021, and the company has received a deposit of VND 2,310 billion from its partners since the first quarter of 2022. As of December 31, 2023, the company no longer records this item. Instead, the company’s balance sheet shows a short-term account receivable of VND 2,776 billion from Sycamore Company.

Despite the high business growth, Becamex IDC’s operating cash flow recorded a negative value of VND 2,915 billion (compared to a positive value of VND 504 billion in the same period). The main reason is the large inventory, accounts receivable, and interest paid.

As of the end of 2023, Becamex IDC’s total assets reached VND 53,800 billion (approximately USD 2 billion), an increase of VND 5,000 billion compared to the beginning of the year. The large proportion of the company’s assets (42%) is inventory worth VND 22,448 billion, an increase of 10%, and long-term financial investments worth about VND 17,245 billion, an 8.8% increase.

The total liabilities to be paid by Becamex IDC at the same time were about VND 34,091 billion, an 11.6% increase compared to the beginning of the year. Among them, bank loans accounted for VND 7,350 billion and bond debts accounted for VND 11,765 billion. The major bondholders are securities companies such as Smart Invest Securities JSC (VND 4,000 billion), Navibank Securities JSC (VND 4,000 billion), Euro Capital Securities JSC (VND 800 billion), etc.