Investors’ Top Stock Picks for the New Year

As the Lunar New Year approaches, investors are looking to buy stocks for good luck. This is the reason why stocks usually increase in price during the first trading sessions of the year or the whole month of January.

So which stocks are investors prioritizing to add to their portfolios at this time of the year? Which stocks are being put on their year-end shopping list?

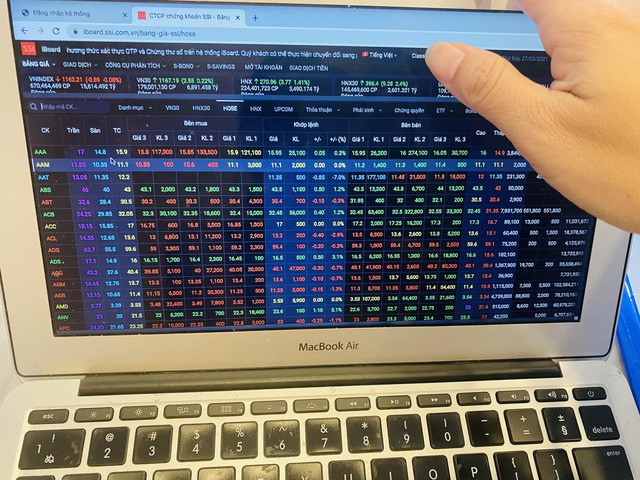

Statistics from brokerage firms show that most stocks have had good price performance in the past month. Among them, banking stocks are the most favored, with rapidly increasing liquidity.

According to data from the Ho Chi Minh City Stock Exchange (HoSE), liquidity of banking stocks has increased by 30-40% from December 2023 until now, following the market trend. Within this group, banking stocks have shown positive price movements of 15-20%. Experts believe there are still plenty of investment opportunities in this group of stocks.

In terms of investment strategy, Huynh Anh Tuan, CEO of Dong A Bank Securities Company (DAS), believes that many investors are still cautious about taking profits before the Lunar New Year. However, after the holiday, many investors will choose to buy or sell stocks for good fortune. Therefore, liquidity will be lively.

Tuan suggests that investors choose good prices for accumulation rather than chasing prices at this time. Among them, banking stocks can be prioritized due to their high profitability. When the VN-Index increases, it is an opportunity for banking stocks, especially leading ones such as MBB, ACB, BID, with good potential for accumulation.

In addition, real estate stocks, after facing difficulties for a long time, have started to rebound. Real estate stocks with strong financial health and good land reserves will benefit from the effectiveness of relevant real estate laws, such as NLG, KDH.

The construction materials sector, construction and infrastructure investment are also on the rise. With steel forecasted to perform well in 2024, investors can consider buying HPG, HSG. Stocks related to infrastructure investment are also prioritized as the government continues to disburse funds, such as CII, VCG. Furthermore, the technology and retail sectors are worth considering, with stocks like FPT, MWG.

SSI and HCM are the “KXR” stocks to watch. During this period, with strong liquidity, large investors prioritize stocks that meet certain criteria, such as SSI and HCM.