The stock market in the session on 31/1 recorded a strong correction under the pressure of banking and real estate stocks. The VN-Index closed down more than 15 points, equivalent to -1.3% at 1,164.31 points. Especially, liquidity increased sharply with a total trading value of VND 27,103 billion on all 3 exchanges. Foreigners unexpectedly became bright spots when net buying with a value of over VND 1,272 billion mainly due to sudden transactions.

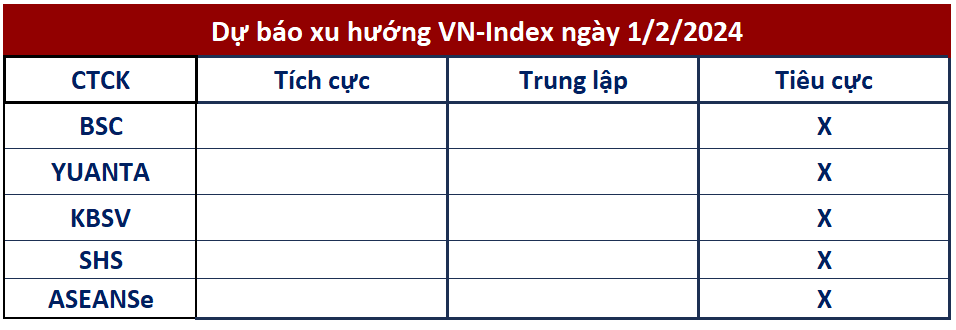

The index has experienced the largest decline in many weeks along with increased liquidity, many securities companies expressed cautious views on developments in the next session, and recommended that investors closely monitor market movements and maintain reasonable stock proportions.

According to BIDV Securities (BSC), bargain-hunting money has appeared at the 1,160 point threshold, however, the market still has many risks when liquidity spikes in a sharply downward session. In the upcoming trading sessions, if buying power is not strong enough at the 1,160 – 1,165 range, the VN-Index could continue to decline to the support level of 1,150. At the same time, BSC recommends that investors also pay attention to the last day of the ETF restructuring period, which is 2/2.

In the same view, Yuanta Securities Vietnam believes that the market may continue to adjust and the downward momentum may narrow towards the end of the session after VN-Index falls to the support level of 1,160 points.

At the same time, the market is still in a short-term accumulation phase, so funds may be differentiated among stock groups, especially banking stocks may continue to decline. Conversely, buying force may be directed toward other stock groups such as securities, steel, real estate,… Yuanta expects that Midcap stocks may continue to attract funds in the short term.

KB Securities Vietnam (KBSV) views the determination of sellers in large-cap stocks has spread adjustment pressure throughout the market, completely overshadowing buying force for midcap stocks. With a sharp decline in points, KBSV predicts that VN-Index is likely to continue to face downward pressure before being able to react to recover around 1,150 points (+-5). Investors are recommended to spread buy orders trading a portion of the proportion when the index returns to the support zone near 1,150 points (+-5).

In the short-term perspective, SHS Securities evaluates VN-Index is experiencing the risk of adjustment after a strong decline session, thereby reconfirming the support level in the 1,150 – 1,160 range in the coming sessions. SHS hopes that today’s decline session is only a temporary fluctuation due to the impact of portfolio reorganization activities according to the index and the market will soon recover.