Aplus Home is one of the biggest deals of Shark Hung on Shark Tank Vietnam season 6 with a total value of 2 million USD (nearly 50 billion VND). According to the introduction, the occupancy rate of this model is always over 95% and it only takes 5-10 days to fill up. Aplus Home startup has more than 40 locations, each location is a 4-5 floors building. While the rent is the same as the market, this model stands out thanks to its beautiful concept and quality management. According to co-founder Dao Quy Phi, initial customers only signed a 6-month lease contract. However, after 6 months, they continued to renew and the percentage of renewal is very high.

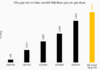

Established in 2021 during the Covid-19 period, Aplus spent its first year focusing on technology development and model optimization, so the revenue only reached a few hundred million VND. In 2022, Aplus earned 7 billion VND by deploying the first locations.

“In the first 6 months of 2023, Aplus achieved a revenue of 12 billion VND and according to our planned target, we will reach 35 billion this year,” said Aplus Home co-founder Dao Quy Phi.

Notably, Phi claimed that with 3 years of managing multiple buildings, Aplus Home’s average profit earned from each building is 35-40%.

On the television show, Shark Hung made an investment deal of 2 million USD, in which 500,000 USD was exchanged for a 4% stake and 1.5 million USD was invested with a requirement to recoup the capital within 24 months. If the commitment is achieved, this 1.5 million USD will be converted into shares with a new maximum valuation of 20 million USD.

Aplus Home co-founder – Dao Quy Phi

Although the investment was agreed upon, the Aplus model also brought contrasting views to the “sharks”.

On the television show, Shark Binh believed that the Aplus model has passed its prime. The big risk comes from the fact that the startup will depend on the macroeconomic situation. If students no longer rent houses or workers return to their hometowns, the number of vacant rooms will increase significantly.

“I apologize to the previous round investors who put in 10 million USD. But they should also understand that we bought at the peak, now the market is at the bottom, so we have to accept a price drop. I guarantee that 90% of startups in the current stage will face a down round when raising capital,” Shark Binh expressed his opinion.

However, in the program “After the Shark Tank”, Shark Hung believed that the high wheat and rice period, the difficulties are opportunities for low-priced real estate products because people will return to basic needs. At that time, affordable housing, affordable commercial housing, and social housing will be on the rise, following the new cycle.

Meanwhile, the co-founder affirmed that the Aplus model serves very essential needs, so there is no question of whether it is in its prime or not.

“This model is considered a proven model, meaning that the model has proven to be successful. It’s nothing new, but the difference here lies in the customer recognition, with a good system, it significantly reduces the cost of finding customers, low investment level. You have presented a cooperative investment model. Real estate investors focus on return on capital rather than cash flow. This is a drawback in Vietnam. Now there is no return on capital because the market is stagnant and we don’t know when it will bounce back, so having cash flow is very important. The Aplus model is solving the pain of the market,” analyzed Shark Hung further.

On the other hand, the co-founder said that sometimes in a “red ocean”, the difference doesn’t have to be too big, just being better than the non-professionals already guarantees a certain market share.

Talking about the suspicion that going on Shark Tank is just for advertising because Aplus is part of Shark Minh Beta’s ecosystem, Phi revealed that Beta Group has an internal investment fund, but Shark Minh Beta has many other startups and business models to focus on. In the “After the Shark Tank” conversation, Shark Hung also appeared optimistic about the actual success of this deal.