Final businesses announce their Q4/2023 financial statements:

As of January 31, almost all listed companies in Vietnam stock market have announced their Q4/2023 financial results. The industries have recorded mixed results, with some companies maintaining their performance and profits as predicted, while others experienced surprising developments.

In particular, the banking, securities, and steel industries have mainly reported positive results, even setting new profit records due to favorable business conditions. Additionally, real estate companies have also achieved surprising outcomes in a difficult market.

Most banks have continued their growth in Q4/2023 compared to the same period last year, contributing to the creation of new profit peaks in 2023. Saigonbank (SGB) recorded the highest growth rate at over 9,000%, reaching 84 billion VND.

LPBank (LPB) and NamA Bank (NAB) also reported significant profit increases in three digits. Well-known banks such as Techcombank, VietinBank, BIDV, VPBank, ACB, SHB, and more, have maintained their growth momentum. However, there were also banks that experienced profit decreases, including Vietcombank and TPBank. In addition, three banks, namely ABBank, NCB, and PGBank, reported losses.

The securities industry also made a strong impression in Q4/2023, with leading companies achieving outstanding growth rates. VNDirect (VND) notably recorded a profit increase of over 11,000%, reaching 991 billion VND. The company topped the securities industry in terms of profit.

TCSB, SSI, and VPS, the three following companies in the securities industry, also reported profit increases in three digits. Some companies even achieved four-digit growth rates, such as KIS Securities. Many companies that reported losses last year achieved significant profits this year, including KB Securities, VIX Securities, and TP Securities. Overall, most companies in this industry have progressed compared to the same period last year.

The steel industry’s comeback in Q4/2023 is also noteworthy. Major companies in the industry, including Hoa Phat (HPG), Hoa Sen (HSG), Nam Kim (NKG), and Ton Dong A (GDA), have returned to profitability after a challenging period from late 2022 to early 2023.

Among them, Hoa Phat has regained its position as a leading enterprise by reporting a pre-tax profit of nearly 3.4 trillion VND, compared to a loss of over 2 trillion VND in the same period last year. Gang Thép Thai Nguyen (TIS), which has regularly reported losses, also returned to profitability. However, Thép Tiến Lên, Thép Pomina, and Thép SMC continued to incur losses.

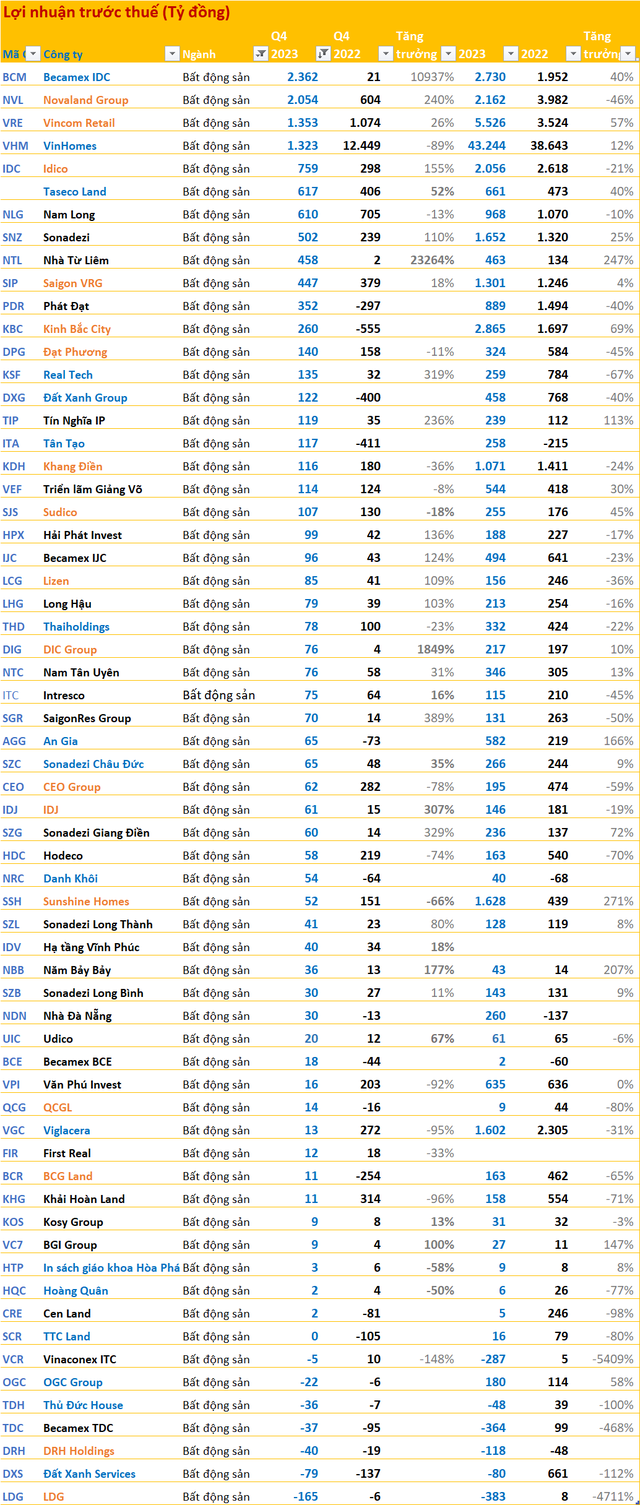

The real estate industry caused the most surprises in Q4/2023. Despite the difficult market conditions, many companies reported “unbelievable” profits. Notable companies in this industry include Becamex IDC (BCM), Novaland (NVL), Phat Dat (PDR), Nha Tu Liem (NTL), Kinh Bac (KBC), and DIC Corp (DIG), which achieved large profits in the last quarter.

However, these large profits do not necessarily imply a market recovery. Many companies in this industry achieved profits by selling assets, divesting from projects, or selling subsidiaries. The largest company in the industry, Vinhomes (VHM), reported a pre-tax profit decrease of 89% to over 1.2 trillion VND.

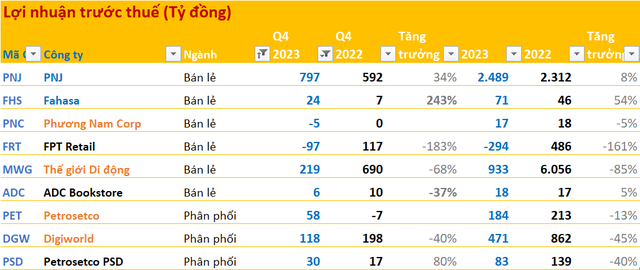

Not every industry experienced impressive growth in Q4/2023 like the industries mentioned above. One example is the retail industry, which faced challenges due to the difficult macroeconomic situation, tightened consumer spending, and the impact of price war on profits.

Thế Giới Di Động (MWG) and FPT Retail (FRT) are two typical examples in the industry with negative results. While MWG reported a nearly 70% profit decrease, FPT Retail even incurred losses. Only PNJ achieved consistent growth and set new profit records in the past year.

Other notable companies that disappointed investors include Vingroup (-68%), Hóa chất Đức Giang (-33%), Petrolimex (-48%), Kido Group (loss of 578 billion VND), Viglacera (-95%), Vĩn Hoàn (-68%), and PV Gas (-19%)…