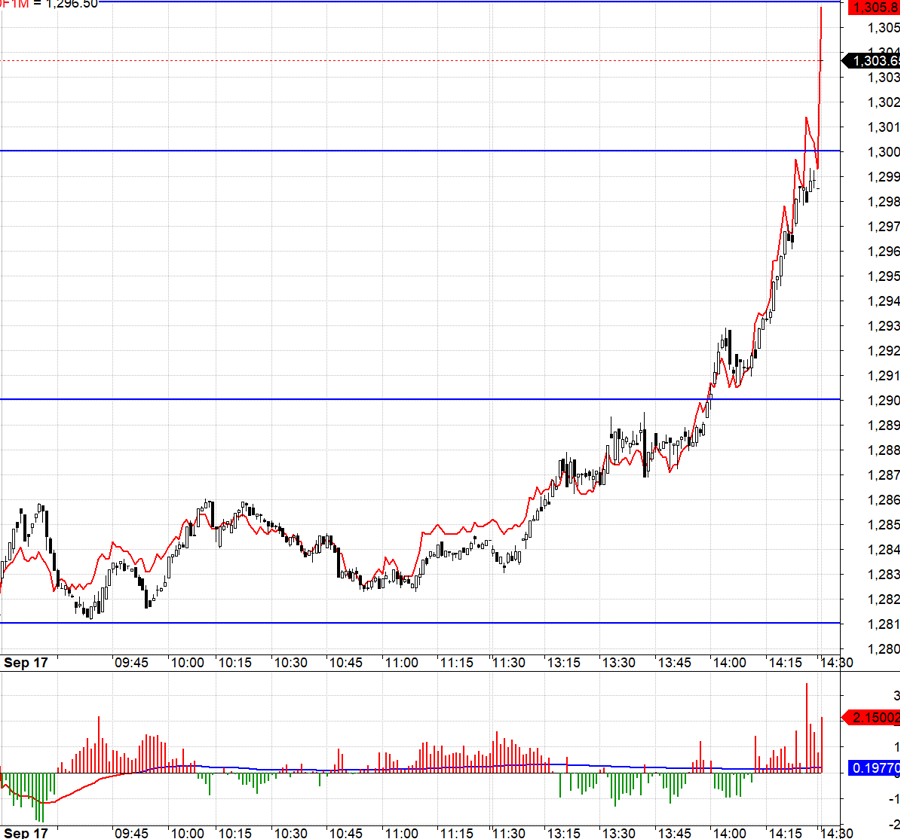

The Vietnamese stock market recorded strong volatility in the last trading session of the month. After a quick opening gap up, buying pressure weakened while selling pressure intensified in large-cap stocks, causing the index to sharply decline.

The VN-Index closed the session on January 31st down more than 15.34 points (1.3%) to 1,164 points. The entire market was painted in red, with over 603 stocks declining, completely overpowering the gaining stocks. This is also the sharpest decline in the past 2 months, since the end of November 2023.

Notably, market liquidity also increased remarkably with a trading volume exceeding 1.1 billion shares. The trading value on HOSE reached nearly 21,900 billion VND, up nearly 80% compared to the previous session and the highest level in nearly 1 month.

Providing insights into the market’s developments, Mr. Bui Van Huy – Director of DSC Securities Branch believes that exchange rate pressures are somewhat escalating, supportive information is weakening as the earnings season passes, combined with the Lunar New Year holiday spirit, creating pressure on the overall market.

The international context is also not very encouraging as Asian markets, especially China, are relatively weak. In addition, investors are also more cautious ahead of the Fed’s night meeting.

Mr. Huy believes that the VN-Index support is around 1,160. Strong support is around 1,130 – After today’s session & holiday pressure, the scenario of consolidation and adjustment from now until the Lunar New Year is highly appreciated.

Commenting on the decline of the market, Mr. Nguyen The Minh – Director of Securities Analysis at Yuanta Vietnam Securities provides some reasons.

Firstly, although geopolitical risks have been present for quite some time, tensions in the Middle East have made investors concerned.

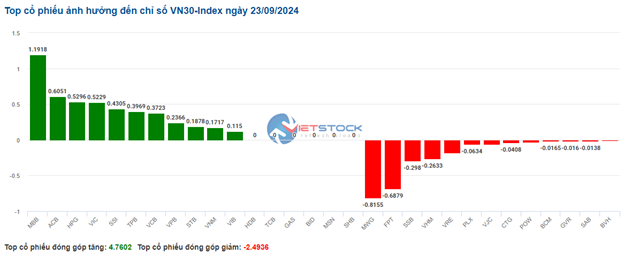

Secondly, after a period of hype, the bank stocks are under considerable pressure as money flows show signs of shifting to mid-cap and small-cap stocks. The leading stock groups are gradually losing momentum while market liquidity remains at a low level, causing investors to tend to take profits.

Thirdly, the downward momentum of large-cap stocks is also a factor that drags the overall market down. After reporting impressive Q4 results, many large-cap stocks were heavily sold off as investors had high profit expectations.

Regarding the surge in liquidity during the deep decline session, Mr. Minh believes that although selling pressure increased, hopeful buyers took advantage of the opportunity to buy at the bottom. Because recently, money circulation has been quite stagnant and the market has been mostly sideways, so many investors consider these adjustment periods as good opportunities to liquidate positions.

However, large-cap stocks have gained a lot, so differentiation will occur and mid-cap and small-cap stocks may be the next destination for money flow. Therefore, the expert evaluates the possibility of VN-Index moving sideways in a narrow range rather than experiencing a sharp decline.