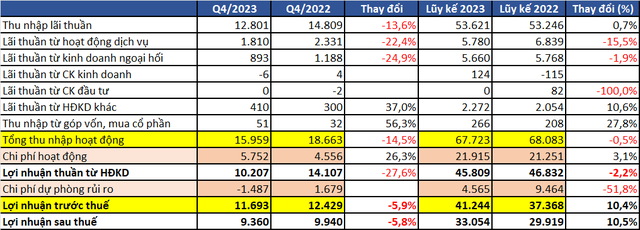

Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank) has recently announced its financial report for the fourth quarter of 2023 with a pre-tax consolidated profit in 2023 reaching VND 41,244 billion, up 10.4% compared to 2022.

With these results, Vietcombank continues to outperform other giants such as BIDV (VND 27,650 billion), MB (VND 26,306 billion), Agribank (VND 25,400 billion), VietinBank (VND 25,100 billion), and sets a new record for profits in the banking industry.

The profit growth momentum of Vietcombank in 2023 comes from the reduction in provision for risk expenses. Accordingly, provision for risk expenses reduced by more than half compared to 2022. In fact, in the fourth quarter, the bank even recovered nearly VND 1,500 billion in credit risk expenses, in contrast to the provision of VND 1,679 billion made in the fourth quarter of 2022.

The financial statement shows that Vietcombank recovered more than VND 5,131 billion of specific provision for credit risk for loans to other credit institutions in 2023. Previously, the bank had to set aside more than VND 6,887 billion for interbank loans in 2022. This change helps to reduce the total provision for credit risk of Vietcombank from VND 9,464 billion in 2022 to VND 4,565 billion.

The reduction in provision expenses is the factor that helps Vietcombank’s pre-tax profit continue to grow despite a 2.2% decrease in net operating profit in 2023 compared to 2022.

Regarding business areas in 2023, net interest income – the main source of income for Vietcombank increased slightly by 0.7% to VND 53,621 billion despite a 10.6% expansion of credit portfolios compared to the end of 2022. This reflects the decrease in profitability of assets as Vietcombank continuously implements preferential interest rate packages to support customers.

Net income from service activities reached VND 5,780 billion, down 15.5% compared to 2022 due to the weakness of the payment sector. Net income from foreign exchange business also decreased by 1.9% to VND 5,660 billion due to the narrowing of revenue from spot foreign exchange trading.

On the other hand, securities trading business recorded positive developments when it turned from a loss of over VND 115 billion in 2022 to a profit of VND 124 billion. Income from capital contributions and share purchases also increased by nearly 28%, bringing Vietcombank VND 266 billion in 2023.

In addition, profits from other business activities increased by more than 10%, contributing more than VND 2,272 billion to the total operating income in 2023. This profit is mainly contributed by the activities of recovering foreign loans and interest rate swaps.

Overall, Vietcombank’s total operating income in 2023 was VND 67,723 billion, down 0.5% compared to 2022. Meanwhile, operating expenses increased by 3.1% to nearly VND 21,915 billion. As a result, Vietcombank’s net profit in 2023 decreased by 2.2% to VND 45,809 billion.

Vietcombank’s Financial Statement (Source: Q4 Financial Report)

As of the end of 2023, Vietcombank’s total assets reached over VND 1,839 trillion, increased by 1.4% compared to the beginning of the year. Of which, customer loans amounted to over VND 1,270 trillion, up 10.9%. Customer deposits increased by 12.2% to nearly VND 1,396 trillion, with the proportion of non-term deposits at 35.2%.

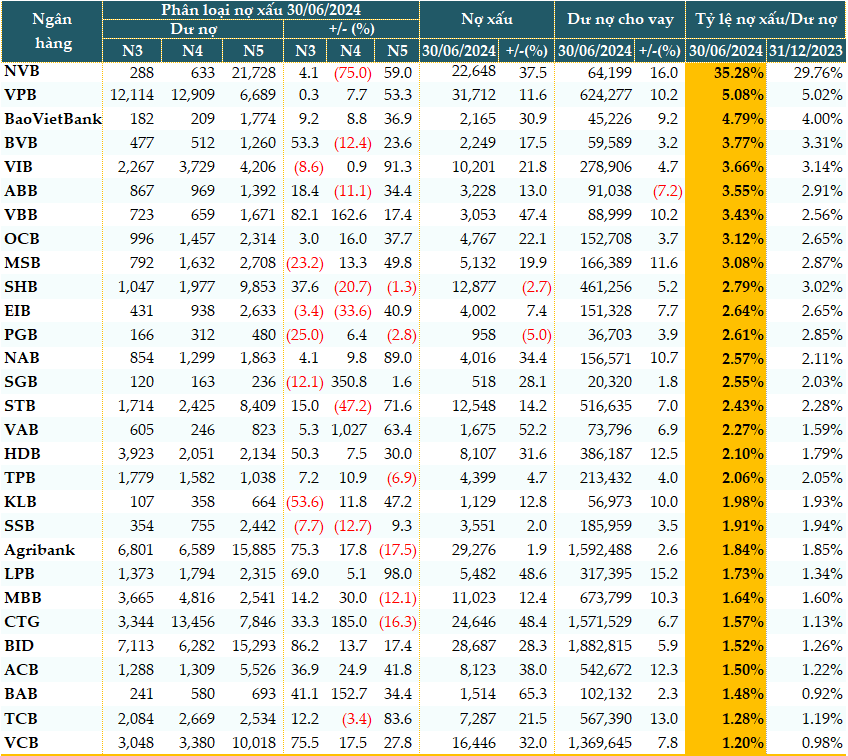

Bad debts of Vietcombank at the end of 2023 were VND 12,455 billion, increased by 59.3% compared to the end of 2022. As a result, the non-performing loan ratio on total loans increased from 0.68% to 0.98%; meanwhile, the coverage ratio of bad debts decreased from 317% to 230%. Nevertheless, Vietcombank still has the lowest bad debt ratio and the highest coverage ratio in the banking system.