The stock market’s largest cap stock, VCB, staged a strong reversal that pushed the VN-Index back above the 20-day moving average. The blue-chips rebounded on significantly lower liquidity, down 46% from the previous day, but still made the necessary impact.

This afternoon, the money flow did not improve much compared to the morning session, but the selling pressure helped stocks rise across the board. In terms of HoSE, the trading value only added VND 6,627 billion, a slight increase of 4% from the morning session. If combined with HNX, the total trading value reached VND 7,314 billion, up 7%.

Compared to the previous session of unusual selling, liquidity decreased significantly, but this is not necessarily a bad signal. The large amount of more than 1.1 billion shares released in the market undoubtedly reduced the selling pressure. Therefore, usually the selling pressure in the next session will weaken. VN-Index’s breadth at the close recorded 270 gainers/177 losers, indicating that the recovery trend is widespread and confirming the weak selling pressure. The total trading value of the two bourses today decreased by 39% compared to the previous day, reaching VND 14,150 billion.

VCB led the index today with a 1.47% increase, pushing the index up by more than 1.8 points, equivalent to offsetting the previous decline of BID (-0.94%), VPB (-1.29%), and TCB (-1.16%). VCB has just experienced nearly 2 weeks of decline, especially yesterday’s session with the sharpest decline of 2.75% since the beginning of 2024. Although today’s recovery session had very low liquidity, especially in the afternoon session, VCB only traded VND 28.9 billion but the price continued to rise by another 0.45% compared to the morning session.

However, VCB does not represent the banking stock group. Only 6 out of 27 stocks in this group on the exchanges rebounded. The total liquidity of the banking group on HoSE decreased by 58% compared to the previous day, reaching the lowest level in 4 sessions. VPB, TCB, and BID were the most heavily sold blue-chips.

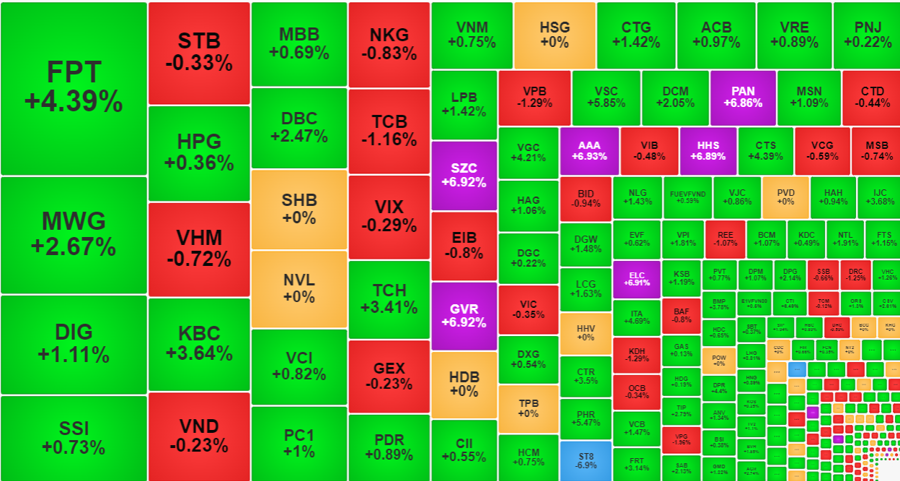

With limited support from the banking stock group, VN30-Index closed up 0.6%, weaker than the 0.75% increase of VN-Index. On the other hand, the medium market cap group of the basket performed well. GVR still maintained the ceiling price at the close and only had an additional selling volume of about VND 11.4 billion. FPT ranked second with a strong increase of 4.39%, followed by MWG (+2.67%), SAB (+2.13%), BVH (+1.85%), which were impressive non-banking stocks. The breadth of this blue-chip stock basket was quite good with 17 gainers/8 losers, but the liquidity only reached about VND 5,118 billion, of which 39% came from banking stock transactions.

There were many strong price transactions in the small and medium stock groups. The 13 stocks that hit the daily ceiling, except for GVR, belonged to these groups, of which high liquidity belonged to AAA, SZC, ELC, HHS, PAN. On HoSE, there were 113 stocks that increased by more than 1%, but VN30 only contributed 9 stocks. The stocks with very high liquidity outside the VN30 basket can be mentioned DIG with VND 443.2 billion, the price increased by 1.11%; KBC with VND 289.3 billion, the price increased by 3.64%; DBC with VND 237.8 billion, the price increased by 2.47%; TCH with VND 196.5 billion, the price increased by 3.41%; VSC with VND 117.8 billion, the price increased by 5.85%; DCM with VND 116 billion, the price increased by 2.05%…

In terms of declines, the largest selling pressure was only seen in some banking stocks such as TCB and VPB with liquidity of over VND 100 billion. The small and medium stock groups also had a few weak stocks, but not many, with only 5 stocks decreasing by more than 1% and liquidity over VND 10 billion, including ST8, KDH, REE, VPG, and DRC.