Dam Phu My Petrochemical and Fertilizer Joint Stock Company (DPM) has recently released its consolidated financial report for the fourth quarter of 2023, which recorded a slight decrease in gross sales and service provision profit to 3,410 billion dong compared to the same period last year. However, the cost of goods sold increased significantly, leading to a drastic decrease in gross profit to only 332 billion dong, a decrease of nearly 80%. Net profit after tax reached nearly 107 billion dong, a decrease of 90.44% compared to the fourth quarter of 2022.

Net revenue reached 13,569 billion dong, a decrease of 13.28%. However, the cost of goods sold increased by 32.39% to 11,917 billion dong, leading to a sharp decrease in gross profit to 1,651 billion dong, a decrease of 78.93% compared to the previous year.

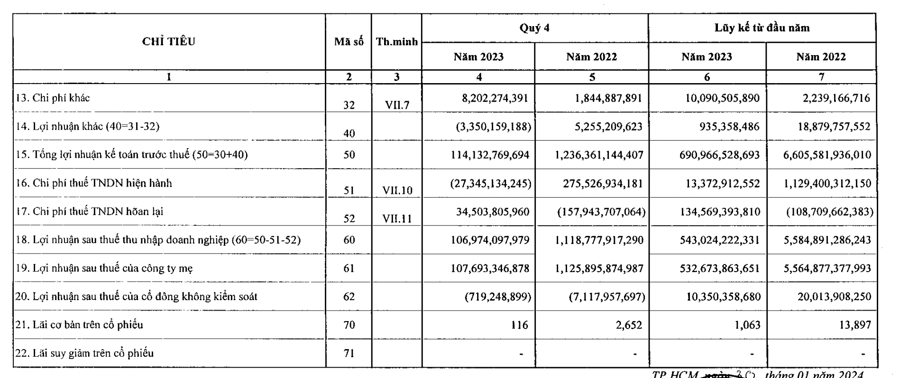

DPM’s net profit for the year 2023 was 543 billion dong, a decrease of 90.28% compared to the previous year. The net profit of the parent company in 2023 was 532 billion dong, a decrease of 90.43% compared to the previous year.

Explaining the drastic decrease in profit, according to the company’s management, the selling prices of fertilizer and chemical products in the fourth quarter of 2023 decreased compared to the same period last year, especially the prices of Urea and NH3 decreased by 30% and 40% respectively. Meanwhile, gas prices increased significantly compared to the fourth quarter of 2022, resulting in a sharp decrease in profit.

As of December 31, 2023, DPM’s total assets were 13,322 billion dong, a decrease of 24.73% compared to the beginning of the year (equivalent to a decrease of over 4,376 billion dong). Of which, current assets were 9,594 billion dong, a decrease of 29.34% (equivalent to nearly 4,000 billion dong). Cash and cash equivalents were 1,241 billion dong, a decrease of 40.42%. Inventories decreased by 50.64% compared to the beginning of the year, reaching 1,910 billion dong.

DPM’s total liabilities as of the end of 2023 were 1,764 billion dong, a decrease of 52.08% compared to the beginning of the year. Short-term liabilities were 1,476 billion dong, a decrease of over 50%.

In a recent update on the prospects of DPM, FPT Securities emphasized that the situation is still very unfavorable in 2024.

In 2024, FPTS estimates the average natural gas price (after VAT) of DPM to reach 10.66 USD/mmBTU (+2.1%). The projected gas price for the period 2024-2028F is based on the following assumptions: The expected fluctuations in FO oil prices are aligned with Brent oil prices, as forecasted by the EIA and Fitch Solutions.

Brent oil prices are forecasted by the International Energy Agency (EIA) to increase again, expected to reach 84 USD/barrel in 1H2024 due to the announcement of an extension of voluntary production cuts of 2.2 million barrels/day until the end of Q1/2024 by OPEC+ on November 30, 2023, and the expected global inventory will decrease in Q1/2024. The EIA expects that the production cuts by OPEC+ will offset the low demand growth, thereby limiting the increase in global oil inventories and keeping Brent oil prices above 80 USD/barrel in 2024.

Therefore, the forecasted Brent oil price for 2024 is expected to reach 85.00 USD/barrel (+3.0% YoY), and the corresponding FO oil price in 2024 is expected to reach 462.9 USD/ton (+4.0% YoY).

The Urea price in 2024 is projected to decrease by -7.1%, negatively affecting the gross profit margin of the Urea segment. The world Urea price has increased significantly with large fluctuations in the period 2021-2023 due to short-term supply-demand imbalances caused by uncertain factors such as fertilizer trade policies, energy costs, and supply chain disruptions.

However, the short-term supply-demand imbalances will no longer continue in 2024 as in the period 2021-2023, because the export supply sources of Russia (the top 1 Urea exporter) and China (the top 2 Urea exporter) are expected to be more relaxed and (2) the import demand in India (the top 2 Urea importer) is gradually decreasing.

The estimated Urea price of DPM will reach 9,800 dong/kg in 2023, before decreasing by -7.1% to 9,100 dong/kg (~374 USD/ton) in 2024, which is lower than the -8.7% YoY decrease of the world Urea price. Accordingly, the gross profit margin of DPM’s Urea segment will decrease to 14.7% in 2024 due to the double pressure of a -7.1% decrease in Urea selling price and a slight increase of +2.1% in gas price. In the period 2025-2028F, the gross profit margin of the Urea segment will fluctuate around 15.1%-16.2%, based on the aforementioned Urea selling price and gas price forecast.