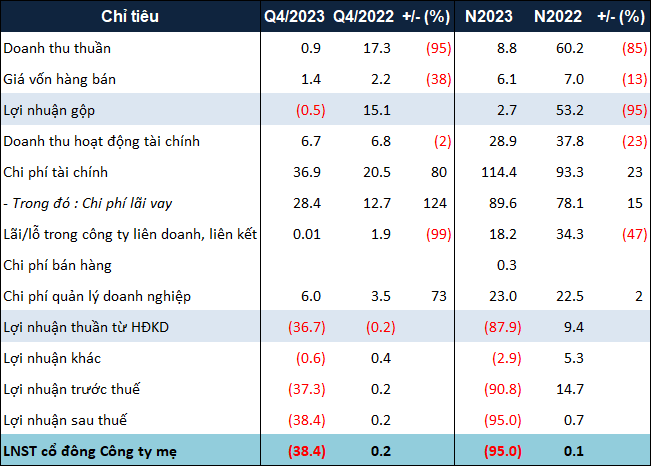

In Q4/2023, the net revenue of DRH reached only 910 million VND, a decrease of 95% compared to the same period. The entire revenue comes from service provision activities. Meanwhile, both real estate business and sales activities did not generate any revenue.

Not only declining compared to the same period, the revenue is also lower than the cost of goods sold, leading to a gross loss of nearly 500 million VND.

The difficulties are exacerbated when financial expenses and management expenses in the period increase sharply by 80% and 73%, respectively, further eroding the company’s achievements.

As a result, DRH incurred a net loss of over 38 billion VND in Q4, while in the same period, it made a profit of nearly 200 million VND. This is the 3rd consecutive quarter of loss for DRH in 2023.

|

Business performance of DRH in 2023

Source: VietstockFinance

|

With the above results, cumulatively in 2023, DRH incurred a net loss of 95 billion VND (compared to a profit of less than 100 million VND in the previous year). It is known that this is the highest loss that DRH has ever recorded since listing.

On the balance sheet, the total assets of DRH as of December 31, 2023, were over 3.9 trillion VND, an increase of 2% compared to the beginning of the year. The two largest items are accounts receivable and inventory, which increased by 22% and 7%, respectively, to over 1.5 trillion VND and 1.1 trillion VND. In contrast, cash holdings decreased by 35% to over 104 billion VND.

In terms of liabilities, accounts payable increased by 8% to over 2.4 trillion VND. Of which, borrowings increased by 11% to 774 billion VND. The cost to be paid increased significantly by 73% to nearly 214 billion VND.