The cash interim dividend ratio is 5% (equivalent to receiving 500 VND per share). Ex-rights trading date is 21/02/2024, and the payment date is 29/02/2024. With over 66.6 million circulating shares, SVC needs to allocate over 33.3 billion VND for this dividend distribution.

|

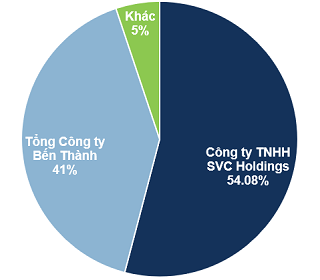

In the shareholder structure, SVC Holdings Co., Ltd. is the parent company of SVC, holding 54.08% of the capital, estimated to receive over 18 billion VND. Another major shareholder is Ben Thanh Corporation, owning 40.79% of the capital and expected to receive nearly 13.6 billion VND.

It can be seen that the shareholder structure of SVC is very concentrated with only 2 major shareholders accounting for 94.87% of the capital.

Previously, the Annual General Meeting 2023 of SVC approved the profit distribution plan for 2023 with a minimum cash dividend rate of 7%, equivalent to receiving at least 700 VND per share.

In the stock market, the price of SVC shares has almost halved in the past year. As of the closing session on 01/02/2024, SVC closed at 28,500 VND/share, a 46% decrease compared to the same period last year, with an average trading volume of over 3.7 thousand shares/day.

| SVC stock performance over 1 year |

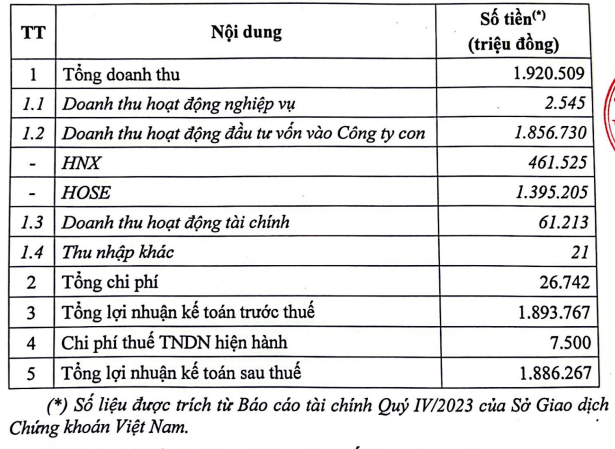

The sharp decline in stock price partly reflects SVC’s difficult business situation in the past year. SVC ended 2023 with a net revenue of nearly 20,849 billion VND, a 2% decrease compared to the previous year. The gross profit margin narrowed by 1 percentage point to 6.8%, resulting in a 16% decrease in gross profit to 1,426 billion VND.

During the year, financial expenses increased by 118% due to a significant increase in interest expenses. Business management expenses also increased by 8% to 758 billion VND. In addition, the profit from joint venture and affiliated companies was pessimistic with a loss of over 1 billion VND, while there was a profit of 173 billion VND in the previous year.

Based on these factors, SVC only achieved a net profit of 23 billion VND, a 93% decrease compared to the previous year. Compared to the net profit target of nearly 265 billion VND approved by the Annual General Meeting 2023, SVC only achieved nearly 9% of the target.

In general, SVC’s unfavorable business situation has been greatly impacted by the difficult automobile market, where member units in the system have to increase operating costs to maintain sales. This has led to a decrease in gross profit, net profit from business operations, and an increase in selling expenses, while revenue has slightly decreased compared to the same period.