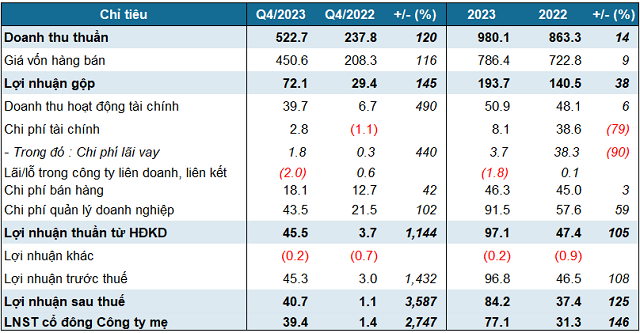

| ELC’s Breakthrough Business Results in Q4/2023 |

In particular, ELC’s net revenue in Q4/2023 reached 523 billion VND, an increase of 120% compared to the same period last year. Gross profit increased by 145% to 72 billion VND. Gross profit margin was at 13.8%, an improvement of 1.4 percentage points.

ELC stated that during this period, the company recorded revenue from projects, contracts for supplying equipment, materials, software, and valuable services, leading to an increase in gross profit compared to the same period last year.

Financial activities also made a notable contribution as the company earned nearly 37 billion VND in profit, a 4.7-fold increase compared to the same period last year, thanks to the profit generated from financial investment activities of nearly 35 billion VND.

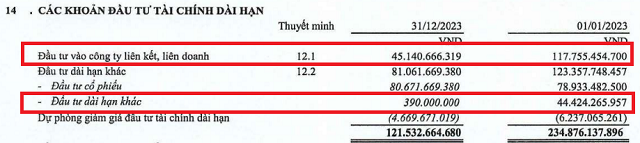

In the balance sheet, the value of long-term financial investments of ELC at the end of Q4 was nearly 122 billion VND, a sharp decrease compared to the 266 billion VND at the end of Q3 and lower than the initial figure of 235 billion VND at the beginning of the year. This indicates that ELC may have transferred long-term financial investments to achieve a breakthrough in profits.

Diving deeper into the Q4 financial statements, it can be seen that the value of investments in associated companies and other long-term financial investments also decreased significantly.

Source: ELC’s Q4/2023 consolidated financial statements

|

Regarding investments in associated companies, in Q4, ELC no longer recorded nearly 92 billion VND of investments in Vietnam Computer and Communication Technology JSC (VCCorp). As for long-term financial investments, ELC has transferred a series of investments, the largest of which is the Tran Phu project with a book value of nearly 38 billion VND.

At the same time, ELC also recorded a corresponding increase in the amount of long-term receivables. The company stated that this is a contribution of capital to implement the mixed resettlement housing project in plot C13/DD2 in Tran Phu ward, Hoang Mai district, Hanoi, under a cooperative investment agreement signed with Thang Long Xanh Investment and Development JSC.

Selling and administrative expenses both increased significantly, by 42% and 102% respectively, reaching 18 billion VND and 44 billion VND, but did not have much impact on the final results. In fact, the SG&A expense-to-net revenue ratio decreased by 2.6 percentage points to 11.8%.

From these fluctuations, ELC achieved a net profit of over 39 billion VND, 28 times higher than the same period last year. The business results of the full year 2023 were also stimulated with net revenue of 980 billion VND, a 14% increase compared to the previous year, and a net profit of 77 billion VND, 2.5 times higher than the previous year.

In 2023, ELC set a target of 850 billion VND in net revenue and 56 billion VND in after-tax profit. Accordingly, the company exceeded 15% of the revenue plan and exceeded 38% of the profit plan.

|

ELC’s Q4 2023 Business Results and Full-Year Results

Unit: Billion VND

Source: VietstockFinance

|

As of December 31, 2023, ELC’s total assets were over 1,823 billion VND, a 59% increase compared to the beginning of the year. Among them, receivables accounted for 45%, with a value of over 817 billion VND, an increase of 53%. ELC mainly generated receivables from customers such as Viettel Group, VETC, and Nam Phat Steel.

Other long-term assets also had a high proportion (18%). What’s more, other long-term assets increased 48 times compared to the beginning of the year, due to a significant increase in the value of allocated tools and equipment.

On the liabilities side, the amount payable exceeded 670 billion VND, an increase of 187%, accounting for 37% of the total capital. Most of it is payables to suppliers such as Ciena Communications Inc and Kết cấu thép 568.

Huy Khai