The specific code for the bond has not yet been issued and will be provided by the Vietnam Securities Depository and Clearing Corporation (VSDC) after the company completes the sale and registration procedures, consolidated at VSDC.

This is a non-convertible bond, not accompanied by warrants, secured by assets. The quantity includes 6.5 million bonds, with a face value of 100,000 dong/bond. The term is 36 months, paying interest every 6 months.

Fixed interest rate of 11% per annum for the first 2 interest periods. After that, the interest rate will float based on the reference interest rate and 4% per annum, but will not be lower than 9.5% per annum. The reference interest rate is the average interest rate for 12-month term individual savings deposits of 4 banks Vietcombank, BIDV, VietinBank, and Agribank.

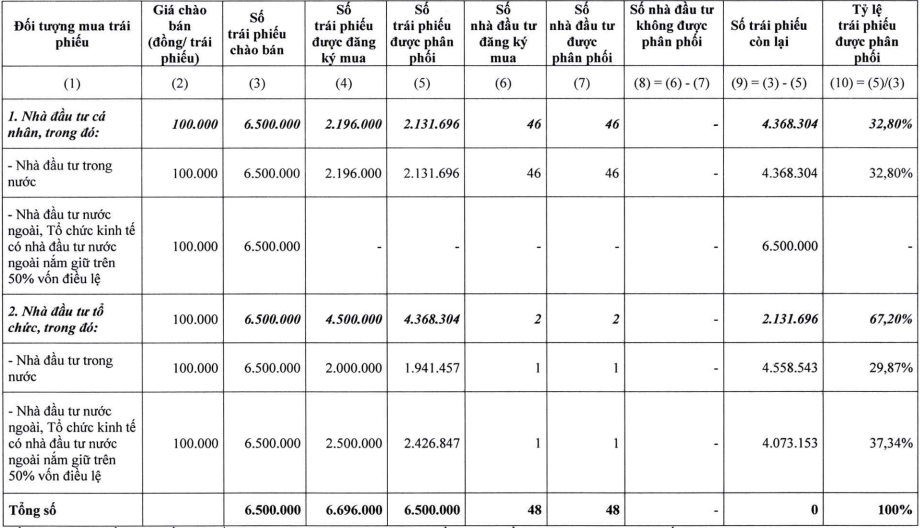

The sale period ends immediately on the issuance date (January 31, 2024), and the expected bond transfer date is in February. The entire 6.5 million bonds are distributed to 46 individual investors (accounting for 32.8%), 1 domestic organization (29.87%), and 1 foreign organization (37.34%). These investors have all paid for the bonds.

The total bond debt of VPI at the end of the sale is nearly 2 trillion dong, accounting for nearly 22% of the total debt repayment.

|

Results of VPI’s public bond offering

Source: VPI

|

In 2023, VPI achieved revenue of 1,877 billion dong, a 13% decrease compared to 2022, a slight decrease in the context of unfavorable economy and the expectation of home buyers leading to a sharp decrease in real estate sales of developers. Revenue from real estate business is 1,619 billion, of which 98% comes from Vlasta – Sam Son project, the rest from The Terra – An Hung project, Grandeur Palace – Giang Vo.

Before-tax and after-tax profits in 2023 were 634.8 billion dong and 463.2 billion dong, respectively, equivalent to and slightly decreasing compared to 2022.

With the above results, the company has achieved 85% of the revenue target and 84% of after-tax profit for the year.