The weekend trading session coincided with the portfolio restructuring activities of HoSE-index tracking ETF funds and a significant increase in buying volume towards the end of January 2024. However, the market did not experience much volatility despite a 34% increase in liquidity compared to yesterday.

Usually, ETF portfolio restructuring activities would be concentrated towards the ATC session, but today, VN30 did not see any significant changes. The continuous matching trading session for VN30-Index recorded a slight decrease of 0.78 points and closed with a gain of 1.41 points. The amplitude was relatively small for a restructuring session.

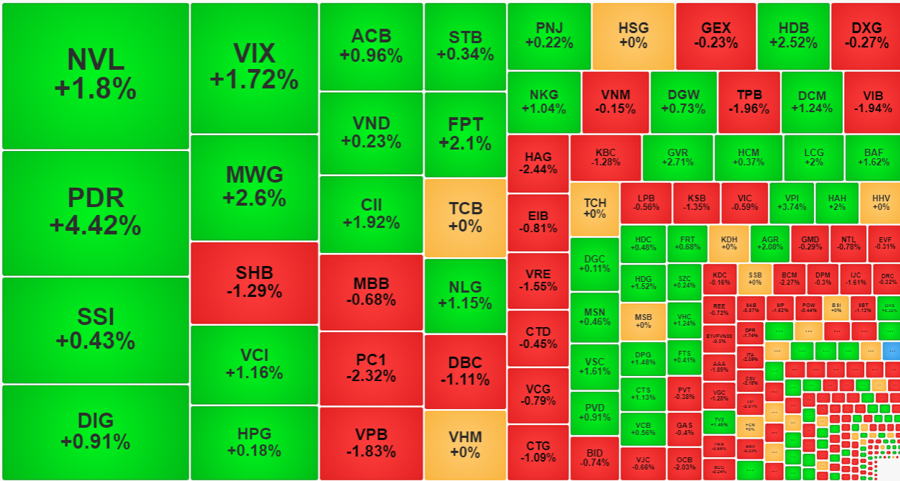

Large-cap stocks also received good buy orders and showed minimal price fluctuations. VN-Index closed with a slight decrease of 0.47 points, which was better than the previous continuous matching trading session’s decline of 2.23 points. VCB had a turnaround from a 0.2% decrease to a 0.56% gain, even surpassing both FPT and GVR, which increased by 2.1% and 2.71% respectively. The strength of market capitalization was clearly demonstrated.

VN30-Index closed the session with 10 gainers and 16 losers. Compared to the morning session, the price level of blue-chips decreased, with 18 stocks declining and only 9 stocks increasing. The impact of the restructuring trades helped HDB surge 2.05% during the afternoon, closing above the reference price by 2.52%. MWG also increased by 1.94%, ending with a 2.6% gain. ACB escaped the reference price, rising by 0.96%. The pressure was on SHB, which dropped 1.29% during the afternoon and closed with a 1.29% decline. TPB decreased by 1.96% compared to the reference price, with a 1.69% decline during the afternoon. VPB also experienced a further drop of 1.05%, resulting in a total decrease of 1.83%…

The ups and downs of different stocks helped stabilize the overall index. While the blue-chips group and the index itself did not fluctuate significantly, it was the mid-cap and small-cap stocks that benefited. At the end of the session, HoSE didn’t fare much worse than the morning session, with 199 gainers and 267 losers. The number of stocks with an increase of over 1% slightly weakened, with 62 stocks compared to 70 stocks in the morning session. The trading volume for this group accounted for nearly 36% of the total trading volume on HoSE, significantly lower than its 52% market share in the morning session. The reason behind this was that some highly liquid stocks performed poorly, such as SSI, which increased by 0.43%, and DIG, which increased by 0.91%…

Trading remained active in the stocks that attracted capital inflows since the morning. NVL had nearly VND 258.6 billion matched in the afternoon, bringing the total trading volume for the day to VND 1,130.6 billion, not including negotiated deals. However, NVL’s price eventually decreased by 1.19% compared to the morning session, closing with only a 1.8% gain. PDR also weakened by about 1.24%, with a 4.42% increase and a trading volume of around VND 210.2 billion in the afternoon, totaling VND 967.3 billion for the whole session. Among the 62 stocks with an increase of over 1% at the close, 14 stocks had trading volumes exceeding VND 100 billion, and the VN30 basket contributed only 4 stocks. Therefore, the capital flow clearly spread to stocks outside the VN30 basket, with this basket only accounting for 34.8% of the total trading volume on HoSE today, the lowest level in 23 sessions.

In the declining group, many stocks dropped more significantly in the afternoon, reflecting not only in a greater decrease in the number of decliners (267 stocks compared to 223 stocks in the morning session), but also in 80 stocks dropping by over 1% (50 stocks in the morning session). Some stocks were heavily impacted in the afternoon, such as SHB with a trading volume of VND 43.6 billion and a 1.29% decrease; PC1 with a trading volume of VND 31.98 billion and a 2.32% decrease; VPB with a trading volume of VND 31.67 billion and a 1.83% decrease; DBC with a trading volume of VND 25.56 billion and a 1.11% decrease; TPB with a trading volume of VND 16.22 billion and a 1.96% decrease; VIB with a trading volume of VND 15.3 billion and a 1.94% decrease; HAG with a trading volume of VND 15.1 billion and a 2.44% decrease…

However, the total trading volume of the declining stocks by over 1% only accounted for 16.5% of HoSE’s trading volume, with the majority concentrated in the aforementioned stocks. About two-thirds of the stocks in this group had trading volumes below VND 10 billion.