In 2023, the main activities of ACB only increased by 6% compared to the previous year when it earned 24,960 billion VND in net interest income.

The contribution ratio of non-interest income to revenue is 24%, thanks to which the pressure on interest income is reduced. In particular, foreign exchange trading and investment activities contribute significantly to ACB’s income growth.

Notably, the securities trading business turned from a loss to a profit of over 168 billion VND. Securities investment trading activities achieved an extraordinary profit of 2,647 billion VND, while it only earned nearly 21 billion VND in the previous year.

Although ACB set aside 1,804 billion VND for credit risk provisions during the year, compared to 71 billion VND in the previous year, the bank still achieved pre-tax profit of 20,068 billion VND, an increase of 17% compared to the previous year.

Thus, ACB has achieved its pre-tax profit target of 20,058 billion VND for the entire year 2023. The ROE ratio stands at nearly 25%.

It is worth mentioning that the securities investment profit of over 1,358 billion VND “carried” the entire fourth quarter of ACB when most revenue sources declined. As a result, pre-tax profit increased by 40% compared to the same period, reaching 5,049 billion VND.

|

Business results for the fourth quarter and the whole year 2023 of ACB. Unit: Billion VND

Source: VietstockFinance

|

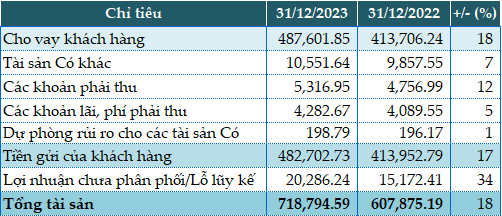

As of the end of 2023, ACB’s total assets increased by 18% compared to the beginning of the year, reaching 718,794 billion VND. The credit scale reached nearly 488 trillion VND, an increase of 18%. This is the highest credit growth rate in the past 10 years for the bank. ACB also implemented timely support under the direction of the State Bank of Vietnam through a 2% interest rate support package with a disbursed amount of nearly 1.9 trillion VND; or restructuring the repayment period and keeping the debt group unchanged according to Circular 02 with a total debt of 2.2 trillion VND.

ACB’s mobilization scale in 2023 reached nearly 483 trillion VND, an increase of 17% compared to the beginning of the year. The CASA ratio grew strongly and reached the target of 22%.

|

Some financial indicators of ACB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

If not counting nearly 4,575 billion VND for ACB’s treasury trading loans, as of December 31, 2023, ACB’s total bad debts recorded 5,887 billion VND, an increase of 93% compared to the beginning of the year. The non-performing loan ratio on the outstanding loan increased from 0.74% at the beginning of the year to 1.22%.

|

The loan quality of ACB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)