Image created by Bing Image Creator

|

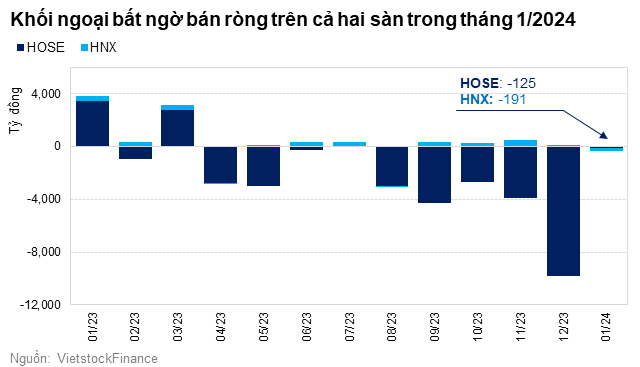

According to data from VietstockFinance, in January 2024, foreign investors net sold over 125 billion VND on HOSE, a signal of strong selling pressure, especially in the last months of the previous year, somewhat loosened. Meanwhile, foreign investors also net sold 191 billion VND on HNX. Combining both exchanges, foreign investors net sold 317 billion VND in the past month.

Although trading sentiment was somewhat gloomy with low liquidity before the extended Lunar New Year holiday, the VN-Index still recorded positive gains from 1,129.93 points at the beginning of the year to 1,179.65 points, before experiencing a more than 15-point correction to 1,164.31 points in the final trading session of January (up 3% from the beginning of the year).

One of the major driving forces behind the upward trend was the “blue-chip” group, following the news that credit growth in 2023 reached nearly the target and the State Bank of Vietnam (SBV) has set a credit growth target of 15% in 2024 for commercial banks early in the year, as opposed to a gradual approach as in the past. From there, banks actively promote credit supply, ensuring sufficient and timely capital supply to boost economic growth.

In addition, the Land Law (amended) and Credit Institutions Law (amended) were passed, creating the biggest policy highlight and bringing positive information to the stock market. Not to mention, the business results of the fourth quarter and the whole year 2023 with many bright spots were also announced, contributing to strengthening market sentiment.

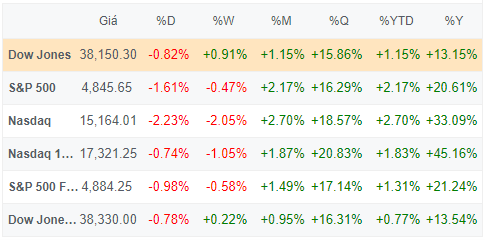

On the other side of the globe, the US stock market also had positive developments in the first month of the year, with most of the major indices (Dow Jones, S&P 500, and Nasdaq) holding on to gains of 1-3% year-to-date (YTD) against the backdrop of better-than-expected GDP growth and inflation trends, increasing expectations that the Fed will shorten the time to interest rate cuts.

|

Performance of major indices on the US stock market

Source: VietstockFinance. As of January 31, 2024

|

In a recent report by ACBS Securities, a cut in interest rates by the world’s most powerful central bank will have an impact on emerging markets and frontier markets.

Vietnam is considered a frontier market, with a scale and liquidity equivalent to an emerging market. In theory, the Vietnamese stock market can benefit as investment capital returns to emerging and frontier markets when the Fed cuts interest rates, according to ACBS.

However, ACBS also noted that past developments have shown that the VN-Index is relatively synchronous with the US stock market due to its large economic openness and the US being the largest export market. History has shown that indices such as the S&P 500 and Dow Jones typically experience a decline, rather than continued gains, after each rapid and strong interest rate cut by the Fed. The most recent interest rate cut in 2019-2020 was an exception due to the impact of the COVID-19 support money printing policy, as the US stock market only experienced a slight decline before rebounding strongly.

Similarly, in the strategy report by Rong Viet Securities (VDSC), analysts expect the policies of major central banks to reverse towards easing in the second half of 2024; and the valuation of equities in developed markets is no longer attractive, which will lead to a reallocation of capital, partly to emerging and frontier markets, including Vietnam.

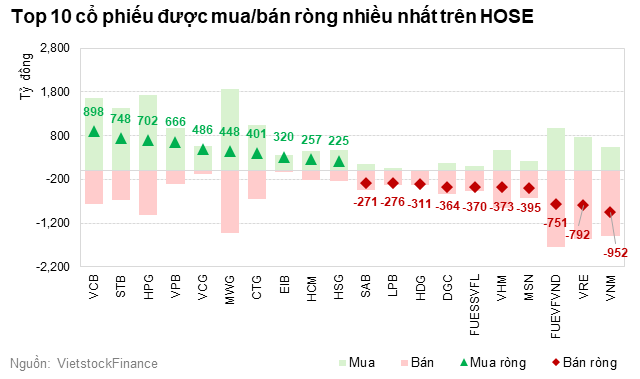

Returning to the Vietnamese stock market, banks are the sector that attracted the most attention from foreign investors. On HOSE, half of the shares in the top 10 most heavily bought were bank stocks. Among them, VCB was the most purchased stock (898 billion VND), followed by STB (748 billion VND). Additionally, steel companies such as HPG and HSG also saw strong net buying of 702 billion VND and 276 billion VND, respectively.

On the selling side, VNM was the most sold stock (952 billion VND), followed by VRE (792 billion VND). Notably, 2 ETF certificates, namely FUEVFVND of DCVFMVN DIAMOND ETF and FUESSVFL of SSIAM VNFIN LEAD, also experienced strong net selling of 751 billion VND and 370 billion VND, respectively.

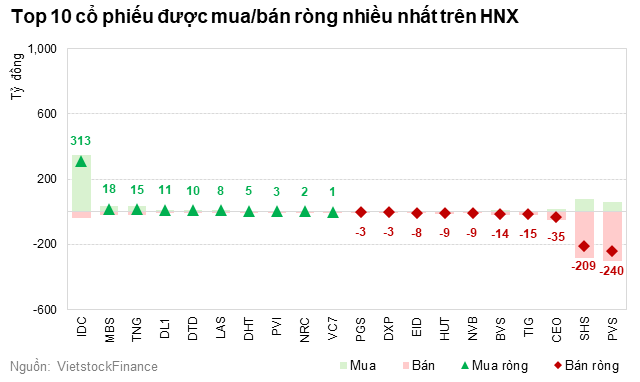

On HNX, the most heavily bought stock was IDC (313 billion VND), surpassing other stocks in the top such as MBS (18 billion VND) and TNG (15 billion VND). Conversely, the most heavily sold stocks were PVS (240 billion VND) and SHS (209 billion VND).

Duy Khanh