In the latest announcement, the Ho Chi Minh City Stock Exchange (HoSE) has noted the possibility of delisting HBC shares of Hoa Binh Construction Group Joint Stock Company, POM shares of Pominia Steel Joint Stock Company, and HNG shares of Hoang Anh Gia Lai International Agriculture Joint Stock Company.

Regarding HBC, the shares are currently under securities supervision for late submission of audited financial statements for 2 consecutive years.

Based on Article 120, Clause 1 of Decree No. 155/2020/ND-CP dated December 31, 2020 of the Government detailing the implementation of some articles of the Securities Law dated November 26, 2019: “Shares of public companies are delisted when one of the following cases occurs: i) The listing organization violates the late submission of annual financial statements for 3 consecutive years”;

Therefore, HoSE notes the possibility of delisting HBC shares of Hoa Binh Construction Group Joint Stock Company if it continues to violate the late submission of audited financial statements for 3 consecutive years in 2023.

In terms of business performance, as of 2023, Hoa Binh Construction recorded revenue of VND 7,546 billion, nearly half of 2022. However, the company still incurred a loss of VND 777 billion for the whole year, compared to a loss of nearly VND 2,600 billion in the previous year.

As of December 31, 2023, Hoa Binh Construction still had accumulated losses of nearly VND 2,900 billion. Therefore, excluding shareholders’ equity funds, the company only had VND 453 billion left.

Similarly, with POM, the shares are currently under securities supervision for the listing organization’s violation of late submission of audited financial statements for 2 consecutive years.

Therefore, if the company continues to violate the late submission of audited financial statements for 3 consecutive years in 2023, Pominia Steel shares may be delisted.

Accumulated as of 2023, Pominia Steel recorded revenue of VND 3,281 billion, a 75% decrease compared to the same period, and the after-tax profit of the parent company’s shareholders recorded an additional loss of VND 960 billion compared to a loss of VND 1,167 billion in the same period, far exceeding the planned loss of VND 150 billion.

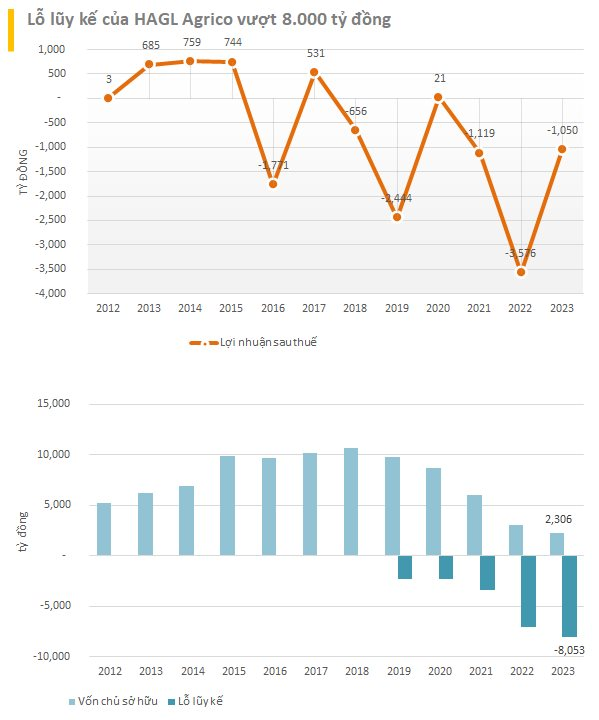

Regarding HNG of Hoang Anh Gia Lai International Agriculture Joint Stock Company (HAGL Agrico), HNG shares are currently under HoSE’s securities supervision due to the after-tax profit of the parent company’s shareholders being negative VND 1,119 billion in 2021 and negative VND 3,576 billion in 2022 based on the audited consolidated financial statements for 2021 and 2022.

On January 30, 2024, HoSE received the consolidated financial report for the fourth quarter of 2023 of HNG, with the after-tax profit of the parent company’s shareholders in 2023 being negative VND 1,050 billion and the undistributed after-tax profit as of December 31, 2023 being negative VND 8,054 billion.

Based on Article e Clause 1 of Decree No. 155/2020/ND-CP dated December 31, 2020, which stipulates that shares of public companies are delisted when the following case occurs: “The production and business results show losses for 3 consecutive years or the total accumulated losses exceed the contributed charter capital or the negative owners’ equity in the latest audited financial statements at the time of review“.

Therefore, HoSE notes the possibility of mandatory delisting of HNG shares of Hoang Anh Gia Lai International Agriculture Joint Stock Company if the consolidated financial report audited in 2023 shows losses in production and business results.

As of the whole year 2023, HNG recorded revenue of VND 606 billion, a decrease of 18%. Deducting costs, HNG had a net loss of over VND 1,050 billion. Previously, in 2021 and 2022, the company had losses of VND 1,119 billion and VND 3,576.5 billion, respectively. The accumulated losses of HAGL Agrico have exceeded VND 8,000 billion and the shareholders’ equity of the company at the end of 2023 continued to decrease to VND 2,300 billion.