Source: VietstockFinance

|

IDICO Corporation – Joint Stock Company (HNX: IDC) has recently announced its consolidated financial statements for the fourth quarter of 2023, with net revenue of over 2.239 trillion VND, an increase of 85% compared to the same period last year. Meanwhile, its net profit was nearly 551 billion VND, 2.7 times higher than the same period last year.

IDICO attributed the growth mainly to the recognition of one-time revenue from infrastructure leasing contracts in accordance with regulations. In addition to its core business activities, the company also saw a significant increase in revenue from financial activities. Furthermore, the company was able to reduce costs compared to the same period last year.

Specifically, IDICO’s financial activities in the fourth quarter saw a remarkable increase of over 89 billion VND, 7.2 times higher than the same period last year. Total expenses during the period decreased by 31% to 151 billion VND.

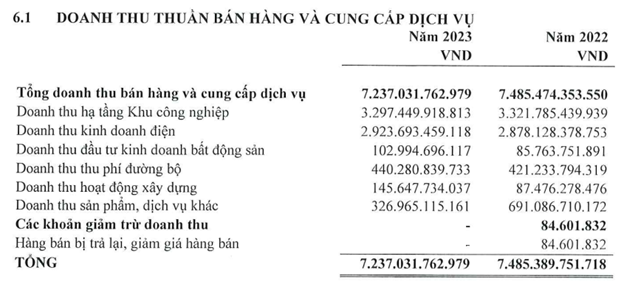

For the full year of 2023, IDICO recorded a net revenue of 7.237 trillion VND and a net profit of 1.393 trillion VND, a decrease of 3% and 21% respectively compared to 2022.

The main sources of revenue in 2023 were from the industrial park infrastructure segment with over 3.297 trillion VND (46%) and the power business with nearly 2.924 trillion VND (40%).

Source: IDC

|

Compared to the annual plan, IDC achieved 90% of its total revenue target and 81% of its pre-tax profit target in 2023.

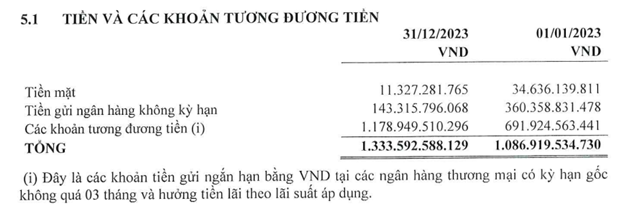

As of December 31, 2023, IDC’s total assets were nearly 17.732 trillion VND, a 4% increase compared to the beginning of the year, with the majority in long-term assets totaling nearly 11.700 trillion VND, accounting for 66%. Cash and cash equivalents increased by 23% to nearly 1.334 trillion VND, primarily in the form of bank deposits.

Source: IDC

|

In addition, IDC had short-term financial investments of nearly 910 billion VND, a 13% decrease, of which nearly 870 billion VND were time deposits at banks with a maturity period of 6 months to 1 year, and 40 billion VND were bond investments of IDICO – CONAC.

Notably, at the end of this period, IDC had over 800 billion VND in accounts receivable from short-term loans to PAN Investment Corporation and An Phuoc Investment Corporation.

Source: IDC

|

Inventory reached over 1.299 trillion VND, an increase of 19% compared to the beginning of the year. Meanwhile, unfinished construction costs decreased by 43% to nearly 1.003 trillion VND, mainly concentrated in two projects: Huu Thanh industrial park with over 271 billion VND and Que Vo 2 industrial park with nearly 206 billion VND.

On the liabilities side, IDC had nearly 11.528 trillion VND in payable debts, a 6% increase compared to the beginning of the year, with the majority being unrealized revenue of nearly 5.245 trillion VND, accounting for 45% of the total liabilities. The total amount of short-term and long-term financial borrowings was nearly 3.523 trillion VND, a 2% increase, accounting for 31% of the total borrowings and 20% of the enterprise’s capital sources.