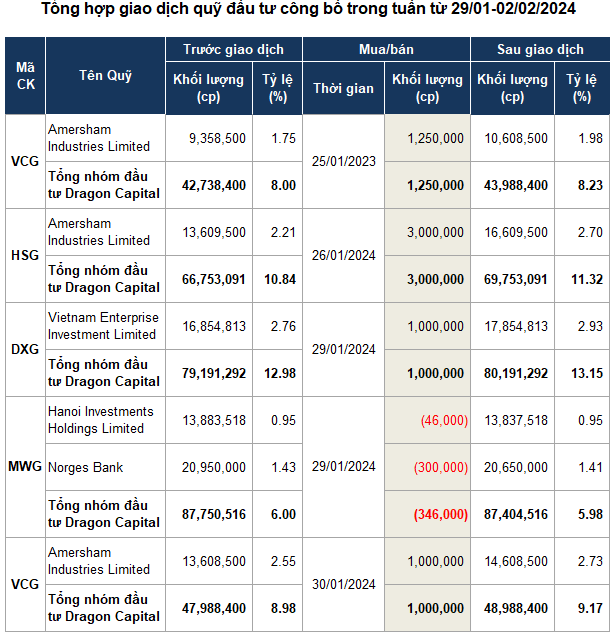

In particular, the billion-dollar fund Vietnam Enterprise Investments Limited – a member of Dragon Capital – bought 1 million shares of DXG (Dat Xanh Group) in the session on 29/01, increasing the ownership rate of the Dragon Capital fund group here from 12.98% to 13.15%, equivalent to over 80 million shares.

| Price movement of DXG shares from the beginning of 2023 to the session on 02/02/2024 |

On 29/01, DXG recorded a negotiated transaction with a volume equal to the trading volume of the Dragon Capital member fund. The transaction value was over VND 19 billion, equivalent to VND 19,310 per share. In this session, DXG closed at VND 18,750 per share.

Earlier on 12/01, the foreign fund Dragon Capital also bought 1.73 million shares of DXG. The move to accumulate DXG shares by Dragon Capital took place in the context of the company’s stock price being in a sideways phase after recovering from the bottom of VND 14,900 per share (in mid-October 2023).

| Price movement of VCG shares from the beginning of 2023 to the session on 02/02/2024 |

In the same session, after buying 4.5 million VCG shares (Vietnam Export Import and Construction Corporation) on 23/01, the Dragon Capital group continued to buy an additional 1 million shares of VCG on 30/01, increasing the ownership at VCG to 9.17%, equivalent to nearly 49 million shares.

Earlier on 06/11/2023, the Dragon Capital group officially became a major shareholder in VCG after buying over 1.3 million shares on 02/11, increasing the group’s ownership at VCG to over 27 million shares, equivalent to a rate of 5.07%.

After becoming a major shareholder, Dragon Capital continued to net buy over 21 million VCG shares in the context of the stock price of this company recovering, increasing by nearly 33% after a sharp decline.

| Price movement of MWG shares from the beginning of 2023 to the session on 02/02/2024 |

On the other hand, Dragon Capital sold 346,000 MWG shares (Mobile World Investment Corporation), reducing its ownership to 87.4 million shares, equivalent to a rate of 5.98%. Based on the closing price of MWG shares in the session on 29/01 at VND 44,600 per share, it is estimated that this fund group has earned about VND 15.4 billion.

Source: VietstockFinance

|