Buy VHM stock with a target price of 77,000 dong/share

According to Shinhan Securities Vietnam (SSV), the shortage of housing supply is expected to increase significantly, with three times the current rate in the period 2022-2025, bringing the number of housing units to 690,000.

SSV believes that the most difficult period for the real estate market is over. However, the recovery will show clear signals from the late 2024 period, starting from the policy delay, the legal documents need time to complete the legal framework (about 6 months), and time for projects to be implemented and started selling.

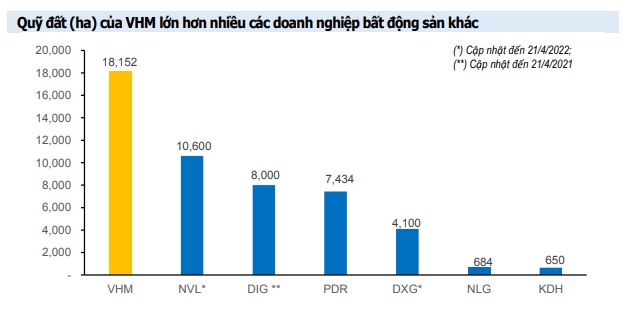

Vinhomes Joint Stock Company (HOSE: VHM) has a dominant advantage with its large and quality land fund, outstanding capacity profile due to the efficient implementation of many projects, reputable brand – high quality in the eyes of customers, and superior capital mobilization ability.

Source: SSV

|

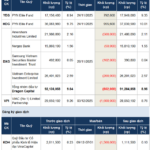

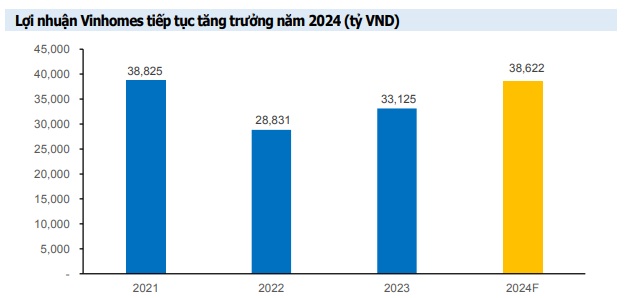

According to SSV, Vinhomes will be the leading enterprise in the recovery of the Vietnam real estate market. In 2024, the sales revenue of VHM is expected to increase by 26.6% compared to the same period, reaching 110.1 trillion dong.

The projected total revenue for 2024 is expected to reach 139,090 billion dong, an increase of 14.6% compared to the same period, due to continued delivery of products in two major projects – The Empire and The Crown, with unrecognized revenue of up to 37.9 trillion dong at the end of 2023 and the sale and delivery of a large volume of remaining products at these two projects.

From there, Vinhomes’ profit for 2024 is expected to continue to grow, reaching 38,622 billion dong, an increase of 16.6% compared to the same period, primarily thanks to the continued delivery of The Empire and The Crown projects.

Source: SSV

|

In addition, the valuation of VHM is relatively cheap compared to the stock itself in the past, the average real estate stock, and the overall market valuation – VN-Index, providing an attractive yield.

Based on these points, SSV recommends buying VHM stock with a target price of 77,000 dong/share.

Find more information here

Buy HPG stock with an expected price of 32,769 dong/share

Yuanta Securities Vietnam (Yuanta) believes that the most difficult period for the steel industry and Hoa Phat Group Joint Stock Company (HOSE: HPG) has passed.

As HPG will focus on producing high-quality steel, leaving basic steel playgrounds such as construction steel to other businesses, the risks based on the real estate market will decrease.

In addition, the shift in the current and future revenue proportion to HRC steel helps HPG‘s business results recover stronger and more stable than other steel companies in the same industry. The Q4 revenue growth of HPG was 33% compared to the same period and 21% compared to the previous quarter, which is considered impressive.

In general, Yuanta values HPG higher than other steel companies because it is one of the two companies producing HRC steel in Vietnam. At the same time, the business prospects of HPG are expected to be positive in 2024.

The information about the phase 2 of the Dung Quat project is still on track, and the project has completed 45% of the progress. After completing phase 2 in 2025, HPG‘s crude steel capacity will increase to 14 million tons/year (an increase of 65%) and HPG will be the largest HRC steel producer in Vietnam.

Dung Quat 2 will contribute an additional 4-5 billion USD in annual revenue after reaching the maximum capacity, from the current revenue of about 6.5 billion USD/year. This will be a growth driver in the medium and long term for HPG.

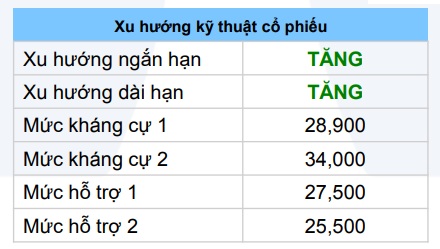

In the stock market, HPG stock is currently fluctuating around the 20-day moving average with trading volume in the session 31/01/2024 approximately equal to the average 20-day volume, indicating an increase in short-term supply.

Source: Yuanta

|

However, the short-term trend of HPG is still increasing, so Yuanta believes that HPG will soon balance back from the price range around 27,500 dong/share. In the short term, HPG is expected to have a narrow fluctuation range of 27,500-28,900 dong/share.

After evaluating the potential as well as the possible risks, Yuanta recommends buying HPG stock with an expected price of 32,769 dong/share.

Find more information here

Hold SIP stock with a one-year target price of 84,000 dong/share

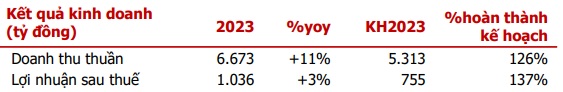

At the end of 2023, Saigon Investment Joint Stock Company – VRG (HOSE: SIP) recorded positive growth with revenue reaching 6,673 billion dong, an increase of 11% compared to 2022, thanks to electricity and water sales and industrial park leasing activities. After-tax profit reached 1,036 billion dong, an increase of 3%, exceeding the target by more than 37%.

Source: Agriseco Research

|

Agriseco Research expects the revenue and profit of SIP to remain stable in 2024. The company has more than 11,000 billion dong of unrealized revenue, which will be recognized in the business results in the coming years.

On August 8, 2023, SIP was transferred from UPCoM to HOSE. SIP does not currently meet the requirements for margin trading as the listing time is less than 6 months. With stable business results and healthy financial condition, it is expected that SIP‘s liquidity will be improved by attracting additional investment funds when margin trading is reinstated.

Agriseco Research evaluates SIP as a potential stock for investment. The company has a large-scale commercial land fund of 1,000 hectares in Ho Chi Minh City, Dong Nai, and Tay Ninh. At the same time, SIP is developing Phuoc Dong Industrial Park Phase 3 (650 hectares), which is expected to be a growth driver in the next 5-10 years. In addition, the expected rental price will increase by 6-8% compared to the same period, and there will be stable revenue from the electricity and water infrastructure business.

SIP stock is currently trading at a P/B ratio of approximately 3.4x, lower than the 5-year average in the past. At the same time, SIP pays regular cash dividends of 30-45%. Therefore, this securities company recommends holding SIP stock with a target price of 84,000 dong/share in the next 1 year.

Find more information here