VN-Index concluded the first trading month of 2024 on a positive note, with a 3% increase compared to the last session of 2023, reaching 1,164.31 points (end of session on January 31, 2024). Among them, banking stocks played a leading role in the market with a higher increase than VN-Index. Specifically, data from VietstockFinance shows that the banking sector index in January increased by 9% from the end of 2023, reaching 658.41 points.

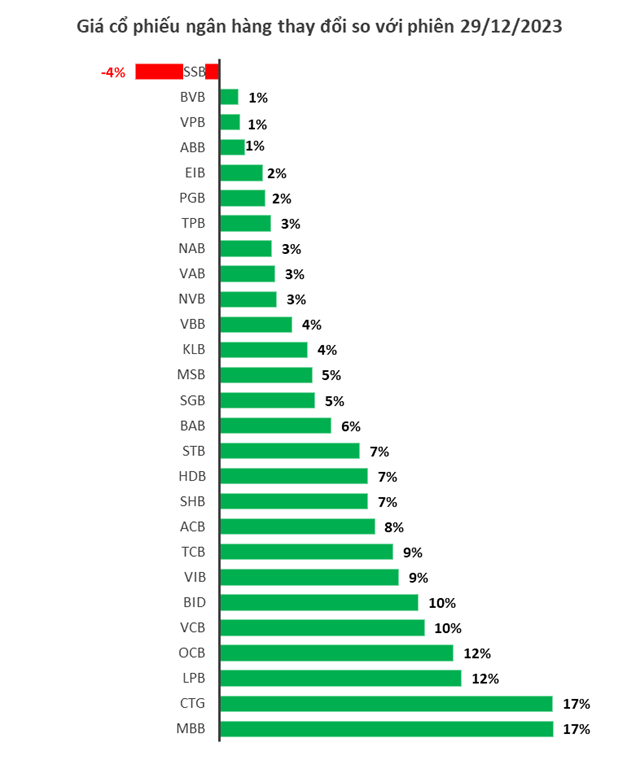

There was only 1 stock that decreased in price.

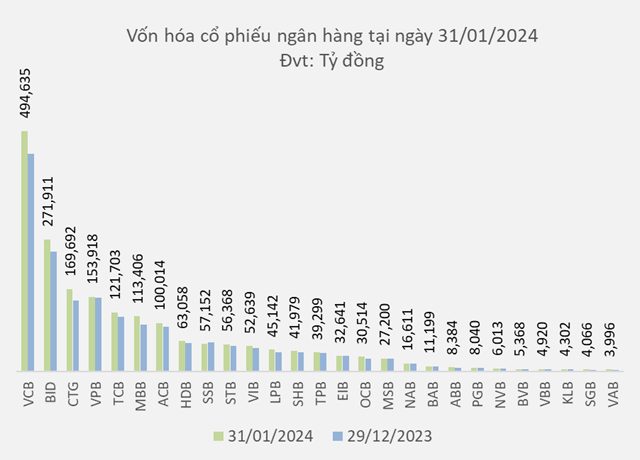

In January, the market capitalization of the banking group increased by 155,689 billion VND, reaching over 1.94 quadrillion VND (as of January 31, 2024), a 9% increase compared to the 1.79 quadrillion VND at the end of December 2023.

Source: VietstockFinance

|

MBB and CTG tied for the strongest increase in market capitalization in January (both increased by 17%) thanks to the corresponding increase in stock prices.

Except for SSB stock, which had a 4% decrease in stock price compared to the end of 2023, resulting in a decrease in market capitalization, the remaining banking stocks had positive stock price increases, contributing to the increase in market capitalization.

The banking stock group experienced a boom at the beginning of the new year thanks to the positive impact of the credit growth target from the beginning of the year and the Law on Credit Institutions (amended). Under this, issues related to cross-ownership, control of credit institutions; agency business activities; early intervention in weak credit institutions and handling of collateral assets will help promote sustainable growth in the medium and long term of the banking sector.

Source: VietstockFinance

|

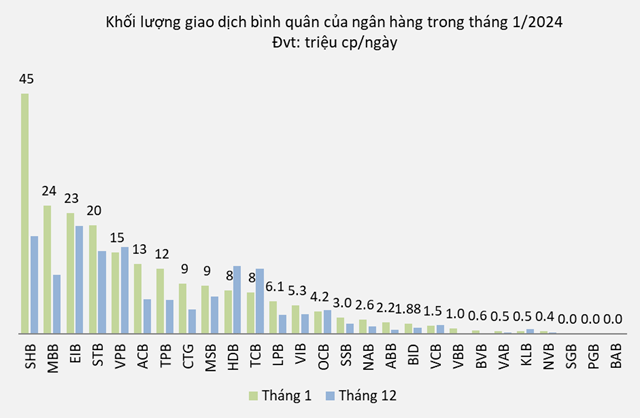

High liquidity

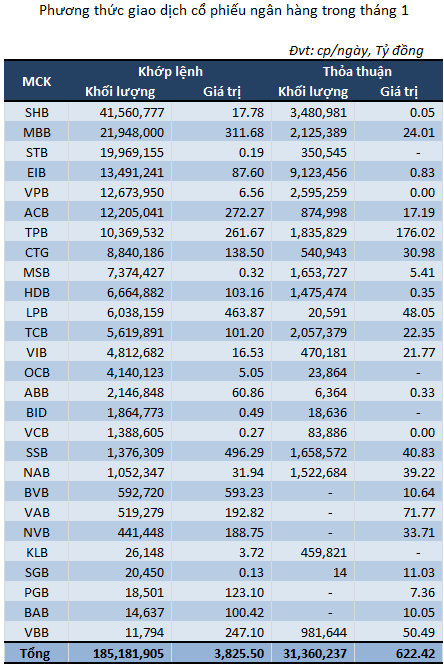

In January, nearly 217 million banking shares were traded per day, an increase of 44% compared to December, equivalent to an increase of over 66 million shares per day. The trading value also increased by 46%, reaching nearly 4,448 billion VND per day.

Source: VietestockFinance

|

Among them, small banks with a dramatic increase in liquidity were VBB (223 times higher), BVB (4.2 times higher), BAB (3.8 times higher), and ABB (3.2 times higher).

On the other hand, KLB stock had the largest decrease in liquidity in the past month, with only 484,969 shares traded per day, a 47% decrease compared to the previous month.

This month, SHB stock led in liquidity with nearly 42 million shares traded per day, and 3.5 million shares per day being transferred, with a total average trading volume reaching over 45 million shares, 2.5 times higher than the previous month.

Although BAB stock had a strong increase in liquidity, it still had the lowest liquidity with only 14,637 shares traded per day, with a value of only over 188 million VND per day.

Source: VietstockFinance

|

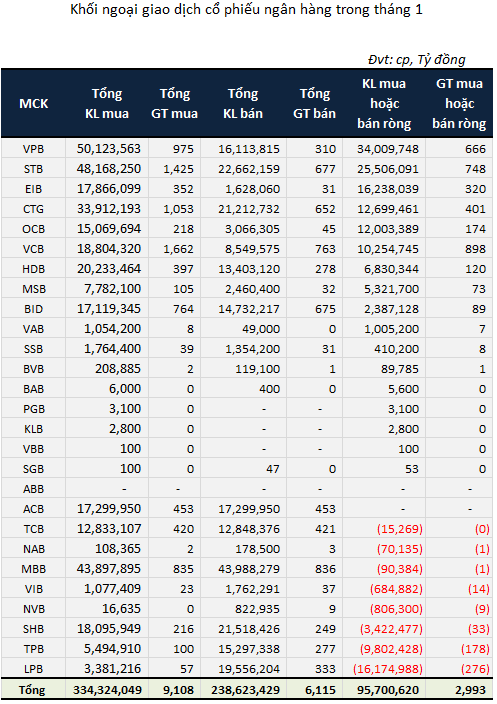

Foreign investors net bought 2,993 billion VND

With the recovery of the “bank” sector, foreign investors took advantage of buying “blue chip” stocks in January, with a net purchase volume of nearly 96 million shares, reaching a value of 2,993 billion VND.

Source: VietstockFinance

|

VPB stock was the most purchased by foreign investors, with over 34 million shares (666 billion VND) in the past month. On the contrary, foreign investors sold the most LPB stock, with a net selling volume of over 16 million shares, equivalent to a value of 276 billion VND.

Is there still time to invest in “blue chip” stocks?

SSI Research stated that the banking stocks they are currently researching have a P/B ratio of 1.1x in 2024, and specifically, the ratio for commercial banks is 0.92x. Meanwhile, if assuming the LGD ratio (estimated loss proportion) for problematic loans is 50% and after using the allocated provisions, the impact on equity will be at 11%. Therefore, experts believe that the current valuation largely reflects the credit risk from overdue loans and restructured loans according to Circular 02. However, this valuation may not fully reflect the additional recapitalization loans for real estate investors disbursed in 2023 at certain designated banks (classified in group 1). In addition, when considering the price movements of banks in previous cycles, SSI Research found that the valuation hardly changed during the bad debt resolution process, but will be revalued within 6-12 months before completing the bad debt resolution process. During this process, banks with the ability to increase capital sooner will have better conditions to accelerate the bad debt resolution process, gain additional market share, and achieve more favorable results than other banks.

According to the assessment of SSI Research, 2024 continues to be a challenging year for the banking sector in terms of asset quality. However, the overall situation will improve compared to 2023, mostly due to the significantly lower cost of capital compared to 2023 and the pre-provision profit improvement, which gives banks more leeway to create a better provision buffer.

Therefore, SSI Research maintains a neutral stance on the banking sector in 2024 due to the ongoing consolidation of the pre-provision buffer, which hinders the strong acceleration of overall sector profit. Nevertheless, the team of experts still values stocks with good asset quality and plans for private placements, which will actively support the bad debt resolution process and medium-term growth prospects.

The VNDirect expert group believes that the GDP growth target for 2024 is 6-6.5%, and accordingly, the target of credit growth of 14-15% set at the beginning of this year is reasonable. Therefore, banks with strong credit growth and a stable business model will have more positive stock prospects.