Vice General Director of DP3 has finished selling 800,000 shares

Mr. Nguyen Thanh Tuan – Member of the Board of Directors, Deputy General Director of Central Pharmaceutical Corporation 3 (HNX: DP3) reported that he has sold 800,000 shares of DP3 as registered from 23-26/01/2024.

After the transaction, Mr. Tuan reduced his ownership ratio in the Company from 9.68% (2.1 million shares) to 5.96% (1.3 million shares).

Based on DP3’s closing price on January 26th of 72,300 VND/share, up over 21% since the beginning of October 2023, it is estimated that Vice General Director DP3 can make more than 57 billion VND after reducing his ownership stake in the Company.

Did T&T Corporation transfer all shares of BHI to Vegetexco?

T&T Corporation reported that it has sold all 9.95 million shares (9.95% stake) of Saigon – Hanoi Insurance Corporation (BSH, UPCoM: BHI). After the transaction, T&T Corporation is no longer a shareholder of BHI. The Corporation stated that the purpose of the transaction is to withdraw capital invested in the insurance company.

Instead, Vegetexco JSC (OTC: Vegetexco) reported that it has purchased 10.1 million shares, equivalent to a 10.1% ownership stake in BHI. Interestingly, both transactions were executed on the same day, January 29th.

On January 29th, BHI recorded a negotiated transaction with a volume equal to Vegetexco’s trading volume. The transaction value was nearly 192 billion VND, equivalent to 19,000 VND/share. In this session, BHI closed at 20,000 VND/share.

It is worth noting that the trading volume of BHI shares matched in this session was only 1,500 shares. Therefore, out of the 10.1 million shares of BHI traded, 9.95 million shares were transferred by T&T Corporation to Vegetexco, earning over 189 billion VND from the deal.

Vegetexco stated that since 2016, T&T Corporation and Saigon – Hanoi Insurance Corporation have been strategic shareholders of the agricultural enterprise. Therefore, it is highly likely that BHI is still within the T&T Corporation ecosystem as a related company of Vegetexco.

Dragon Capital Group owns over 11% in HSG

The ownership of the Dragon Capital Group exceeds 11% in Hoa Sen Group (HOSE: HSG), after a member fund purchased 3 million HSG shares.

Specifically, a member fund of the Dragon Capital Group named Amersham Industries Limited bought 3 million HSG shares in the session on January 26th, thereby increasing its ownership in HSG to nearly 2.7%, bringing the total ownership of the Dragon Capital Group to over 11.3%, equivalent to nearly 69.8 million shares.

Based on the closing price of HSG shares on January 26th at 23,550 VND/share, it is estimated that Amersham Industries Limited spent about 71 billion VND on the deal.

Vice Chairman and a series of AIC Board Members registered to sell over 10 million shares

Mr. Nguyen Thanh Quang – Vice Chairman of the Board of Directors, General Director of Aviation Insurance Corporation (UPCoM: AIC) and 2 Board Members, Mr. Tran Sy Tien and Ms. Nguyen Dieu Trinh, registered to sell over 10 million AIC shares to recover investment capital.

Specifically, Mr. Quang wants to sell 742,000 shares, while both Mr. Tien and Ms. Trinh want to sell all the shares they hold, with respective quantities of 4.73 million shares and 4.65 million shares. The transactions are expected to take place from 30/01 to 28/02/2024, with a total registered quantity of 10.11 million shares.

If successful, Mr. Quang’s ownership ratio will decrease from 0.92% (920,000 shares) to 0.18% (178,000 shares). Meanwhile, Mr. Tien and Ms. Trinh will no longer own any AIC shares and will no longer be shareholders of AIC.

Thép SMC wants to sell all 13 million NKG shares after holding for nearly 7 years

Recently, SMC Trading Investment Corporation (HOSE: SMC) has registered to sell all NKG shares amid continuous losses and being stuck with bad debts of over 1,300 billion VND.

Specifically, on January 29th, 2024, SMC registered to sell all 13.1 million NKG shares through matching and negotiated transactions. The trading period will take place from 05/02 to 04/03/2024. This share quantity is equivalent to 4.98% of the capital in Nam Kim Steel (HOSE: NKG).

If the transaction is completed, SMC will end its “marriage” with NKG after holding it for many years.

|

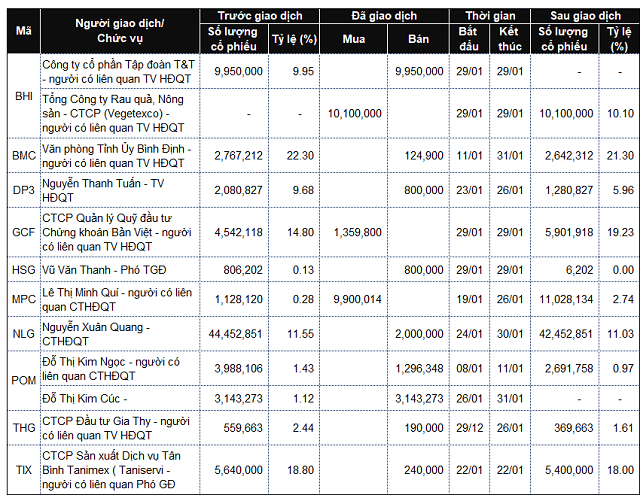

List of company leaders and relatives who traded from January 29th to February 2nd, 2024

Source: VietstockFinance

|

|

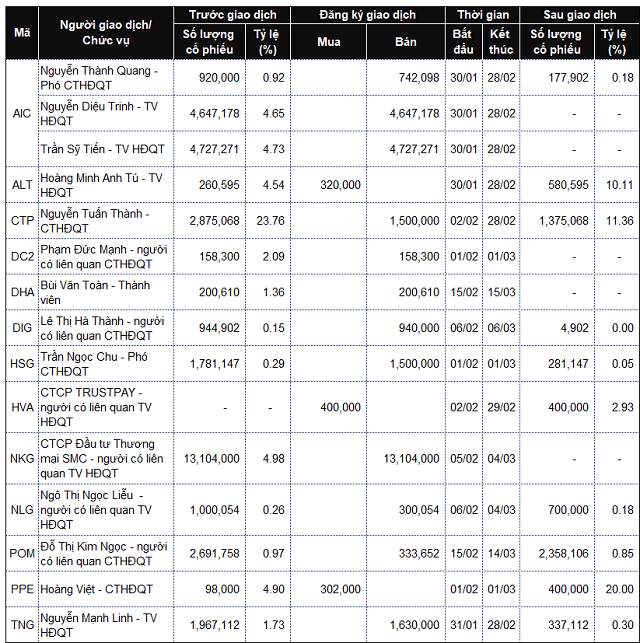

List of company leaders and relatives who registered transactions from January 29th to February 2nd, 2024

Source: VietstockFinance

|

Thanh Tu