The market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching nearly 791 million shares, equivalent to a value of over 17 trillion dong; HNX-Index reached nearly 75 million shares, equivalent to a value of nearly 1.4 trillion dong.

VN-Index opened the afternoon session quite negatively as selling pressure reappeared, pulling the index slowly into red despite buying side trying to support but the index still closed below the reference level. In terms of influence, VCB (0.56%), FPT (2.10%), and GVR (2.71%) are the stocks that have the most positive impact on VN-Index with nearly 2 points increase. On the contrary, VPB, BID, and CTG are the stocks that have the most negative impact on the index.

|

Top 10 stocks with strong impact on VN-Index Measured by points |

HNX-Index also had a similar trend, in which the index was negatively impacted by stocks IDC (-1.61%), DTK (-1.80%), PTI (-4.55%), PVS (-0.54%),…

|

Source: VietstockFinance

|

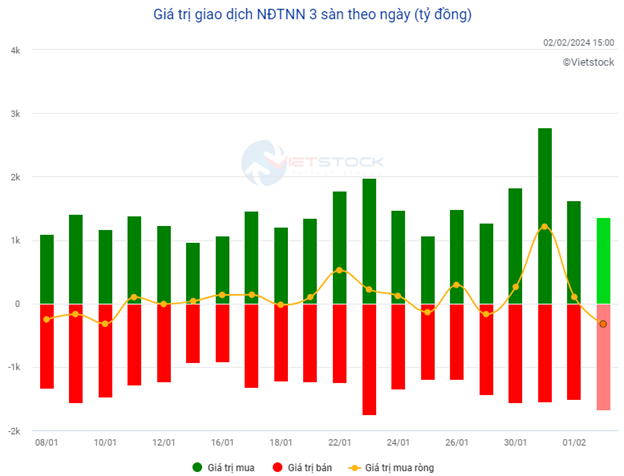

The technology and information sector is the sector with the strongest recovery, up 1.98%, mainly driven by stocks FPT (+2.1%) and CTR (+0.63%). Following that are the retail sector and the plastic-chemical industry with growth rates of 1.36% and 1.19% respectively. On the contrary, the agriculture-forestry-fishery sector has the sharpest decline in the market with -0.89%, mainly attributed to stocks HAG (-2.44%), HNG (-3.1%), and HSL (-3.13%).

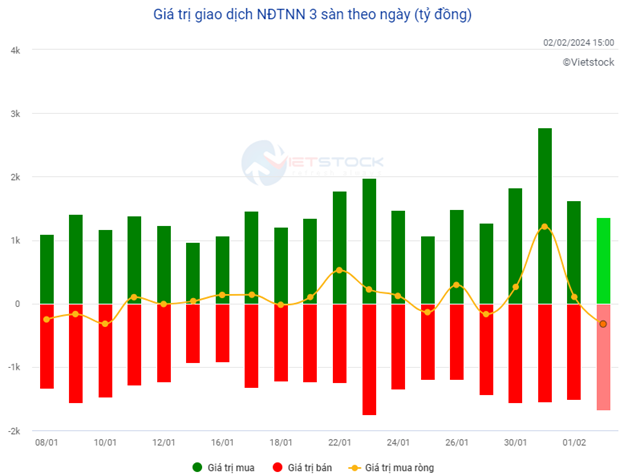

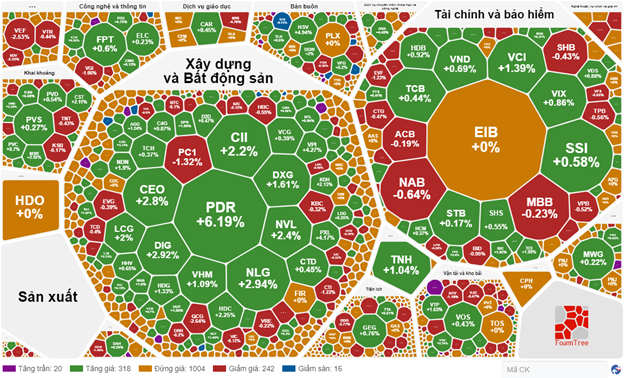

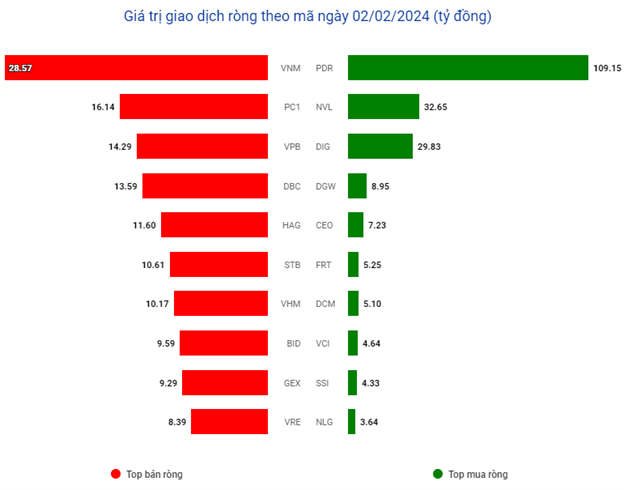

In terms of foreign trading, this sector returned to net selling of over 255 billion dong on HOSE trading floor, concentrating on stocks VNM (78.16 billion dong), PC1 (53.70 billion dong), VPB (42.48 billion dong), and GEX (41.10 billion dong). On HNX trading floor, foreign investors net sold over 62 billion dong, focusing on stocks SHS (55.33 billion dong), IDC (4.75 billion dong), and DTD (3.32 billion dong).

Source: Vietstock Finance

|

Afternoon session: Foreign selling continues, VN-Index narrows its gains

The market ended the morning session with the narrowing of the upward trend of the index towards the reference level. VN-Index increased by 0.7 points, temporarily stopping at 1,173.72 points; HNX-Index increased by 0.67 points, to the level of 231.25 points. The whole market temporarily tilted towards the buying side with 298 gainers and 334 losers. The VN30 basket temporarily tilted towards the selling side with 10 gainers, 16 losers, and 4 stocks unchanged.

The trading volume of VN-Index recorded in the morning session reached nearly 389 million units, with a value of over 8.5 trillion dong. HNX-Index recorded a trading volume of nearly 36 million units, with a trading value of over 652 billion dong.

At the end of the morning session, the rubber product group is still leading but has decreased significantly compared to the opening session when it kept at a growth rate of 1.41%. Specifically, there are strong rising stocks such as SRC up 5.9%, CSM up 1.56%, and slight increase of DRC 0.47% with decreasing momentum.

Notably, the real estate group did not make a significant contribution to the index in this morning session. However, some stocks in this group have impressive growth rates such as PDR up 4.61%, NVL up 2.99%, DIG up 2.92%, NLG up 3.46%, and KDH up 2.13%. The remaining stocks also had positive increases, including DXG (+1.34%), CEO (+2.34%), VPI (+4.45%), HDC (+1.77%),…

On the contrary, the remaining groups such as food and beverage, seafood, banks, utilities, manufacturing machinery all recorded not so positive trends.

At the end of the morning session, the market’s tug-of-war affected the opposite movements in different industries. Specifically, the rubber product industry was the strongest to increase with a growth rate of 1.41%. On the contrary, accommodation, food, and entertainment industry had the lowest decline with a decrease of 0.88%.

Foreign investors net sold over 75 billion dong on HOSE trading floor with the most selling volume in VNM. On HNX trading floor, foreign investors net sold over 39 billion dong, concentrating mainly on selling SHS.

10:40 am: Real estate leads the market, VN-Index maintains its gains

Investor sentiment is quite divided, VN-Index fluctuates around the reference level. Real estate stocks and securities stocks lead the market’s uptrend.

In the real estate group, there are 5 stocks that have a significant impact on the VN-Index: VHM up 0.85%, PDR up 6.19%, NVL up 2.30%, KDH up 2.13%, and NLG up 2.94%. As of 10:30 am, over 2,612 billion dong has been poured into the real estate group.

|

Top 10 stocks with impact on VN-Index on 02/02 session (as of 10:50 am) Measured by points |

After that, securities stocks also spread the green color with most of the top 5 stocks in the industry such as SSI up 0.72%, VND up 0.92%, VCI up 1.27%, MBS up 1.16%, and HCM up 0.19%. The rest of the stocks were mostly unchanged or slightly decreased.

On the contrary, the banking group showed a differentiation with red predominance. Specifically, stocks like BID, CTG, VPB, and MBB all had slight decreases from 0.22% to 1.06%. The rest with some stocks unchanged and 3 stocks that maintained gains were HDB, MSB, and NVB with insignificant increases.

The market breadth tilted towards the buying side, with more than 330 gainers, higher than about 250 decliners. VN-Index at this time increased by nearly 1 point to 1,174 points; HNX-Index increased by 0.29%, around 231 points, and UPCoM-Index increased by 0.09%.

Source: VietstockFinance

|

The total trading volume on all three exchanges reached over 354 million units, equivalent to over 7.4 trillion dong. In addition, foreign investors returned to slight net selling of nearly 0.2 billion dong, focusing on VNM, PC1, VPB, and DBC.

Source: VietstockFinance

|

Opening session: Positive cash flow

After yesterday’s positive point increase, VN-Index opened this morning’s session with a continued green color covering the whole market. In which, the positive contribution comes from the securities, information technology, and plastic-chemical industries.

After the PMI index for January 2024 was announced yesterday when it returned to above the 50-point level in the first month of the year, specifically increasing to 50.3 points compared to 48.9 points in December. This has had a positive impact on the opening trading session this morning, with cash flow spreading across various industries. Notably, the securities industry, most of the stocks in this group have good growth such as VND (+1.15%), VCI (+1.73%), SHS (1.09%), HCM (+0.94%), VIX (+0.86%), MBS (+1.93%), FTS (+1.03%),…

The plastic-chemical industry also recorded positive performance as the leading stocks in the industry all had strong gains from the beginning of the session. Specifically, GVR increased by over 2%, followed by HDA and DCM stocks with growth rates of 2.13% and 1.7% respectively.

In addition, stocks in the information technology sector also made significant contributions to the upward trend of the index such as FPT (+1.1%), CTR (+0.42%), CMG (+0.61%), ELC (+1.15%),…

Lý Hỏa