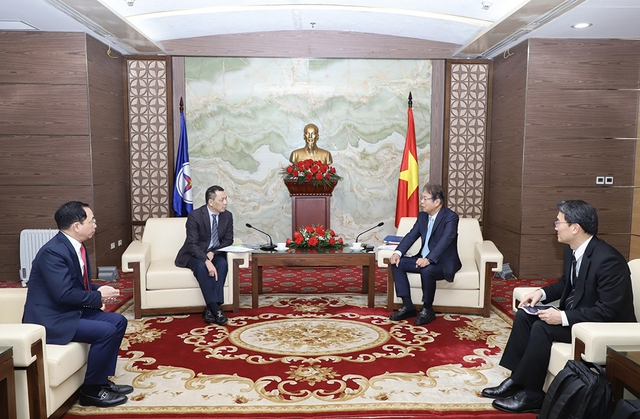

On February 2, in Hanoi, Chairman of the Board of Directors of Vietnam Electricity Group (EVN) Dang Hoang An received and worked with Mr. Takeshi Yokota – CEO, and Deputy Chairman of Hyosung Vietnam Co., Ltd. to discuss cooperation.

Hyosung is proposing to buy shares of EVN in Dong Anh Electric Equipment Corporation (EEMC – stock code TBD, Upcom). Mr. Takeshi Yokota hopes to receive support and advice from EVN during this process. In addition, Hyosung also wants to develop a long-term cooperation strategy with Vietnam Electricity Group in areas where Hyosung has a lot of experience and advanced technologies such as GIS STATCOM, ESS, transmission line construction, renewable energy…

This is not the first time Hyosung has expressed its desire to buy shares in TBD.

Hyosung Vietnam working group working at EVN. Photo: EVN

Since May 2018, Hyosung Vietnam Co., Ltd., a member unit of Hyosung Group of South Korea, has sent a proposal to EVN to purchase a total of more than 13 million shares of Dong Anh Electric Equipment Corporation (equivalent to 46.58% of charter capital) from EVN at a price of up to VND 90,000 per share or more, equivalent to about VND 1,180 billion.

The proposal was sent after the announcement of the sale of all of EVN’s 13,131,632 shares of TBD in mid-March 2018. The transaction method is matching order, expected to be implemented from April 2 to April 27, 2018. However, this plan later failed due to the unusually fluctuating TBD shares and the high stock price. In that context, EVN is concerned that if sold in multiple stages, investors may only buy enough controlling shares, and EVN may not completely divest according to the direction of the Ministry of Industry and Trade.

According to Hyosung Vietnam, the demand for high-quality electricity in Vietnam is expected to grow steadily as the industry develops and national income increases. To meet this demand, EVN needs a transformer company equipped with after-sales service capabilities and global quality standards.

In this regard, Hyosung can turn EEMC into a global company capable of manufacturing transformers up to 500kV.

However, as of May 19, 2018, Hyosung Vietnam has not received any response from EVN. Meanwhile, along with EVN’s divestment announcement, the top leaders of TBD have sold all of their shares. THIBIDI Joint Stock Company (THIBIDI stock code THI) bought gradually and became the second largest shareholder after EVN.

In August 2020, EVN once again put more than 13 million shares of TBD up for auction with a starting price of VND 153,100, equivalent to a total starting price of over VND 2,000 billion. TBD’s market price at that time was only VND 88,000 per share. This auction also failed to take place.

At that time, THI held 24.89% of TBD shares. Currently, the ownership structure of TBD shareholders still includes EVN holding 46.58% of shares, THIBIDI holding 46.17%. The company has increased its ownership ratio after publicly offering to buy 6.88 million TBD shares at a price of VND 96,600 in August 2023.

THIBIDI is a company owned 98.7% by Gelex Power Joint Stock Company (GEE) – a subsidiary of GELEX Group (GEX) which owns 79.99% of the charter capital.

According to the Q4/2023 financial report just released by Dong Anh Electric Equipment Corporation, net revenue reached VND 890.5 billion – an increase of nearly 40% compared to the same period and after-tax profit reached nearly VND 35 billion – an increase of 84%. Accumulated in 2023, the company achieved VND 1,818 billion in revenue – an increase of 8.4% compared to 2022 and after-tax profit reached over VND 50 billion – an increase of 17.7%. In the last trading session, TBD hit the ceiling price, increasing 15% to VND 73,800, establishing a market capitalization of nearly VND 2,400 billion.

In Vietnam, Hyosung is a quiet Chaebol, not as prominent as Samsung, LG, Hyundai, Lotte… because their products are not consumer goods, household items, or technology products. Nevertheless, Hyosung is known as a major investor in Vietnam and the largest in Dong Nai province. The group operates in the fields of manufacturing fibers for textiles, automobile tires; manufacturing transformers, chemicals, industrial materials, heavy industry, and information technology.

At the Vietnam – Korea Economic Forum in 2023, Chairman of Hyosung Group, Mr. Cho Hyun Joon, shared that the Group has been investing in Vietnam for over 20 years with a total capital of about 20,000 billion won (about 3.5 billion USD) and more than 9,000 laborers.

At the end of 2023, representatives of Hyosung Group presented an idea to build a Biofiber Factory in Phu My 2 Industrial Park with a total investment of 720 million USD. This is the first project of Hyosung Group in the world that applies modern, advanced, and environmentally friendly technologies to produce Spandex fabric fibers.