After failing to surpass the 1,173 mark in the early afternoon, the buying side retreated to defend the 1,170 level. However, the selling side was too overwhelming, causing the index to repeatedly break through this level. VN-Index dropped to 1,168, which was the last moment when the buying side had the strongest upper hand before recovering and closing at the aforementioned level.

|

Source: VietstockFinance

|

Although market participants were in a fierce battle, the trading volume on HOSE today was only over 10 trillion VND, lower than the 13.3 trillion VND of the previous session and the 13.7 trillion VND 5-day average.

In the list of stocks influencing VN-Index (contributing to a decrease of nearly 3 points), we witnessed the rotation of BID from the most negative impact to the largest support before returning to its initial position. BID contributed to a decrease of 0.69 points to the index, followed by SAB, VIC, and VHM. On the other hand, VCB once again became one of the stocks with the biggest impact on VN-Index.

In the group of stocks with positive impact, two retail stocks MWG and FRT started a surge in price at the last minute, while they were almost absent earlier, contributing an increase of 0.29 points and 0.25 points respectively.

The end-of-day market balance was more apparent in the foreign investor group. At the close, foreigners were net sellers of nearly 5.1 billion VND. The most sold stock was FPT, on the other hand, the most bought stock was MBB.

14:00: Sellers have the upper hand, VN-Index continues to decline sharply

The initial stage of the afternoon session was positive, then quickly reversed when the index started to drop. The buying and selling sides continued to struggle, surrounding the benchmark of 1,173 points of VN-Index. As of 13:32, sellers had the upper hand, pushing the index into a decline.

The top stocks that positively impacted the market performed better, with a reversal of the situation, contributing to an increase of nearly 1.39 points, while the opposite group contributed to a decrease of 1.36 points. However, the index still remained in the red, showing pressure from both mid and small-cap stocks. The number of declining stocks increased to 298, while the number of advancing stocks was 313. Trading liquidity has not improved yet.

Following BID, VCB also “turned around”, not only changing into the positive impact side but also leading this group with a contribution of 0.55 points. BID came next with a contribution of 0.28 points.

Among the stocks with negative impact on the market, SAB made the largest contribution to the decrease of 0.189 points; and all three large-cap stocks of Vingroup, VIC was the second biggest negative factor for the market, followed by TCB, GAS, and VHM.

In the financial group, the weak green color fading away indicates the intense struggle of the buying side, especially in banking stocks such as SSI and HCM. In the banking group, the dominant color was red, with stocks like STB, HDB, VND, MSB, MBB, and TCB all showing declines.

The AAA stock in the manufacturing group still maintained a significant price increase of nearly 5%, while the steel stocks such as HPG and HSG, although with modest increases, had positive movements.

In terms of foreign investors, selling pressure continued to be strong, but buying side showed signs of recovery, with the selling value decreasing to 248 billion VND.

Morning session: Reversing course, VN-Index returns to green

After rising from 1,169, VN-Index started to move positively, regaining the morning’s green color. However, when the index reached 1,173.47, it suddenly changed direction and fell back into the red zone, closing the morning session on January 25 at 1,170.91 points.

At the close of the morning session, the divergence continued to be shown through 283 gainers, 278 decliners, and 1,013 stocks standing unchanged. Among them, there were 23 stocks hitting the ceiling and 10 stocks hitting the floor.

In the banking group, SHB, ACB, and BID maintained their positive momentum, while MBB, STB, and TCB declined. In the securities group, SSI remained stable, while VIX, HCM, and MBS increased.

The manufacturing group attracted attention with the opposite movements of DGC, down 1.34%, and AAA, up to 4.47%. The wholesaler group, represented by ST8, hit the floor for unknown reasons.

Stocks NTL, DIG, and CII in the construction and real estate group also gained ground, with NTL increasing by 4.65%.

The market liquidity continued to be lower than the previous session and the 5-day average, about 4.351 trillion VND.

In the group of stocks that had a strong impact on the market, the top stocks with negative contributions led to a decrease of 1.77 points. SAB was the leading stock in this group, taking the place of VCB – the stock that had the largest negative pressure on the index in the early hours of the morning session.

In contrast, the group of supporting stocks contributed to an increase of 0.82 points, with a surprising reversal of position by BID, becoming the leading stock with a contribution of 0.42 points, a significant difference compared to the remaining stocks in the group.

Foreign investors followed the general trend, net selling 251 billion VND.

10:30: Sellers have the upper hand

Continuing the morning’s development, VN-Index continued to drop, reaching 1,169 and then bouncing back. However, the index was still in a downward range compared to the previous day. Stocks began to show wider divergence, gradually choosing sides. Overall, the market still tilted toward sellers, as of 10:11, the number of declining stocks reached 242, and the number of advancing stocks was 234.

The divergence also occurred in different sectors. In the financial group, banking stocks such as MBB, CTG, TCB, and ACB declined, while stocks STB and SHB showed positive movements. Stocks in the securities group such as SSI and HCM also declined, and VND remained stable. VIX had a contrary development, maintaining its green color.

Market liquidity did not significantly improve compared to the previous session, averaging about 650 billion VND.

In terms of stocks impacting the index, VCB and BID continued to decline further, adding further downward pressure. In addition, among the stocks with negative impact on the market, 2 large-cap stocks in the Vin family, VIC and VHM, also contributed to compressing the market. Conversely, stocks such as GAS, GEX, PGV, and AAA were still weakly increasing, providing support to the market.

Opening: VN-Index opens indecisively

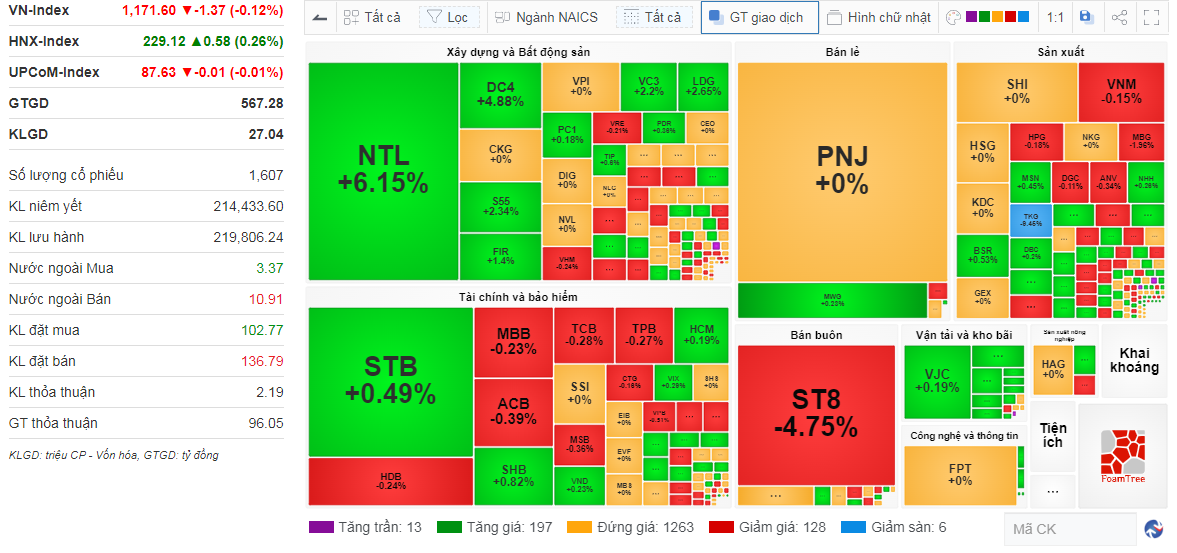

VN-Index opened with a slight increase before turning back, dropping 1.37 points to 1,171.60 points, with 13 limit-up stocks, 197 gaining stocks, 1,263 stocks standing unchanged, 128 declining stocks, and 6 hitting the floor.

Market movement at 9:22. Source: VietstockFinance

|

The Large Cap and Micro Cap groups also slightly declined. However, the Mid Cap and Small Cap groups had the opposite trend.

Market liquidity did not have a significant breakthrough compared to the previous session, averaging about 650 billion VND.

VCB and BID were the two stocks in the banking group that had the greatest pressure on VN-Index, followed by BCM. Conversely, CTG, MSN, and STB were three gaining stocks that were attempting to balance the market.

Kha Nguyễn