Total trading value on three exchanges reached 14,538 billion with 685.51 million shares changing hands.

The banking sector increased by 0.8% and supported the market. The sector had 2 declining stocks out of 14 increasing stocks.

Foreign investors net bought over 300 billion on all three exchanges. The stocks HSG, VCG, HPG were net bought with amounts of 82 billion, 76 billion, and 70 billion respectively. Of note, VHM was net sold with a value of 103 billion, the highest in the market.

2 p.m: Maintaining the Green

Banking sector stocks are all green. Except for EIB, SSB, and STB which are red. The remaining banking stocks are mostly green. It is worth noting that ACB increased by 1.74%. No stock increased by more than 2%.

NTL is slightly down 500 (1.57%) at a price of 31,300 VND/share. NTL just announced its Q4/2024 results with a net profit of 363 billion VND, 279 times higher than Q4/2022. This is also the quarter when NTL achieved its record high profit since its listing on HOSE in 2007.

The rubber industry stock DRC is strongly increasing by 4.86%. The stock is traded at a price of 29,100 VND/share. The rubber tire factory Phase 3 of Cao su Đà Nẵng has been put into operation since December 2023, helping increase the total radial tire capacity by 67%, reaching 1 million tires per year. The investment rate for Phase 3 of Cao su Đà Nẵng is lower than 50% compared to the previous 2 phases, significantly increasing the company’s gross profit margin when the entire factory operates at maximum capacity.

Cao su Đà Nẵng recorded a net profit after tax of 96 billion VND in Q4/2023, a 19% increase compared to the same period in 2022.

For the whole year of 2023, Cao su Đà Nẵng recorded a total net revenue of 4,495 billion VND and a pre-tax profit of 307 billion VND, a decrease of 8% and 21% respectively compared to 2022; thus, achieving 89% of the annual revenue target and 93% of the annual profit target in 2023.

Morning session: Banking group supporting the market

The market maintained the green color in the morning session, VN-Index increased by nearly 5 points, with the banking group still performing well and supporting the market.

The seafood processing industry is operating well. ASM (10,550; 200; 1.93%); VHC (64,300; 1,500; 2.39%) are the leading stocks.

The securities stocks are all green except for HBS and TVB which are slightly red. The remaining stocks are either gold or green, with only TCL and HCM showing strong increases of 4.2% and 3% respectively; not many stocks are increasing significantly. Stocks increasing by more than 1% include VFS, FTS, EVS, BSI, and APS.

Meanwhile, VNS closed the morning session with a decrease of 200 VND to 13,500 VND/share. In Q4/2023, Vinasun (VNS) recorded a revenue of 278 billion VND, a 14.2% decrease compared to the same period. Pre-tax profit is over 25 billion VND, a 55% decrease.

9:50 a.m: Green after US GDP news

The stock market opened the session on January 26 with widespread positivity. VN-Index increased by more than 5 points as of 9:30 a.m. HNX-Index increased by 1 point to nearly 230 points.

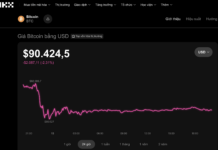

In the US market, at the end of the trading session on January 25, the S&P 500 index increased by 0.53% to 4,894.16 points, setting another record for the highest closing level of all time. The Dow Jones index increased by 242.74 points (equivalent to 0.64%) to 38,049.13 points.

According to the announcement from the US Department of Commerce on January 25, the US economy has grown much better than expected in the last 3 months of 2023. Previously, many experts believed that a recession was unavoidable.

According to the announcement, the US GDP index increased by 3.3% in Q4/2023 (adjusted on an annual basis), higher than the forecasted growth of 2% by Wall Street experts. In Q3, the growth rate was 4.9%. The US economy is showing positive signs.

Banking stocks quickly emerged and led the market. VCB, BID, TCB, MBB, ACB, CTG… are the top stocks that pushed the index up strongly.

Other Large Cap stocks such as VNM, FPT, HPG, GVR are also performing positively.