Market liquidity increased compared to the previous trading session, with the trading volume of VN-Index reaching over 644 million shares, equivalent to a value of over 13 trillion dong; HNX-Index reached nearly 56 million shares, equivalent to a value of nearly 1 trillion dong.

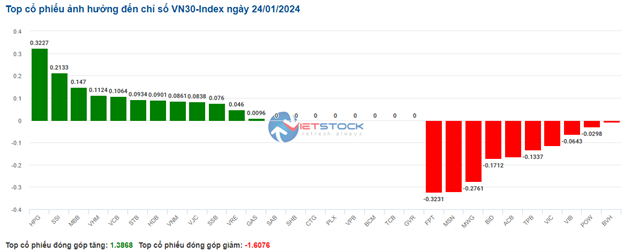

VN-Index opened the afternoon session with an optimistic atmosphere as buying pressure appeared right from the beginning of the session, pushing the index to recover above the reference level. Afterward, selling pressure appeared, pulling the index gradually into the red and closing near the day’s lowest level. In terms of impact, VHM (0.35%), HCM (4.38%), and STB (0.82%) were the stocks that had the most positive impact on VN-Index, contributing to an increase of more than 0.4 points. On the contrary, BID, VCB, and MSN were the stocks that had the most negative impact on the index.

|

Top stocks impacting VN-Index on 24/01 session Measured in points |

HNX-Index also had a similar development, in which the index was negatively affected by stocks such as DXP (-3.1%), NTP (-1.86%), LHC (-1.72%), L14 (-1.43%),…

|

Source: VietstockFinance

|

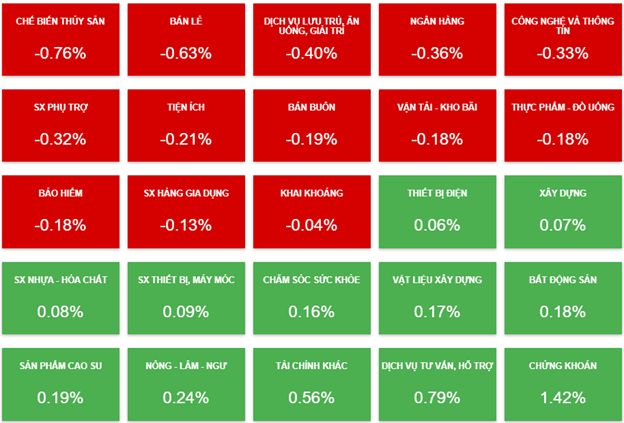

The retail sector saw the strongest decline with 1.56%, mainly driven by stocks like MWG (-2.2%), PNJ (-0.45%), and FRT (-0.7%). This was followed by the seafood processing and agriculture, forestry, and fishery sectors with decreases of 1.07% and 0.8% respectively. On the other hand, the rubber product sector had the strongest increase in the market with 1.2%, mainly driven by stocks like DRC (+1.83%) and CSM (+0.42%).

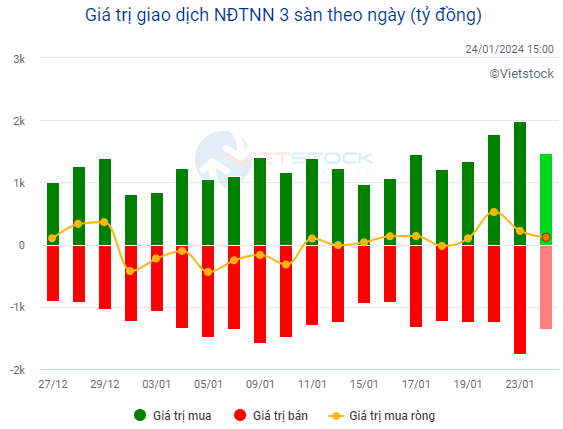

Regarding foreign trading, this group continued to be net buyers with over 63 billion dong on HOSE, focusing on stocks like SSI (119.5 billion), EIB (78.14 billion), HPG (71.4 billion), and VCG (37.84 billion). On HNX, foreign investors net bought over 2.4 billion dong, focusing on stocks like BVS (5.25 billion), IDC (4.33 billion), and MBS (1.73 billion).

Source: Vietstock Finance

|

Morning session: Selling momentum, VN-Index falls into the red

Selling force prevailed, the market sank into the red in the second half of the morning session. At the temporary close, VN-Index decreased by 1.25 points, to the level of 1,176.25 points; HNX-Index increased slightly by 0.14 points, to the level of 229.4 points. The whole market leaned towards the buying side with 306 stocks increasing and 304 stocks decreasing. The majority of VN30-Index was in red with 10 stocks increasing, 14 stocks decreasing, and 6 stocks standing at the reference price.

The trading volume of VN-Index recorded in the morning session reached nearly 261 million units, with a value of over 5.1 trillion dong. HNX-Index recorded a trading volume of over 24 million units, with a trading value of over 400 billion dong.

Development of major indexes in the morning session on 24/01. Source: VietstockFinance

|

At the temporary close, BID, VCB, and MSN were the stocks that had the most negative impact by deducting more than 1.8 points from the index. On the contrary, VHM, VRE, and HCM were the stocks that had the most positive impact by offsetting more than 0.7 points of the index.

Most of the industry groups were in the red, with the seafood processing industry recording a significant decline. The retail, accommodation, food, and entertainment sectors also experienced a smaller decline.

Development of industry groups at the end of the morning session on 24/01. Source: VietstockFinance

|

At the end of the morning session, red temporarily took the upper hand when looking at the overall market. Among them, the seafood processing industry experienced the largest decline with a decrease of 0.76%. On the contrary, the securities industry had the strongest increase in the market with a growth of 1.42%.

The market liquidity continued to be low. Foreign investors net bought over 4.85 billion dong on HOSE, with the highest buying volume in HPG’s stock. On HNX, foreign investors net sold over 3.85 billion dong, mainly on TIG’s stock.

10:35 AM: Intense tug-of-war

The hesitancy of investors caused the main indices to continuously fluctuate around the reference level in the market. As of 10:30 AM, VN-Index decreased by 0.92 points, trading around 1,176 points. HNX-Index increased by 0.19 points, trading around 229 points.

The stocks in VN30 basket appeared to alternate between gains and losses, but buying pressure still dominated. Specifically, HPG, SSI, MBB, and VHM contributed 0.32 points, 0.21 points, 0.15 points, and 0.11 points respectively to the general index. On the contrary, MWG, FPT, and MSN faced strong selling pressure and deducted nearly 1 point from VN30-Index.

Source: VietstockFinance

|

The securities industry was one of the most volatile sectors in the market. Most of the stocks in this industry were colored in green, such as SSI (+0.44%), VND (+0.91%), VCI (+0.47%), SHS (+0.54%), HCM (+2.19%),…

The banking sector experienced a slight decline at the beginning of the trading session. Selling pressure mainly affected stocks such as BID (-0.91%), CTG (+0.47%), VPB (-0.25%), TCB (-0.42%),…

Lý Hỏa